Crypto Is Helping Nigerians Escape Digital Poverty

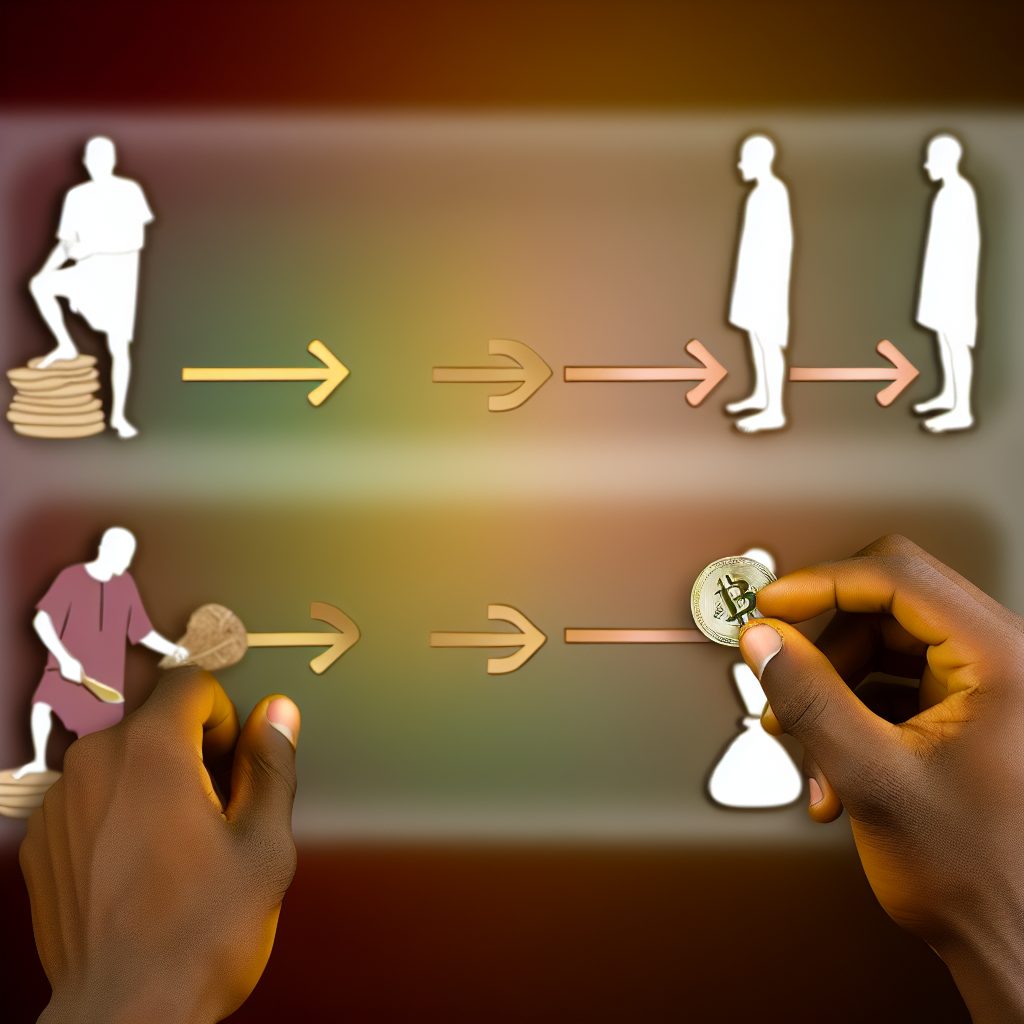

The rise of cryptocurrency has transformed the financial landscape across the globe, and Nigeria is no exception. With a significant portion of its population facing economic challenges, the adoption of digital currencies is providing new avenues for financial inclusion and empowerment. This article delves into how cryptocurrencies are helping Nigerians escape digital poverty, exploring the mechanisms, benefits, and challenges associated with this financial revolution.

The State of Digital Poverty in Nigeria

Nigeria, Africa’s largest economy, has a population exceeding 200 million people. Despite its vast resources, a substantial number of Nigerians live below the poverty line. According to the National Bureau of Statistics, over 40% of the population is classified as poor, struggling to meet basic needs such as food, shelter, and healthcare.

Digital poverty, characterized by a lack of access to digital technologies and the internet, exacerbates these economic challenges. Many Nigerians are excluded from the global economy due to limited access to banking services, high transaction fees, and a lack of financial literacy. This situation has created a fertile ground for the adoption of cryptocurrencies, which offer an alternative to traditional financial systems.

Understanding Cryptocurrency

Cryptocurrency is a form of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. This decentralization allows for peer-to-peer transactions without the need for intermediaries, such as banks.

Some of the most popular cryptocurrencies include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Cardano (ADA)

These digital currencies have gained traction in Nigeria, where many individuals are turning to crypto as a means of financial empowerment.

