In a notable development for the financial landscape, RAKBANK (National Bank of Ras Al Khaimah), one of the prominent banks in the UAE, is set to launch a groundbreaking crypto brokerage service. This initiative marks a pivotal moment, indicating a significant convergence between traditional finance (TradFi) and the burgeoning digital asset sector. By embracing cryptocurrency, RAKBANK aligns itself with an increasing number of financial institutions recognizing the necessity for regulated and accessible digital asset solutions.

The forthcoming service will be conveniently available through the RAKBANK mobile application, enabling clients to purchase and trade cryptocurrencies directly in AED. This functionality enhances customer experience by providing easy access to leading cryptocurrencies, particularly at a time when Bitcoin remains resilient near its historical peaks, while altcoins face heightened fluctuations. The understanding that traditional finance is evolving with crypto adoption plays a crucial role in bolstering long-term investor confidence in the sector.

For many observers, the entry of RAKBANK into the cryptocurrency arena signifies a larger trend in the global financial landscape. As regulations become clearer and more banking institutions venture into this space, the groundwork for sustainable growth in the crypto market is solidifying.

Strategic Alliance with Bitpanda

RAKBANK’s new crypto brokerage service is being launched in collaboration with Bitpanda, a reputable European investment platform known for its comprehensive regulatory adherence and advanced technology. This partnership utilizes the expertise of Bitpanda Broker MENA DMCC, a licensed Virtual Asset Service Provider (VASP) under the supervision of the Virtual Assets Regulatory Authority (VARA) in the UAE. Such regulatory compliance ensures that RAKBANK clients can trade in a safe and secure environment.

The integration between the RAKBANK app and Bitpanda’s platform facilitates effortless trading, allowing users to utilize their RAKBANK accounts for transactions without the need for external transfers. This design not only enhances user satisfaction but also meets the growing demand for quick, secure, and user-friendly access to digital assets.

As the global crypto adoption accelerates, the Middle East is positioning itself as a key player alongside the United States in the realm of decentralized finance (DeFi) innovation and regulatory frameworks. With VARA at the forefront and banks like RAKBANK leading the charge, the region is rapidly becoming a desirable destination for compliant cryptocurrency services. This transition conveys a growing trust in digital assets among institutional players and signifies the increasing integration of crypto within conventional financial systems.

Crypto Market Approaching $4 Trillion Milestone

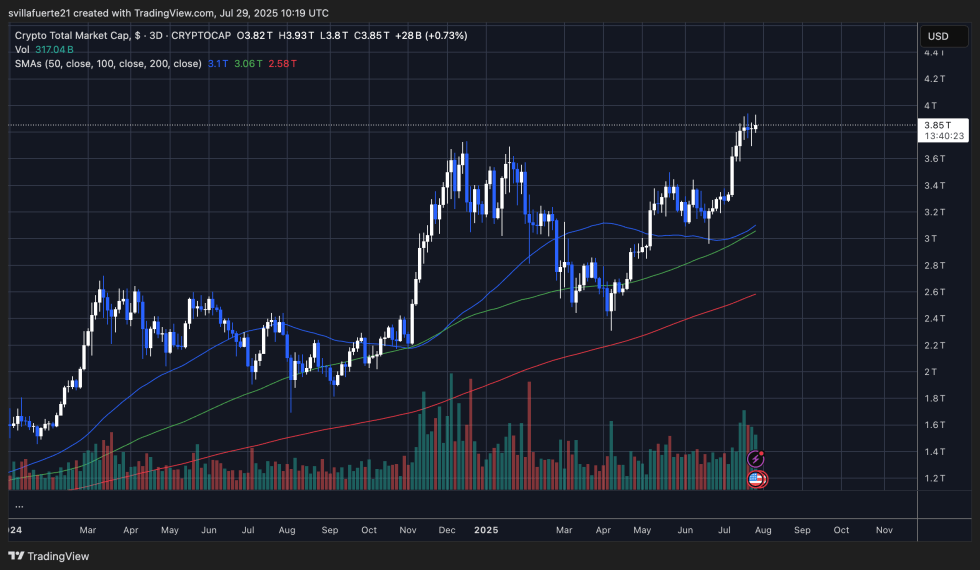

The perspective on the total cryptocurrency market cap continues to be optimistic, currently standing at approximately $3.85 trillion. A review of the 3-day chart indicates a decisive breakout above previous resistance levels around $3.7 trillion, with the market now eyeing the significant $4 trillion threshold. The momentum remains positive, highlighted by continually forming higher highs and higher lows since early May.

The price trends are supported by essential moving averages, with the 50 SMA positioned at $3.1 trillion, the 100 SMA at $3.06 trillion, and the 200 SMA at $2.58 trillion, all indicating upward movement. The market’s ability to remain above these critical levels reflects substantial underlying demand, despite intermittent volatility across certain altcoins.

Overall trading volume has maintained a stable footing, indicating that this phase might just be the beginning. A confirmed ascent beyond the $4 trillion mark could incite renewed market interest as traders pursue breakout opportunities, particularly as macroeconomic dynamics and institutional interest converge to favor ongoing growth.

Image credit from Dall-E, chart by TradingView.