The recent rise of BlackRock’s iShares Ethereum Trust (ETHA) has sent shockwaves through the cryptocurrency market, reaching an impressive $10 billion in assets in just 251 days. This remarkable achievement positions it among the top three fastest ETFs to hit this benchmark.

Additionally, the fund reported $5 billion of its total within a mere 10 days, marking the quickest transition in history from $5 billion to $10 billion. This remarkable uptick underscores the increasing institutional enthusiasm surrounding Ethereum, enhanced by favorable price movements, clear regulatory landscapes in the US, and a thriving environment for stablecoin adoption.

This surge also reflects heightened interest in projects utilizing the Ethereum blockchain, including essential ERC-20 tokens like Snorter Token ($SNORT).

The Meteoric Rise of Ethereum ETFs and the Surge in $ETH

Coinciding with BlackRock’s achievement is a significant upward trajectory in $ETH’s price. Just recently, the cryptocurrency peaked at $3,700—levels unseen since January 2025.

Today’s valuation stands at approximately $3,600, having nearly doubled since the previous month.

The connection between ETF inflows and $ETH’s price fluctuations is intricate. Bloomberg’s Eric Balchunas articulates that while they influence each other, it’s not a straightforward correlation—raising the age-old question of causality.

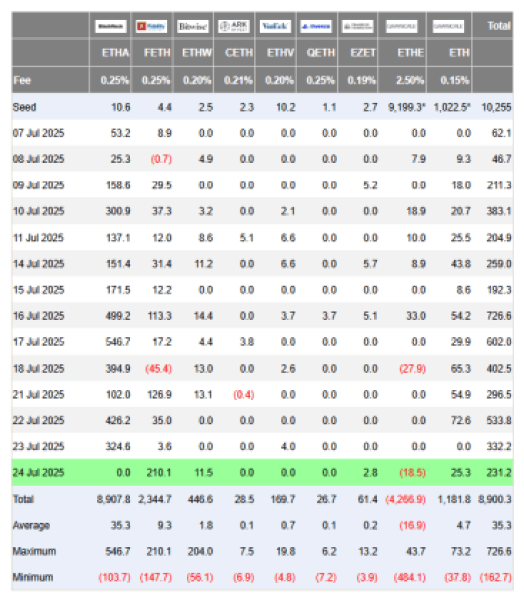

Recent weeks have witnessed a tremendous surge in Ethereum ETFs. Between July 7 and July 24, 2025, US-listed Ethereum ETFs attracted a staggering $9.9 billion in net inflows, spurred by strong interest in low-cost options offered by BlackRock and Fidelity that accumulated $8.9 billion and $2.3 billion, respectively.

The broader market environment continues to be favorable for $ETH, especially after the recent passing of the GENIUS Act, which enhances the outlook for Web3 and other blockchain technologies.

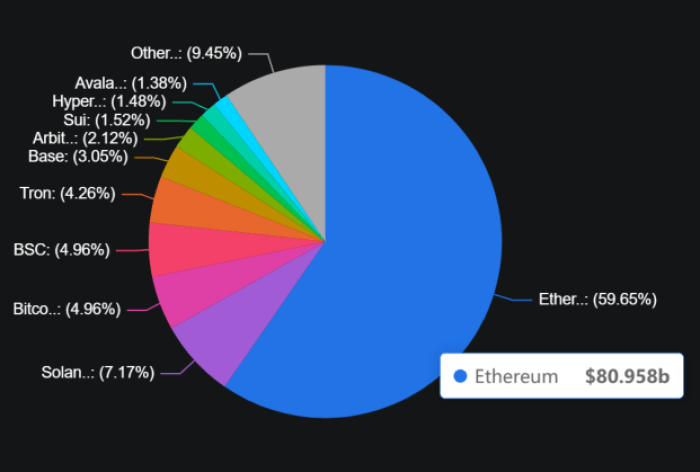

Ethereum is positioned to reap significant benefits here, dominating the stablecoin ecosystem with a remarkable $80.958 billion in total value locked (TVL), accounting for nearly 60% of the entire market share.