How Cryptocurrency is Empowering Nigerians

1. Financial Inclusion

One of the most significant benefits of cryptocurrency is its potential to promote financial inclusion. In Nigeria, where a large percentage of the population remains unbanked, cryptocurrencies provide an accessible alternative to traditional banking systems. With just a smartphone and internet access, individuals can create digital wallets and engage in transactions without the need for a bank account.

2. Lower Transaction Costs

Traditional banking systems often impose high fees for transactions, especially for cross-border payments. Cryptocurrencies significantly reduce these costs, making it easier for Nigerians to send and receive money. For instance, using Bitcoin or Ethereum for remittances can save users substantial amounts compared to conventional methods.

3. Economic Opportunities

The cryptocurrency market has opened up new economic opportunities for Nigerians. Many individuals are engaging in trading, investing, and even mining cryptocurrencies. This has led to the emergence of a new class of entrepreneurs who are leveraging digital currencies to create businesses and generate income.

4. Hedge Against Inflation

Nigeria has experienced significant inflation rates, which erode the purchasing power of the Naira. Cryptocurrencies, particularly Bitcoin, are often viewed as a hedge against inflation. By investing in digital assets, Nigerians can protect their wealth from the devaluation of their local currency.

5. Access to Global Markets

Cryptocurrencies enable Nigerians to participate in the global economy. With digital currencies, individuals can access international markets, invest in foreign assets, and engage in global trade without the restrictions imposed by traditional banking systems.

The Role of Peer-to-Peer (P2P) Platforms

Peer-to-peer (P2P) platforms have played a crucial role in facilitating cryptocurrency transactions in Nigeria. These platforms allow users to buy and sell cryptocurrencies directly with one another, bypassing traditional exchanges. This is particularly beneficial in a country where access to banking services is limited.

Some popular P2P platforms include:

- Binance P2P

- Remitano

- P2PB2B

- CoinCola

These platforms provide a secure environment for transactions, often with lower fees than traditional exchanges. They also offer various payment methods, including bank transfers, mobile money, and cash payments, making it easier for Nigerians to engage in cryptocurrency trading.

Challenges Facing Cryptocurrency Adoption in Nigeria

Despite the numerous benefits, the adoption of cryptocurrency in Nigeria is not without challenges. Some of the key obstacles include:

1. Regulatory Uncertainty

The Nigerian government has expressed concerns about the use of cryptocurrencies, leading to regulatory uncertainty. In 2021, the Central Bank of Nigeria (CBN) issued a directive prohibiting banks from facilitating cryptocurrency transactions. This has created confusion among users and hindered the growth of the crypto market.

2. Lack of Financial Literacy

Many Nigerians lack the necessary knowledge and understanding of cryptocurrencies and blockchain technology. This lack of financial literacy can lead to poor investment decisions and increased vulnerability to scams and fraud.

3. Internet Access and Infrastructure

While internet penetration in Nigeria has improved, many rural areas still lack reliable access. This digital divide limits the ability of individuals in these regions to participate in the cryptocurrency market.

4. Security Concerns

As with any digital asset, security is a significant concern for cryptocurrency users. Hacks, scams, and phishing attacks are prevalent in the crypto space, and many Nigerians may be hesitant to invest due to fears of losing their funds.

The Future of Cryptocurrency in Nigeria

Despite the challenges, the future of cryptocurrency in Nigeria looks promising. The increasing adoption of digital currencies, coupled with the growing interest in blockchain technology, suggests that cryptocurrencies will play a vital role in the country’s economic development.

Several initiatives are underway to promote cryptocurrency education and awareness. Organizations and communities are working to provide resources and training to help Nigerians understand the benefits and risks associated with digital currencies.

Furthermore, as regulatory frameworks evolve, there is potential for a more supportive environment for cryptocurrency businesses and users. This could lead to increased investment and innovation in the sector, ultimately benefiting the Nigerian economy.

FAQs

What is cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates on decentralized networks based on blockchain technology.

How can cryptocurrencies help reduce poverty in Nigeria?

Cryptocurrencies can promote financial inclusion, lower transaction costs, provide economic opportunities, serve as a hedge against inflation, and grant access to global markets.

What are P2P platforms?

P2P platforms allow users to buy and sell cryptocurrencies directly with one another, facilitating transactions without the need for traditional exchanges.

What challenges does cryptocurrency face in Nigeria?

Challenges include regulatory uncertainty, lack of financial literacy, limited internet access, and security concerns.

Is cryptocurrency safe to invest in?

While cryptocurrencies offer potential for high returns, they also come with risks. It’s essential to conduct thorough research and understand the market before investing.

Conclusion

Cryptocurrency is emerging as a powerful tool for financial empowerment in Nigeria, offering solutions to many of the challenges posed by digital poverty. By promoting financial inclusion, reducing transaction costs, and providing access to global markets, digital currencies are helping Nigerians build a more secure financial future.

As the landscape continues to evolve, it is crucial for stakeholders to address the challenges facing cryptocurrency adoption. With increased education, regulatory clarity, and technological advancements, Nigeria has the potential to become a leader in the cryptocurrency space, paving the way for economic growth and prosperity.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.