In recent developments, Bitcoin has once again captured the attention of investors, this time eclipsing significant price thresholds as it embarks on a quest for new record highs. Following an extended period marked by bearish sentiment and selling pressure, the leading cryptocurrency has orchestrated an impressive resurgence. Now trading around the pivotal $105,000 mark, Bitcoin is demonstrating remarkable resilience, with optimistic bulls poised for a breakout into untested price zones.

The momentum began to accelerate when Bitcoin decisively reclaimed the $90K level and swiftly moved through the $94K–$100K resistance band. Market analyst Jelle reports a compelling case for continued upward movement, citing increased buying activity and a rapidly shifting market perception. This unexpected rally not only surprises the skeptics but also rekindles a sense of enthusiasm within the broader cryptocurrency market.

Despite this rising confidence, the $105K zone poses a significant challenge. Historically, such price levels have led to both profit-taking and renewed interest from sidelined investments. If bulls sustain their current momentum and breach this resistance, we might witness the onset of a new price discovery phase. Long-term holders have begun to demonstrate renewed faith, and with overall investor sentiment on an upswing, the impending days hold critical importance for Bitcoin’s future direction. A definitive break above the current range could validate a robust macro uptrend, resetting expectations for the rest of 2025.

Bitcoin Pursues New Heights Amid Trade Deal Optimism

Currently positioned at a crucial turning point, Bitcoin hovers over $104,000, as optimism surrounding a possible trade agreement between the United States and China surfaces. As geopolitical tensions appear to be easing, markets are positively responding, and Bitcoin is thriving as investor appetite for risk grows. This recent price surge follows a succession of pivotal breakouts, particularly exceeding the $90K and $100K levels, reclaimed with evident market confidence in the prior two weeks.

This latest rally has pushed Bitcoin to its second-highest weekly closing price, suggesting a significant shift in macroeconomic sentiment. The previous resistance levels are transforming into potential support zones, indicating that Bitcoin is gearing up to venture into uncharted price territory, with one last primary hurdle remaining—its previous all-time high around the $109K mark.

Jelle shared an optimistic forecast, stating, “Bitcoin cut through the $90K–$94K barriers effortlessly.” He emphasized that the January 20 peak may not hold for long as Bitcoin enters what promises to be a new era of price exploration. The blend of technical prowess, favorable macro conditions, and strengthening investor sentiment lays a solid groundwork for further upward movement.

Nonetheless, the forthcoming days are poised to be transformative. Should bulls decisively breach the $105K threshold, the prospect for a breakout to fresh highs will dramatically increase. However, if resistance proves steadfast, a period of consolidation may ensue. Regardless, Bitcoin stands on the cusp of charting the next chapter in its market cycle—potentially reaching unprecedented price levels and inciting wider momentum throughout the cryptocurrency space.

Bitcoin Solidifies Position Above $104K amid Bullish Trends

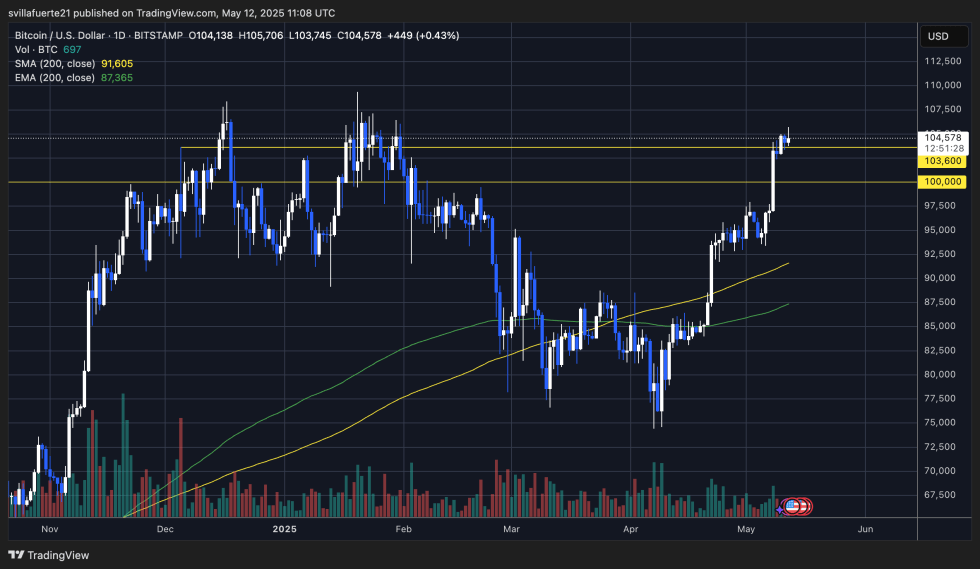

Analyzing the daily chart reveals Bitcoin’s solid positioning above the $104,000 mark after breaking through extended periods of resistance. Following a vigorous ascent since late April, BTC has surpassed key psychological milestones like $90K and $100K, with buyers firmly in control, evidenced by the creation of higher highs and lows. This structure aligns with a classic bullish continuation pattern, consolidating right below the $105K level.

The 200-day simple moving average (SMA) and exponential moving average (EMA) continue their upward trends, affirming long-term strength and underlying momentum. Trading volume has increased in recent sessions, underscoring broad participation from bullish investors, supporting the recent breakout.

As we look forward, the $105,700 level, currently the highest local peak, remains the next critical challenge. A successful daily close above this point could pave the way for a vigorous move into price discovery, setting sights on the all-time high at $109K. Conversely, immediate support can be found at $103,600 and $100K—recently established levels that could serve as robust foundations if a pullback occurs.

Featured image from Dall-E, chart sourced from TradingView.