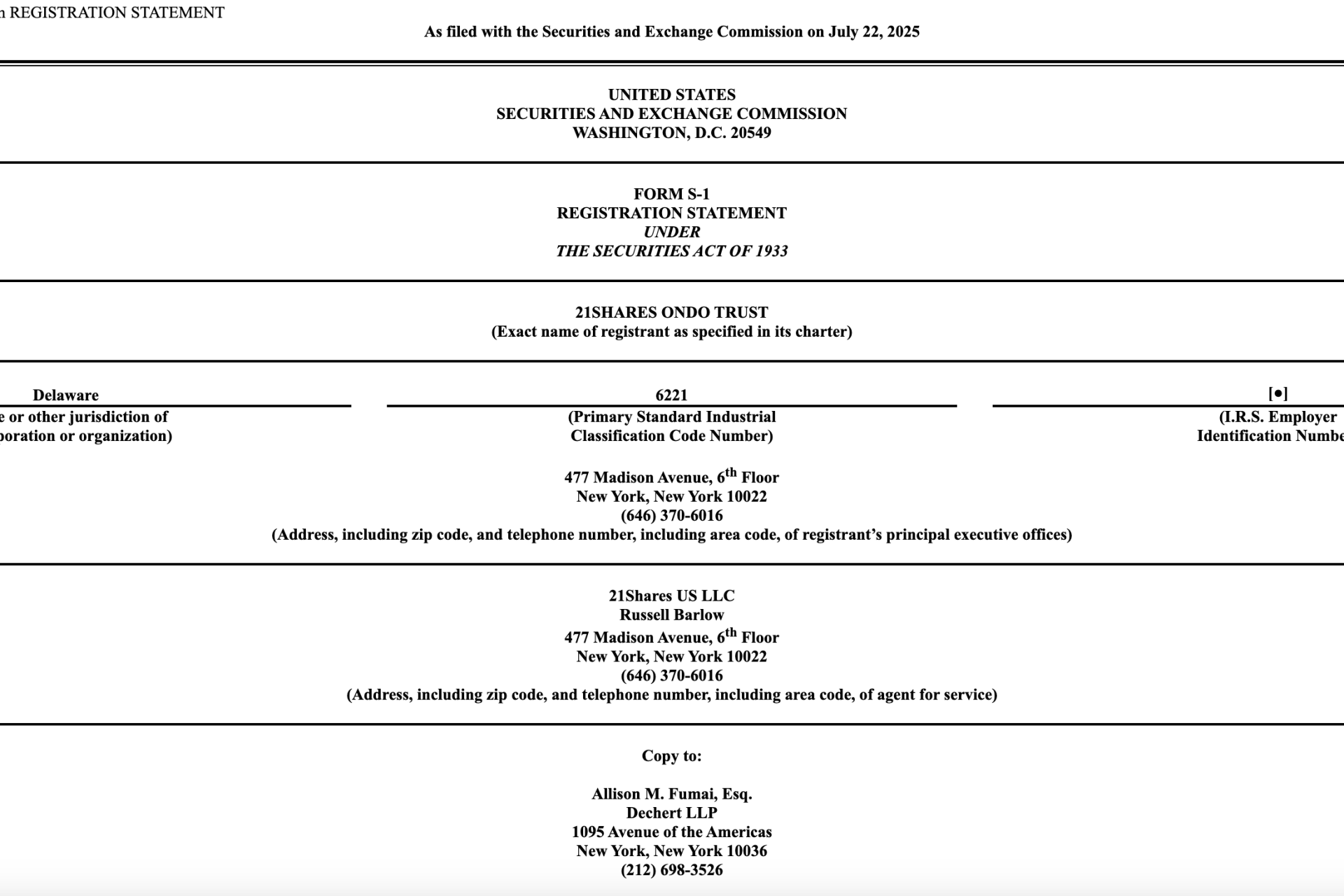

In the evolving realm of decentralized finance, Ondo Finance is gaining increased attention following recent developments that signal a shift in institutional engagement. The renowned crypto product provider, 21Shares, has taken a notable step by filing a preliminary proposal with the U.S. Securities and Exchange Commission (SEC) for a spot exchange-traded fund (ETF) that aims to track ONDO, the platform’s native token. This initiative promises to broaden the appeal of Ondo Finance, reflecting a surging interest from institutional investors in the DeFi sector.

The immediate market reaction to this announcement was significant, with ONDO’s price climbing above $1.16 shortly after the news emerged. Although it has since experienced a slight pullback, this fluctuation underscores the crypto market’s sensitivity to regulatory developments and investor mood. The current fluctuations within the broader market may temper rapid price increases, yet the listing application could signal a path toward recovery as interest builds.

As circumstance aligns with regulatory clarity and rising institutional interest, ONDO stands to gain from heightened visibility and investment over the coming weeks. Market participants are keenly awaiting the SEC’s decision, which may open new avenues for its long-term prospects.

Examining the 21Shares ONDO ETF Proposal: Design, Intent, and Market Consequences

The 21Shares preliminary prospectus for the ONDO ETF outlines a passive investment strategy designed to reflect ONDO’s performance without engaging in speculative trading practices. Known formally as the 21Shares Ondo Trust, this ETF aims to issue shares corresponding to the value of the native token in an uncomplicated structure.

This Trust seeks to mirror ONDO’s price by utilizing the CME CF Ondo Finance-Dollar Reference Rate, aggregating data from leading exchanges for accuracy. Importantly, the ETF will refrain from using leverage or derivatives, focusing purely on maintaining a direct hold on ONDO tokens, which will be valued on a daily basis based on the established Pricing Benchmark.

In terms of security and management, Coinbase Custody is set to serve as the custodian, ensuring that the tokens are held safely on behalf of the Trust. The creation and redemption of shares will occur through significant transactions known as “Baskets,” which allow authorized entities to exchange ONDO tokens or cash.

Upon receiving regulatory approval, this Trust could substantially enhance ONDO’s standing within established financial sectors, increasing liquidity and interest in the token while adhering to clear regulatory standards.

Market Retracement Following a Price Surge

A review of recent price action indicates a significant breakout past the crucial $1.00 resistance level, followed by a healthy retracement to around $1.07. The initial surge to a peak of $1.14 was driven by heightened investor excitement concerning the 21Shares ETF application. Currently, ONDO is consolidating above essential moving averages — the 50-day ($0.84), 100-day ($0.88), and 200-day ($0.99) — indicating a robust change in market sentiment and bullish potential.

This latest surge represents ONDO’s most decisive breakout since the downturn witnessed in early 2025. The rise above the critical 200-day SMA often serves as a precursor to a major trend reversal. Although a 6% intraday decline illustrates the market’s broader volatility, the retention of value above $1.00 signals underlying strength.

Presently, the trading range of $1.06 to $1.14 could act as a springboard for upward movement towards $1.30 to $1.40, especially if optimism surrounding institutional uptake and ETF developments persist. Conversely, should the price fall below the 200-day SMA, key support levels will be found near the 100-day moving average and the $0.95 area.

Image courtesy by DALL-E, chart data from TradingView