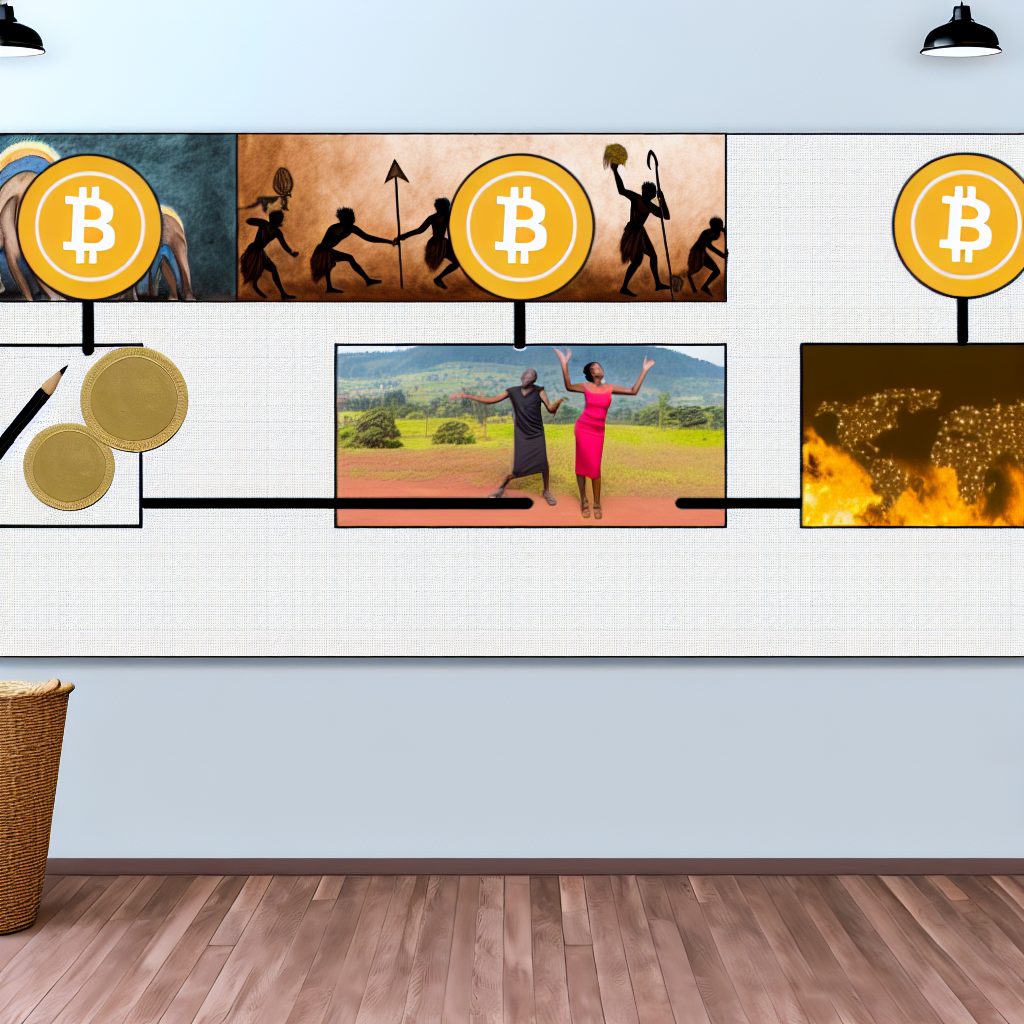

3 Ugandan Myths About Crypto Debunked

The cryptocurrency landscape in Uganda is rapidly evolving, yet misconceptions persist. As digital currencies gain traction, it’s crucial to address these myths to foster a better understanding of the crypto ecosystem. This article will debunk three prevalent myths about cryptocurrency in Uganda, providing clarity and insight into the realities of this innovative financial technology.

Myth 1: Cryptocurrency is Illegal in Uganda

One of the most widespread myths is that cryptocurrency is illegal in Uganda. This misconception stems from the Ugandan government’s cautious approach to regulating digital currencies. However, the reality is more nuanced.

In 2019, the Bank of Uganda issued a public notice warning citizens about the risks associated with cryptocurrencies, stating that they are not recognized as legal tender. This warning led many to believe that cryptocurrencies are outright banned. In truth, while the government has not officially endorsed cryptocurrencies, they have not been declared illegal either. This means that individuals can still buy, sell, and trade cryptocurrencies, albeit with caution.

