Bitcoin has once again captured the limelight, achieving an impressive peak of $124,500 and marking a significant new all-time high. This surge initially stoked optimism within the cryptocurrency community, sparking dreams of an enduring bullish trend. However, the excitement was quickly tempered as the price reverted to $121,500, prompting conversations about the potential for a more profound market correction.

Recent analytics from CryptoQuant reveal intriguing dynamics within the Net Unrealized Profit/Loss (NUPL) metric, which contrasts sharply with historical cycles. In previous market highs, sharp NUPL peaks indicated overheated conditions that often led to abrupt reversals. In this instance, however, the metric appears to ascend steadily, signifying a more stable environment indicative of a maturing market. Analysts credit this evolution to the influx of institutional investors and the influence of US-based spot Bitcoin ETFs, which have contributed to reduced volatility and limited the extremes of profit-taking.

The outlook for Bitcoin remains positive in the long term; yet, the forthcoming trading sessions could be pivotal in assessing if this current retraction serves as a necessary pause or is an early signal of a broader downturn. Market participants are keenly monitoring both pricing dynamics and NUPL trends to glean insights into upcoming price movements.

Bitcoin’s NUPL Provides Insights into Market Cycles

Market strategist Alex Morales highlights that the NUPL measurement serves as a crucial on-chain indicator for discerning market enthusiasm and positioning relative to pricing cycles. By calculating the ratio of coins held at a profit versus those at a loss, NUPL provides valuable context.

Historically, peaks in market cycles have often aligned with NUPL highs. For example, during the 2017 bull phase, the NUPL metric peaked sharply before a rapid downturn. The 2021 cycle, however, showcased two marked peaks, correlating with pronounced price surges followed by notable corrections.

In the current environment, NUPL seems poised to establish a third peak, a pattern not typically observed in prior bullish eras. Rather than the rapid, singular peaks of before, the market now exhibits a more gradual bullish trend. Morales indicates that this shift is largely attributed to a surge in institutional investment, particularly due to the recent approval of spot Bitcoin ETFs in the US.

This institutional involvement has enhanced market liquidity and stability, even as it dampens the extreme returns seen in prior rallies. This indicates a potential for prolonged market phases, with less likelihood of sharp, short-lived spikes.

In practical terms, this scenario suggests that Bitcoin could experience longer-lasting uptrends accompanied by milder corrections, as opposed to the unpredictable booms and busts of its past. Observers of the NUPL are keen to see whether this anticipated third peak materializes and what it may signify for Bitcoin’s future trajectory.

Testing Resistance After Historic High

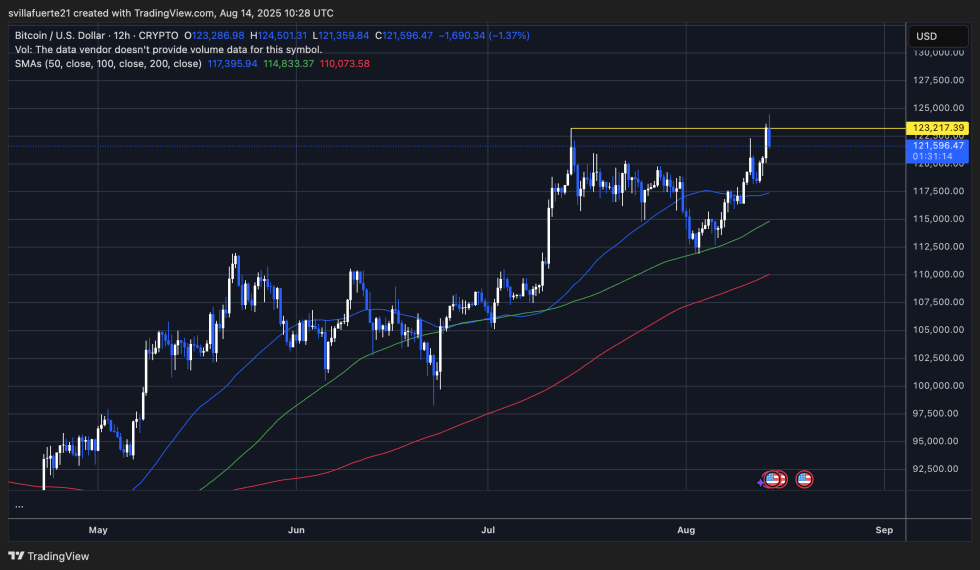

Currently, Bitcoin (BTC) is trading at around $121,596, reflecting a decline of 1.37% after briefly surpassing $124,501, a new historical high. This fluctuation underscores yet another challenge against the $123,217 resistance level, which has proven to be a formidable barrier for price movements. The swift rejection from this upper zone indicates considerable selling pressure at elevated price points, at least in the short term.

Despite the recent drop, BTC maintains a robust bullish framework, remaining comfortably above its 50 SMA ($117,395), 100 SMA ($114,833), and 200 SMA ($110,073). These rising moving averages indicate strong underlying momentum, and the surge from early August’s lows near $113,000 reflects that bulls remain firmly in control of medium-term market trends.

The $123K–$124K zone remains critical to monitor. A confirmed close above $124K would likely propel the market into new territory, igniting momentum buying and enhancing the potential for unprecedented price spikes. Conversely, immediate support now stands around the $120K mark, with firmer backing at $117K, where the 50 SMA correlates with prior price consolidations.

Featured image from Dall-E, chart from TradingView