Recent trends indicate that interest in Ethereum has surged significantly, signaling potential market fluctuations ahead.

Ethereum Open Interest Rises Dramatically

According to analysis by prominent crypto analyst Maartunn, the Open Interest for Ethereum has experienced a sharp increase, as detailed in a recent tweet shared on X. This critical metric tracks the total volume of derivative positions still open on various centralized platforms, encompassing both short and long positions associated with ETH.

Accompanying this rise is an insightful chart from the analyst, illustrating the accelerated trend in Ethereum’s Open Interest.

As showcased in the graph, the Ethereum Open Interest has surged by approximately $1.9 billion, pushing it to a substantial $24.5 billion, marking an impressive 8.5% increase.

This notable escalation in the derivatives market corresponds directly with the price ascent of ETH. Typically, significant price fluctuations, such as upward movements, trigger a rise in market activity and speculative engagements. The current scale of the Open Interest uptick is particularly striking.

Over the last 24 hours, Ethereum’s price grew by 4%, which, while significant, pales in comparison to the Open Interest surge. This discrepancy suggests that underlying speculation is particularly heightened at this moment.

Historically, sharp increases in Open Interest have often preceded periods of increased volatility for Ethereum. This correlation arises because an influx of new positions drives up leverage, escalating the likelihood of mass liquidations that can unfold chaotically.

Given the strong increase in Open Interest relative to price, one might anticipate volatile movements for ETH in the very near future.

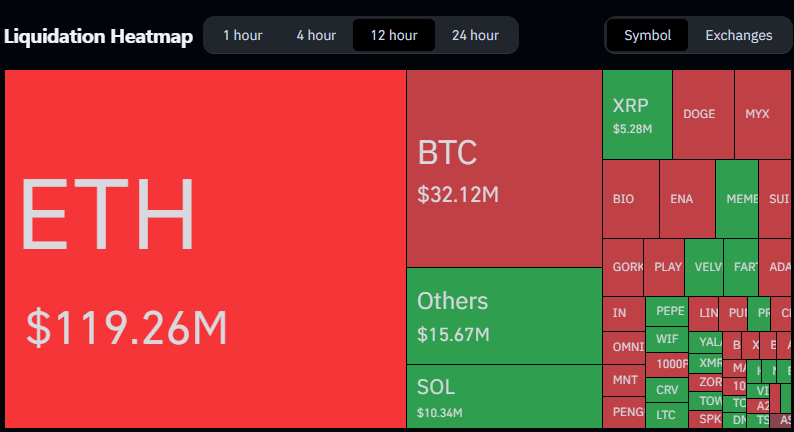

Data from CoinGlass shows that a significant number of liquidations have already occurred in the past 12 hours, further complicating the trading environment.

Visible in the graphic is that $119 million in liquidations related to Ethereum have transpired, making it the one with the highest derivatives clear-out, significantly exceeding Bitcoin’s $32 million in second place. Notably, a majority of these liquidations were attributed to short positions.

Overall, the broader cryptocurrency market encountered $284 million in liquidations over the last day, with an astonishing $233 million occurring in just the last twelve hours alone.

Current ETH Price Analysis

With this latest wave of momentum, Ethereum has managed to break through and stabilize above the $3,820 threshold, distinguishing itself from other market participants.