In a bold stance, Gemini has publicly denounced the Commodity Futures Trading Commission (CFTC), claiming that the agency has engaged in what they deem a “trophy-hunting lawfare” campaign over the past several years, supported by unsubstantiated allegations and a misuse of regulatory power against the crypto platform.

Gemini Raises Concerns About Regulatory Practices

Recently, the leadership at Gemini Trust reached out to Christopher Skinner, the Inspector General of the CFTC, expressing numerous grievances regarding the agency’s Division of Enforcement (DOE). Their letter highlighted a series of troubling behaviors exhibited by the DOE in relation to their dealings with the exchange.

In their letter, which was dated June 13, Gemini criticized the DOE for allegedly using the Commodity Exchange Act to target them with unfounded accusations. They contend that this approach undermines fundamental principles of justice and governance.

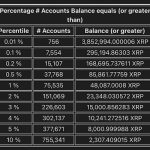

In 2022, the CFTC initiated a lawsuit against Gemini, alleging that the exchange misled regulators regarding its proactive measures to mitigate market manipulation risks for Bitcoin (BTC) back in 2017. The CFTC claimed that Gemini provided misleading data during the evaluation of a BTC futures contract for self-certification.

Flash forward to January 2025, and Gemini agreed to pay $5 million to resolve the claims, maintaining that it didn’t concede guilt, but applied this route due to lack of options at that moment.

Gemini further argues that the conduct exhibited by the CFTC has not been focused on safeguarding the integrity of the commodities market but rather on generating notable victories for the DOE personnel at the expense of justice.

Additionally, they assert that the agency failed to consider that Gemini was a victim of exploitative practices instigated by several malicious actors and that the charges arose from a “whistleblower” claim that lacked credibility and was influenced by personal vendettas related to a former employee’s termination.

This letter firmly denounces the prolonged misuse of public resources by the DOE, alleging that millions have been squandered in pursuing what they classify as false narratives against an innocent entity.

CFTC Working Towards Regulatory Reform

The communication also pointed to deeper cultural issues within the DOE, suggesting an environment that is detrimental to fair governance. They indicated that the DOE is perceived as operating in an “out of control” capacity, guided by a detrimental philosophy.

Public statements from acting chair Caroline Pham reflect a shift in priorities, as she highlights the necessity for the CFTC to move away from a history marked by enforcement actions that miss the intent of regulatory clarity.

Critically, she has called into question the previous administration’s approach that seemed to redefine laws in a way that targeted the crypto sector unfairly. Pham reassured stakeholders that the CFTC would focus on protecting market integrity without criminalizing emerging technologies and assets.

While she emphasized the push for innovation-friendly policies, Pham acknowledged that the industry would still face rigorous oversight. Therefore, reassessing how the CFTC interprets existing laws has become a central goal during her tenure.

To conclude their letter, Gemini extended an offer to support the CFTC in fostering meaningful change and ensuring that dubious practices are addressed, advocating for a cultural transformation within the agency.