Recently, the cryptocurrency market has witnessed a surge of activity linked to a landmark event orchestrated by Galaxy Digital, a trailblazer in the financial services realm focused on digital assets. The firm finalized a staggering transaction involving over 80,000 BTC, valuing more than $9 billion, making this one of the most significant Bitcoin trades in history. This monumental transfer has not only instigated pronounced price fluctuations but has also ignited speculation regarding the seller’s identity and its broader implications for the market.

Insights from Ki Young Ju, the Founder and CEO of CryptoQuant, further enrich the narrative. He disclosed that the Bitcoin involved had remained untouched for an impressive 14 years. These coins originated from wallets linked to MyBitcoin, an early Bitcoin exchange that collapsed back in 2011. The sudden movement of these dormant assets has raised questions within the cryptocurrency community, with many theorizing about the potential involvement of early adopters or hackers connected to the original operation.

As market participants react to this extraordinary transaction, many investors are keeping a keen eye on Bitcoin’s price trends and institutional behaviors to gather insights into future developments. The upcoming period may prove critical for Bitcoin’s short-term outlook.

Intrigue Surrounds Bitcoin Whale in Volatile Market

Ki Young Ju has provided intriguing insights regarding the identity of the elusive Bitcoin whale associated with the recent 80,000 BTC transfer. His observations reveal that the wallets holding these coins had been dormant since April 2011, just before a significant hack led to the demise of MyBitcoin. The unexpected activation of these coins might indicate a connection to the hacker responsible for the breach or possibly the platform’s founder, Tom Williams, whose whereabouts remain shrouded in mystery.

The scenario has stirred intense speculation, with Ju suggesting that Galaxy Digital may have acquired the Bitcoin from this enigmatic figure. However, uncertainties linger regarding whether due diligence was applied to ascertain the legitimacy of these coins. The magnitude of this transaction has heightened concerns among traders about potential market corrections and their subsequent effects on sentiment.

The next few days will be crucial as Bitcoin navigates these developments. While Bitcoin faces volatility challenges, Ethereum (ETH) has shown a propensity to outperform BTC, indicating a possible shift in market dynamics. This divergence between the two major crypto assets may shape the market landscape in the weeks ahead.

BTC Stabilizes After Volatile Movements

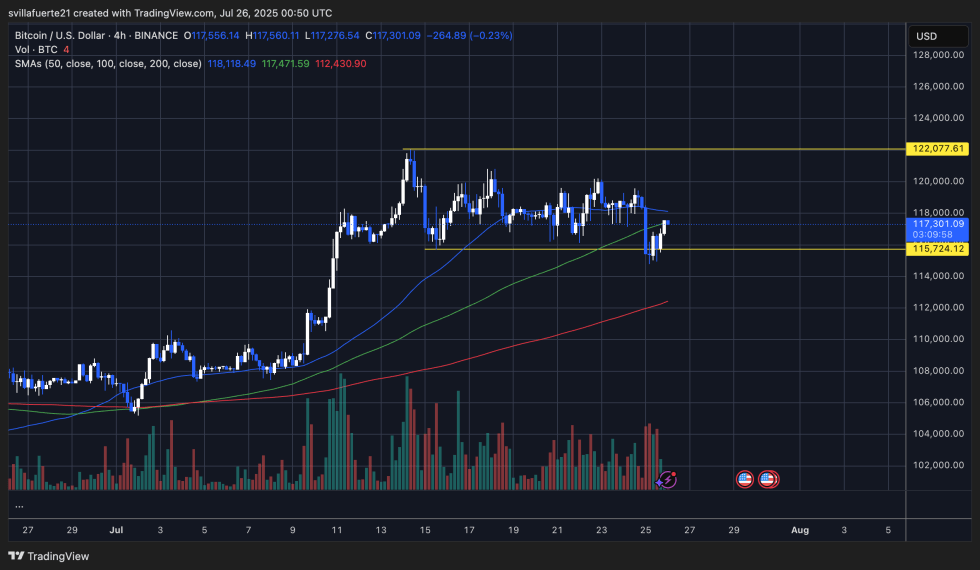

Analysis from the 4-hour Bitcoin chart reveals that after a brief dip below the 100 SMA (green) at approximately $117,471, BTC discovered robust support around $115,724—a crucial level that has acted as a protective barrier in previous trading scenarios. This rebound was supported by a surge in trading volume, indicating solid demand just beneath that threshold.

As of now, Bitcoin is trading around $117,300, having reclaimed the 100 SMA and is striving to surpass the 50 SMA (blue), which is currently presenting short-term resistance around $118,118. A confirmed breakout and sustained position above this point could pave the way for a retest of the primary resistance at $122,077, which marks the critical level for any attempt at reaching new all-time highs.

The consolidation pattern forming between $115,724 and $122,077 resembles a mid-cycle continuation setup. The recent dip into lower ranges may have liquidated leveraged long positions, laying the groundwork for a healthier rebound ahead. However, failing to maintain the 100 SMA or dipping below $115,724 could negate the current bullish outlook, potentially triggering further declines.

Featured image from Dall-E, chart from TradingView