Memecoins have faced significant challenges since late 2024, as many market participants question their viability. The sharp decline in prices has left the sector in a precarious situation, with dwindling liquidity and a notable drop in retail excitement that once propelled their success. As these coins have struggled to maintain momentum, investor confidence is wavering, leading to widespread skepticism regarding their future.

However, some financial analysts propose that it may be premature to write off memecoins entirely. As shifting liquidity trends and institutional investments emerge, there’s a glimmer of hope for revitalization within this dynamic market. Analyst Darkfost raises an interesting point, suggesting that conditions may soon favor a resurgence in memecoins. Historical data indicates trends where these coins have previously regained dominance, often leading to explosive recoveries.

While the volatility surrounding memecoins remains a daunting prospect, the allure of substantial returns continues to captivate various investors.

Indicators of a Possible Memecoin Revival

Darkfost emphasizes the necessity of observing Memecoin Dominance within Altcoin Markets, which provides insights into the overall health of memecoins as compared to established alternatives. This comparative analysis can be instrumental in identifying whether memecoins are experiencing growth or decline relative to the broader altcoin ecosystem.

The frenzied trading that characterized the end of 2024 has since transitioned into a slow decline, where once-invested capital seems to be retreating. The frenzied activity has faded as the sector retraces its trajectory, reflecting the broad market’s exhaustion.

Investors involved in memecoins face unique challenges due to the oftentimes speculative nature of these digital assets. Unlike more established cryptocurrencies like Bitcoin, memecoins frequently lack essential fundamentals backing them, making them susceptible to sharp price swings. As such, strategic timing for both entry and exit becomes critical for capturing potential profits. Delays or miscalculations can quickly turn gains into substantial losses.

Despite these inherent risks, Darkfost’s observations indicate a potential upturn in the memecoin market. Current charts reflect an area where memecoins have historically found strength, hinting at the beginning stage of corrective rallies. With nascent signs of a shift in market sentiment, it appears that ether speculative capital is cautiously re-entering this previously buoyant sector.

If the favorable trend persists, conditions may align to ignite a new wave of interest in memecoins. While not likely to replicate past euphoria, an increase in speculative enthusiasm could result in notable market volatility and potential rallies. For those trading within this space, current data suggests that memecoins might regain their former narrative, though strict risk management remains essential.

Analyzing Market Capitalization Trends

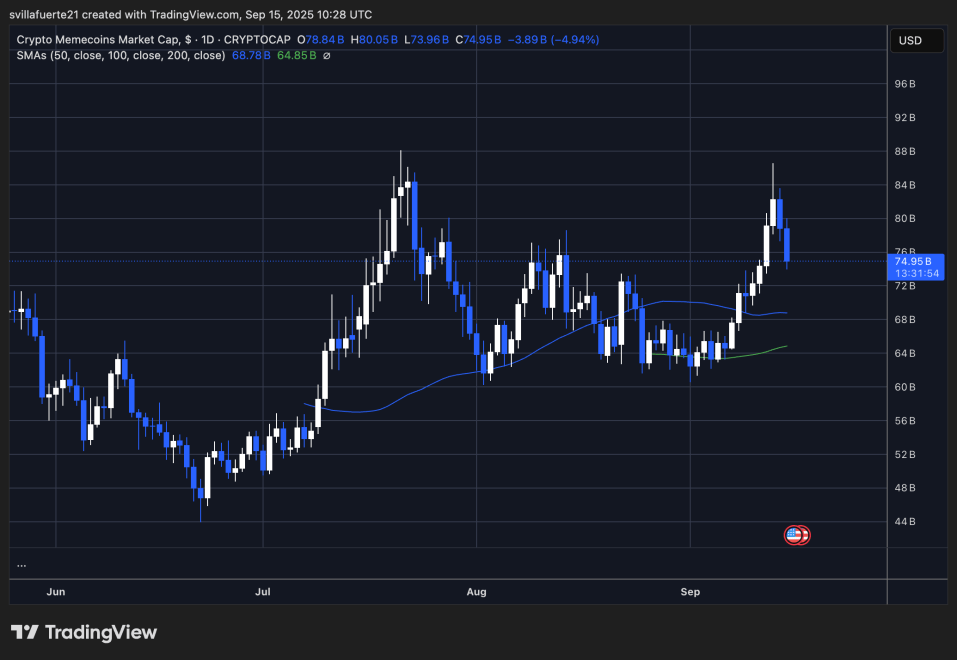

The daily chart tracking Memecoin Market Capitalization vividly illustrates the sector’s high volatility, underscoring the speculative nature of this market segment. Following a substantial rebound from the lows near $64 billion in July, the sector surged to over $88 billion in early September. Unfortunately, this momentum was short-lived, leading to a recent dip toward the $75 billion mark—representing a nearly 5% decrease in current sessions.

The 50-day moving average at $68.7 billion has proven to act as dynamic support during this market recovery, suggesting a consistent buyer interest at this level. At the same time, the ability of the sector to push past the $80 billion threshold and briefly flirt with $88 billion indicates that while profit-taking remains prevalent, speculative capital has not entirely vanished.

Currently, the memecoin market is in a consolidation phase following its rapid ascent, seeking to find an equilibrium. If the capitalization stabilizes in the range of $72 billion to $74 billion, traders may see a renewed attempt to breach the $80 billion mark, possibly boosting bullish sentiment. Conversely, dropping below the 50-day moving average could signal weakening momentum, opening pathways for a more significant retracement. Ultimately, memecoins remain subject to the dynamics of liquidity and broader investor sentiment, making timing an indispensable asset in trading strategies.

Image credits: Featured image from Dall-E, chart source: TradingView