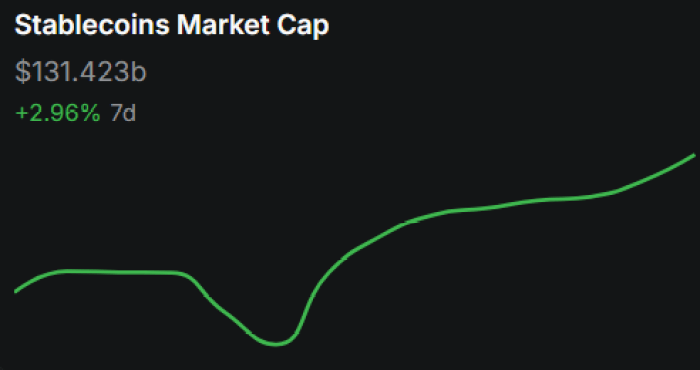

With a robust $131.42 billion stablecoin market cap, Ethereum-based stablecoins like $USDT dominate by making up about 51% of the market.

In contrast, Solana stands far behind with $9.739 billion in TVL, clearly illustrating that Ethereum remains unparalleled in its usage, community engagement, and financial activity.

As institutional investments pour into $ETH, and as Ethereum maintains its leadership in TVL, stablecoin prevalence, and on-chain transactions, demand for innovative trading tools is expected to surge.

This is where the $SNORT Telegram trading assistant—Snorter Bot—comes into play.

Introducing Snorter Bot: Revolutionizing Crypto Trading

Envision trading, sniping, and managing $ETH along with other tokens directly on the world’s fourth-largest messaging platform, without the need for browsers or extensions. This is the vision behind Snorter Bot, expected to launch in Q3 2025.

Upon its release, users will enjoy instant token buying and selling capabilities, the option to set stop-losses, the ability to track portfolio performance, and even mirror trades through a seamless interface.

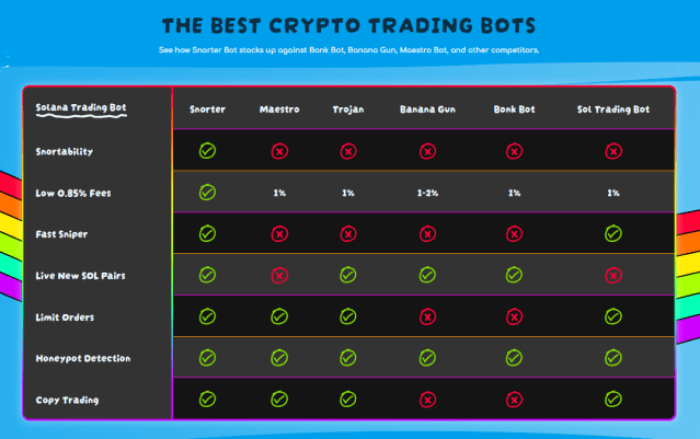

Designed with speed and cost-effectiveness in mind, it aims to provide superior execution speeds compared to competitors on Solana while offering impressively low fees of only 0.85% for token holders—significantly undercutting rivals like Maestro, BonkBot, and Trojan that charge 1% or more.

The service will initially roll out on Solana, with future integrations on Ethereum and BNB Chain nearing completion. Eventually, additional EVM-compatible chains like Polygon and Base will be incorporated as part of its ambitious growth plan.

This multi-chain functionality represents a significant advantage, simplifying the trading process across various networks without the hassle of switching wallets and settings.

Security remains a priority, with Snorter Bot’s infrastructure leveraging private RPC, MEV protection, and numerous scam detection features, including filters for honeypots and rug pulls.

Such protective measures are increasingly vital, as rug pulls comprised 68% of all crypto-related scams in Q1 2025.

Owning $SNORT provides unique access to a variety of ecosystem benefits, such as enhanced analytics, no sniping limits, and voting privileges within its imminent DAO.

Additionally, it is poised for staking, offering an eye-catching 173% APY. Early acquisitions are advantageous, as the rate is expected to decline as participation increases.

With $SNORT already surpassing $2.3 million in presale funds, significant whale investors are contributing notable amounts like $40,000, $10,800, and $10,000.

$SNORT Anticipates Significant Growth as $ETH Rises

The impressive $10 billion milestone achieved by BlackRock’s Ethereum ETF highlights the growing institutional enthusiasm for Ethereum. As $ETH climbs and Ethereum network activities multiply, the demand for efficient and secure trading solutions is likely to increase concurrently.

Snorter Bot is tailored to meet these demands, offering real-time tracking of $ETH’s price and performance alongside other major cryptocurrencies. By doing this, it positions users advantageously in the trading landscape as the market continues to thrive.

To capitalize on Snorter Bot’s potential, consider acquiring $SNORT during presale for just $0.0993. Upon the bot’s full launch, projections suggest the price could rise to $1.92, paving the way for potential gains exceeding 1,833%.

Please remember, this is not financial advice. Always conduct your own research and never invest funds you are uncomfortable risking.