Furthermore, the Ugandan government has shown interest in exploring blockchain technology and its potential applications. For instance, the National Information Technology Authority of Uganda (NITA-U) has been involved in discussions about how blockchain can enhance transparency and efficiency in various sectors.

In summary, while cryptocurrencies are not recognized as legal tender in Uganda, they are not illegal. The government’s stance is more about regulation and consumer protection than outright prohibition.

Myth 2: Cryptocurrency is Only for Tech-Savvy Individuals

Another common myth is that cryptocurrency is only accessible to tech-savvy individuals or those with advanced knowledge of finance. This belief can deter many potential users from exploring the benefits of digital currencies.

In reality, the cryptocurrency market has evolved significantly, making it more user-friendly for the average person. Here are some reasons why cryptocurrency is accessible to everyone:

- User-Friendly Platforms: Many cryptocurrency exchanges and wallets have simplified their interfaces, allowing users to buy, sell, and store cryptocurrencies with ease. Platforms like Binance, Coinbase, and local exchanges have made it straightforward for beginners to navigate the crypto space.

- Educational Resources: Numerous online resources, including tutorials, webinars, and forums, provide valuable information for newcomers. Websites like CoinDesk and Investopedia offer comprehensive guides on cryptocurrency basics.

- Community Support: The growing crypto community in Uganda offers support and guidance for those looking to enter the market. Local meetups and online forums provide a platform for sharing knowledge and experiences.

Moreover, the rise of mobile money services in Uganda has facilitated easier access to cryptocurrencies. Many exchanges now allow users to purchase cryptocurrencies using mobile money, bridging the gap between traditional finance and digital currencies.

In conclusion, while a basic understanding of technology can be beneficial, it is not a prerequisite for engaging with cryptocurrencies. The industry is becoming increasingly accessible to everyone, regardless of their technical background.

Myth 3: Cryptocurrency is a Get-Rich-Quick Scheme

The allure of quick profits has led many to view cryptocurrency as a get-rich-quick scheme. This myth is particularly dangerous, as it can lead to poor investment decisions and significant financial losses.

While it is true that some individuals have made substantial profits from cryptocurrency investments, these cases are often highlighted in the media, creating a skewed perception of the market. The reality is that investing in cryptocurrencies carries risks, and potential investors should approach it with caution.

Here are some key points to consider:

- Volatility: The cryptocurrency market is known for its price volatility. Prices can fluctuate dramatically within short periods, leading to potential gains or losses. Investors should be prepared for this volatility and not invest more than they can afford to lose.

- Long-Term Perspective: Successful cryptocurrency investment often requires a long-term perspective. Many seasoned investors advocate for holding onto assets rather than attempting to time the market for quick profits.

- Research and Due Diligence: Before investing in any cryptocurrency, it is essential to conduct thorough research. Understanding the technology, the team behind the project, and market trends can help investors make informed decisions.

In summary, while there are opportunities for profit in the cryptocurrency market, it is not a guaranteed path to wealth. Investors should approach the market with realistic expectations and a willingness to learn.

Frequently Asked Questions (FAQs)

1. Is cryptocurrency safe to invest in?

Investing in cryptocurrency carries risks, including market volatility and potential scams. It is essential to conduct thorough research and only invest what you can afford to lose.

2. How can I buy cryptocurrency in Uganda?

You can buy cryptocurrency in Uganda through various exchanges that accept local payment methods, including mobile money. Popular exchanges include Binance and local platforms that cater to Ugandan users.

3. What are the benefits of using cryptocurrency?

Cryptocurrencies offer several benefits, including lower transaction fees, faster cross-border payments, and increased financial privacy. They also provide an alternative to traditional banking systems.

4. Are there any regulations for cryptocurrency in Uganda?

While cryptocurrencies are not recognized as legal tender in Uganda, they are not illegal. The government is working on regulations to ensure consumer protection and mitigate risks associated with digital currencies.

5. Can I use cryptocurrency for everyday purchases in Uganda?

While some businesses in Uganda accept cryptocurrency as a form of payment, it is not yet widely adopted for everyday transactions. However, this is gradually changing as awareness and acceptance grow.

Conclusion

Understanding the realities of cryptocurrency in Uganda is essential for anyone looking to engage with this innovative financial technology. By debunking these myths, we can foster a more informed community that embraces the potential of digital currencies.

As the cryptocurrency landscape continues to evolve, staying informed and connected with trusted resources is crucial. For the latest news, airdrops, and market insights, consider joining the Bitrabo community. Follow Bitrabo on X, Instagram, Threads, Facebook, and LinkedIn for updates and support.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.