Recent analytics indicate a significant shift in Bitcoin adoption, with a notable portion of the supply transitioning to long-term holders (LTHs), reinforcing the trend of HODLing in the crypto space.

Shift in Bitcoin Holding Patterns Over Recent Weeks

In a recent update on social media, analyst Maartunn from the CryptoQuant community shared insightful information regarding the changing landscape of Bitcoin ownership between short-term holders (STHs) and long-term holders (LTHs).

The distinction between STHs and LTHs is primarily based on the duration of their holdings, with a key threshold at 155 days. Those holding Bitcoin for shorter than this period are categorized as STHs, while those who maintain their holdings past this mark become classified as LTHs.

Tracking these categories is crucial for understanding market dynamics. The Position Change metric enables analysts to monitor changes in supply over 30 days among these distinct groups.

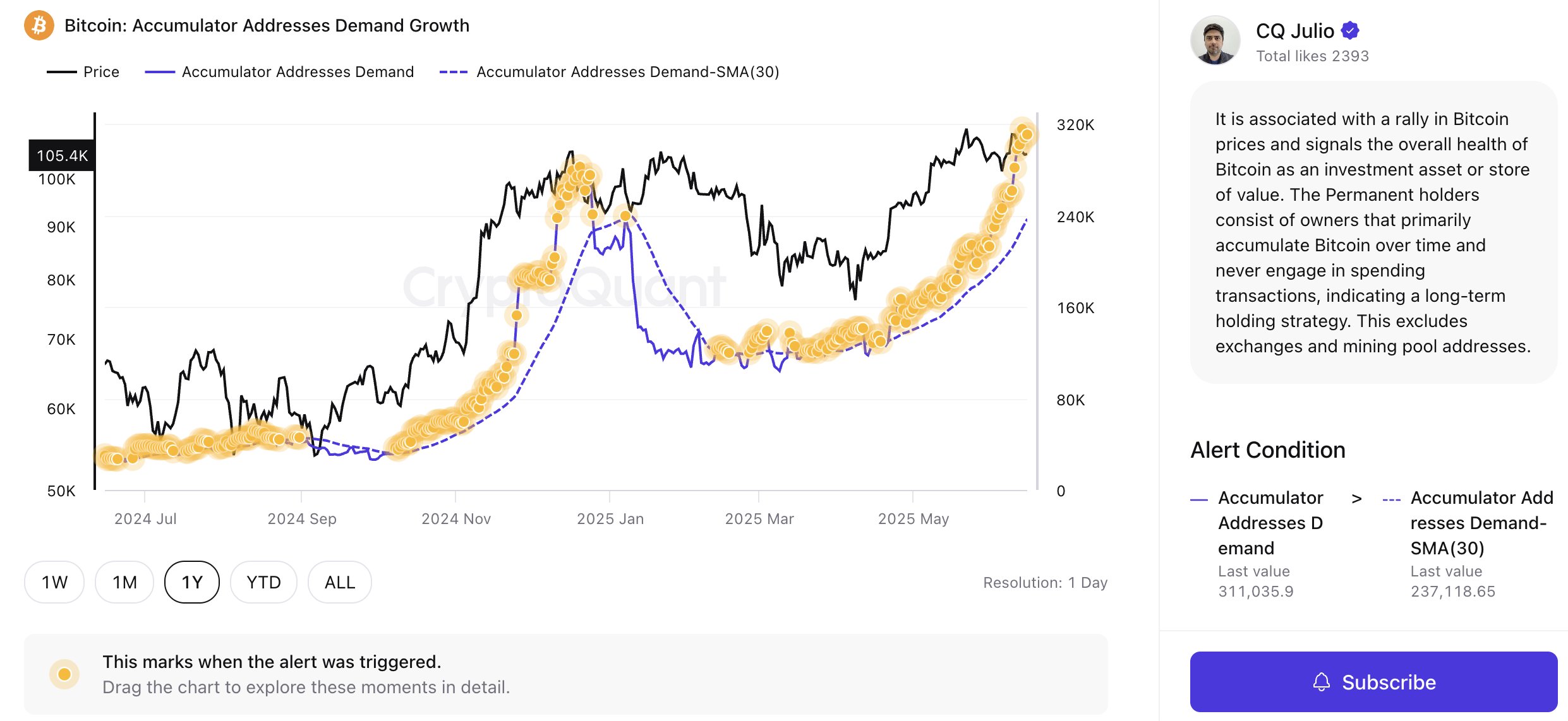

Displayed below is a graphical representation illustrating the shifts in the Bitcoin supply between STHs and LTHs over the past year:

The graph indicates a significant positive trend in LTH supply recently, highlighting a substantial influx of Bitcoin into this category. Notably, there has been an increase of 1.019 million Bitcoin into the LTH pockets, correlating with a decrease in the STH inventory by the same amount.

Data suggests that the longer Bitcoin is held, the lower the likelihood of selling, marking STHs as the more transient players in the market compared to LTHs, who exemplify commitment and stability.

With a growing trend of STHs transitioning to LTHs, it appears that the overall sentiment and confidence in Bitcoin are on the rise.

Historically, this pattern surfaced during the consolidation phase of 2024, leading to a noteworthy price surge. Such trends of accumulation by HODLers often precede market rallies and can signal soaring demand.

Moreover, the ascent of LTHs reflects a concerted shift toward long-term investment strategies, as highlighted by CryptoQuant in their social media updates regarding the increase in Accumulator Addresses.

Accumulator Addresses are a particularly interesting segment, characterized by not having engaged in any selling activities. Their transactional history is solely comprised of incoming transactions. Recent data shows a rapid increase in demand from these addresses, implying that heightened interest often precedes a bullish market phase, as noted by CryptoQuant.

Current Bitcoin Valuation

As of now, Bitcoin is trading at approximately $108,500, marking a 3% increase in the past 24 hours.