Bitcoin continues to navigate a complex landscape, currently hovering around the significant resistance level of $113,000. This situation has left many investors feeling cautious as the short-term market dynamics remain elusive. Despite recent attempts by bullish traders to establish a foothold, the insufficient momentum has resulted in a hesitant atmosphere among those looking for definitive signals regarding Bitcoin’s trend direction.

Recent insights from expert analyst Darkfost reveal intriguing on-chain data indicating a notable increase in BTC outflows from miners. Specifically, these flows are measured over a 7-day average and suggest that miners might be repositioning their assets. This behavior is typically perceived as a precursor to potential selling, although it can also indicate strategic adjustments or new security protocols. What’s especially striking is the record low levels of BTC inflows from miners during this period.

This cycle shows that miner inflows are decidedly weak compared to previous phases, hinting at a strategy where miners are opting to retain more of their reserves. While miner conviction seems unwavering, investors are split on whether Bitcoin’s trajectory will tilt upwards or downwards in the near future.

Strong Resilience Among Bitcoin Miners

According to analyst Darkfost, the unprecedented decline in BTC inflows reflects a transformative shift within mining operations. He points out that Bitcoin’s market value and overall adoption are on the rise, enhancing credibility among miners.

As governments and major corporations increasingly integrate Bitcoin into their financial frameworks, it lends the cryptocurrency a degree of legitimacy that bolsters miners’ confidence. With institutional demand on the upswing, miners are more likely to hold their coin reserves rather than liquidate them hastily.

The remarkable appreciation in Bitcoin’s price means that miners no longer need to sell large quantities to cover their operational costs. A small liquidation can now afford them ample capital for equipment and energy expenses. This evolution drastically reduces the consistent selling pressure that characterized earlier market trends, allowing more BTC to remain off exchanges and bolstering its scarcity narrative.

Darkfost also notes the resilience displayed by miners during challenging market conditions. Although volatility has been a constant companion, Bitcoin’s declines have been relatively mild compared to historical downturns. In fact, given past cycles, today’s miners may be experiencing their most favorable operating conditions ever, thanks to solid fundamentals and growing global adoption.

This behavioral shift signifies Bitcoin’s maturation. Miners have transitioned from being forced sellers to strategic holders, able to adopt a long-term view without the constant pressure to liquidate.

Key Resistance and Potential Breakout

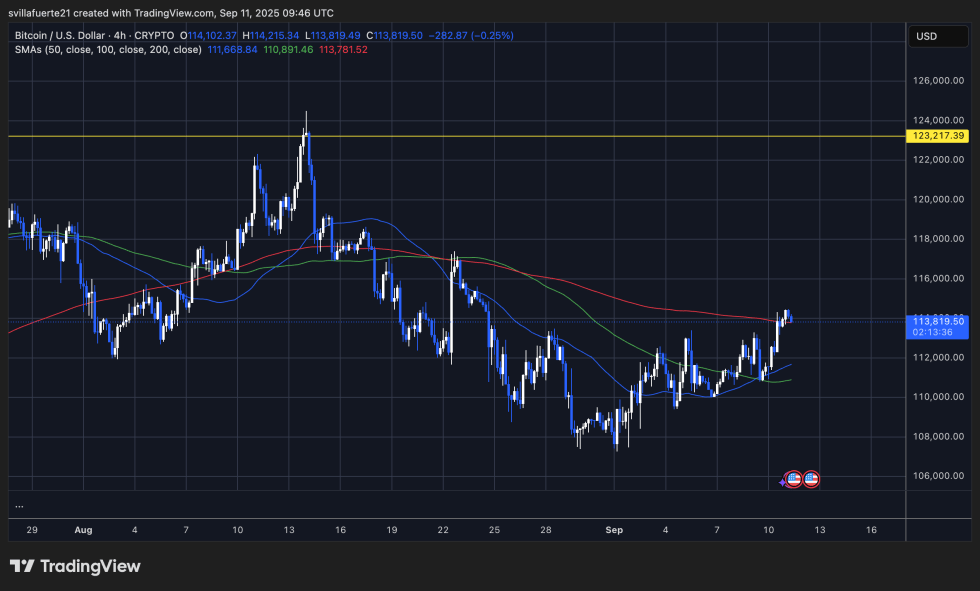

Currently, Bitcoin trades at $113,819 following a steady ascent from early September lows around $110,000. An analysis of the 4-hour chart indicates that BTC is approaching a critical resistance area outlined by the 200 SMA at $113,781, which has historically limited bullish attempts. Successfully breaking and consolidating above this barrier could signal heightened bullish momentum, potentially leading to targets of $116,000 and ultimately aiming for the major resistance at $123,217.

Supporting indicators, such as the 50 SMA at $111,668 and the 100 SMA at $110,891, are trending positively below the current price, providing essential support and highlighting the overall improvement in market structure. As long as Bitcoin maintains above $112,000, the short-term outlook remains optimistic, with buyers gradually reclaiming control after a prolonged period of sideways movement.

Nevertheless, the risk of rejection at the 200 SMA cannot be overlooked. Should Bitcoin fail to establish a support base above this level, it may retreat toward $112,000, with a drop below that level exposing the crucial $110,000 support area once more.

The current landscape is pivotal for Bitcoin. Bulls are gaining ground, but solidifying a hold above the 200 SMA is crucial for unlocking further upside possibilities. Until this happens, Bitcoin remains in a range-bound state, positioned between increasing support and substantial resistance overhead.

Image source: Featured image from Dall-E, chart from TradingView.