In recent developments, Metaplanet, a company listed in Tokyo, has emerged as a significant player in the corporate Bitcoin market. The firm reportedly holds 15,555 BTC, and CEO Simon Gerovich has ambitious plans to accumulate over 210,000 BTC by 2027, which would represent approximately 1% of the total Bitcoin supply.

Accelerating the Acquisition of Bitcoin

Gerovich stated that Metaplanet initiated its Bitcoin purchasing strategy in 2024. Initially seen as a hedge against inflation, the approach has transformed into a prioritized race for assets. The company recently invested $237 million to acquire an additional 2,204 BTC.

With the current Bitcoin price sitting around $108,600 per coin, this latest acquisition has adjusted the average cost per BTC to approximately $99,985. This strategic move has certainly drawn attention from investors, with Metaplanet’s share price soaring by 340% this year, despite the company currently generating limited revenue.

Japanese microstrategy Metaplanet announced that its Bitcoin strategy has entered the second phase, planning to use BTC as collateral leverage to acquire cash flow businesses. Potential targets include Japanese digital banks, providing digital banking services that are better…

— Wu Blockchain (@WuBlockchain) July 8, 2025

Transforming Cryptocurrency into Liquidity

As per reports, Metaplanet has outlined a two-phased approach for its strategy. The first phase focuses on accumulation, while the second will leverage Bitcoin as collateral to secure funds that can be utilized for acquiring profitable businesses.

Gerovich has identified a digital banking venture in Japan as a potential target, suggesting that the company can surpass the offerings of traditional banks. Notably, established players like Standard Chartered and OKX have already initiated pilot programs for crypto-backed lending, a path Metaplanet aims to explore on a more extensive scale.

Assessing the Competitive Landscape

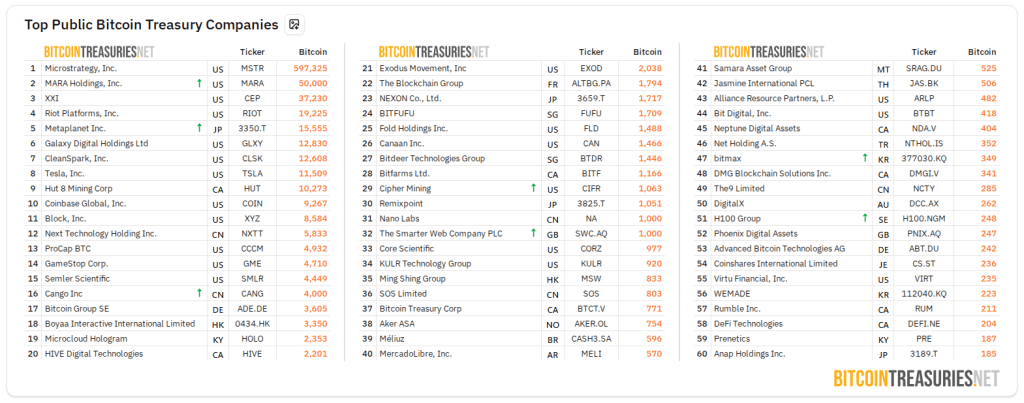

With its growing Bitcoin reserves, Metaplanet positions itself among the top players in the cryptocurrency landscape. For context, Strategy boasts over 597,000 BTC and a market capitalization of $112 billion, while Metaplanet’s current market value hovers around $7 billion.

Both firms share a belief in the long-term value retention of Bitcoin over traditional cash assets. However, Gerovich has opted out of convertible debt, favoring preferred shares to avoid the complexities associated with repayments influenced by fluctuating share prices.

Challenges and Opportunities of a Bitcoin-Driven Strategy

Utilizing Bitcoin as collateral certainly comes with risks. Financial institutions tend to enforce strict “haircuts” on collateral, which could create vulnerabilities for Metaplanet if Bitcoin’s value were to decline.

Furthermore, regulatory frameworks in Japan for crypto-backed lending are still evolving. This regulatory uncertainty could potentially delay or impede the execution of Metaplanet’s ambitious plans.

Moreover, the transition from a hotel operation to a banking system necessitates a significant adjustment in business capabilities. Metaplanet’s plans are both bold and groundbreaking, potentially reshaping corporate finance practices surrounding Bitcoin.

Nevertheless, this Tokyo-based company faces a daunting challenge. Should any aspects of its strategy falter, it may find itself struggling to maintain momentum amidst its lofty ambitions. Regardless, the financial world will be watching closely as Metaplanet charts its future course, capturing the interest of both cryptocurrency enthusiasts and traditional financial institutions alike.

Featured image from Meta, chart from TradingView