As Bitcoin finds itself navigating the complex waters of market sentiment, it presently hovers just above $117,000. This phase of consolidation has ignited discussions among traders and analysts, speculating about a potential pivotal breakout as volatility looms on the horizon. The steadfast bulls are entrenched at the $117K mark, bolstering an environment ripe for accumulation.

Market expert Axel Adler recently emphasized that Bitcoin’s existing valuation falls within the “growth zone” as defined by the Bitcoin Investor Price Model. At this juncture, BTC trades between the significant thresholds of the Investor Price Median at $92K and the Hype Alert ceiling at $139K—crucial levels that mark psychological junctures in market behavior. This positioning reflects an atmosphere of controlled optimism, suggesting the market has room to grow without overextending.

While some market participants adopt a cautious stance due to dwindling trading volume, others view this lull as a precursor to an impending directional movement. The developments in the coming days will be pivotal, determining whether Bitcoin can elevate above resistance or experience a necessary pullback before advancing.

Understanding Bitcoin’s Growth Zone: A Positive Outlook

The current Bitcoin price of $117,000 positions it favorably within the market as noted by analyst Axel Adler, who highlights its placement between essential benchmarks: the Investor Price Median at $92,000 and the Hype Alert at $139,000. This segment is typically characterized by robust holder confidence and sustainable market enthusiasm.

Adler points out that Bitcoin’s ability to maintain its position above vital demand zones signals strong conviction among long-term holders, who show minimal selling interest. On-chain analytics align with this sentiment, revealing low exchange inflows and a growing number of dormant coins, indicating diminishing selling pressure. Additionally, well-placed bids near $115,000 in order books signal that buyers are prepared to protect these significant levels.

Despite a period of consolidation, it’s essential to note that periods of compressed volatility often set the stage for substantial movements. Analysts are observing the $123,000 resistance zone closely; a breakout in this area could unleash a wave of buying activity and switch market sentiment to bullish. Conversely, a dip below $115,000 could expose Bitcoin to substantial retracements.

A Crucial Consolidation Phase as Bitcoin Awaits Its Next Move

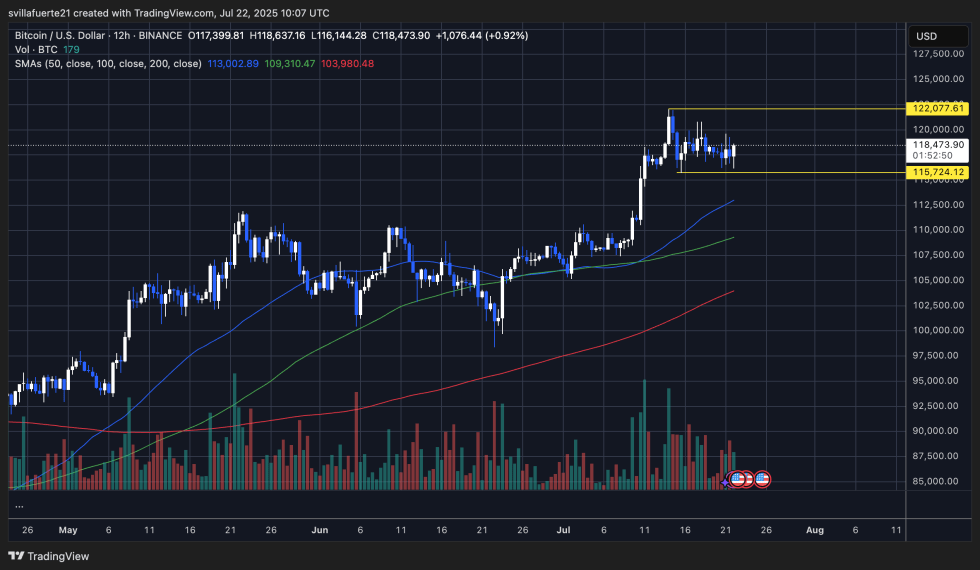

Currently trading around $118,473, Bitcoin operates within a compact range between $115,724 and $122,077, as illustrated in recent 12-hour charts. This period of consolidation follows a notable rise from early July, where BTC soared from below $110,000 to its recent peaks. Despite fluctuations, bulls remain vigilant in defending the support level at $115,724, which has been tested repeatedly.

The trend of the 50, 100, and 200-period simple moving averages indicates an overall bullish structure. Notably, the 50 SMA remains well above the 100 and 200 SMAs, suggesting positive momentum over recent weeks. However, a declining volume trend hints at weakening buying interest, contributing to the current sideways motion.

For a bullish continuation to unfold, Bitcoin needs to breach the $122,077 resistance, which has been a rejection point multiple times since mid-July. A breakout here could trigger increased upward movement as traders expect a high-volatility phase. On the contrary, a slip below the $115,724 support level would bring the next significant support near $113,000 into focus.

As market conditions evolve, a vigilant approach will be crucial for investors and traders navigating the ever-changing landscape of cryptocurrency.