Recent analysis by blockchain data specialists highlights the ongoing trends in Bitcoin’s spot ETF inflows, which remain subdued compared to previous bullish phases.

Current Dynamics of Bitcoin Spot ETF Inflows

According to a recent update by the on-chain analytics firm, the inflows into Bitcoin spot exchange-traded funds (ETFs) have not yet reached levels indicative of robust market interest. These ETFs serve as a convenient method for investors to participate in Bitcoin’s market movements without the complexities of direct ownership, such as managing wallets or private keys.

The approval of Bitcoin spot ETFs by the US Securities and Exchange Commission (SEC) in January 2024 has facilitated broader market access. By investing in a spot ETF, buyers can gain exposure while the fund directly holds Bitcoin assets for them.

This streamlined approach has attracted attention from traditional investors, especially institutions that favor regulated investment products. Monitoring the net inflows of these ETFs is vital, as they can reflect institutional sentiment toward Bitcoin.

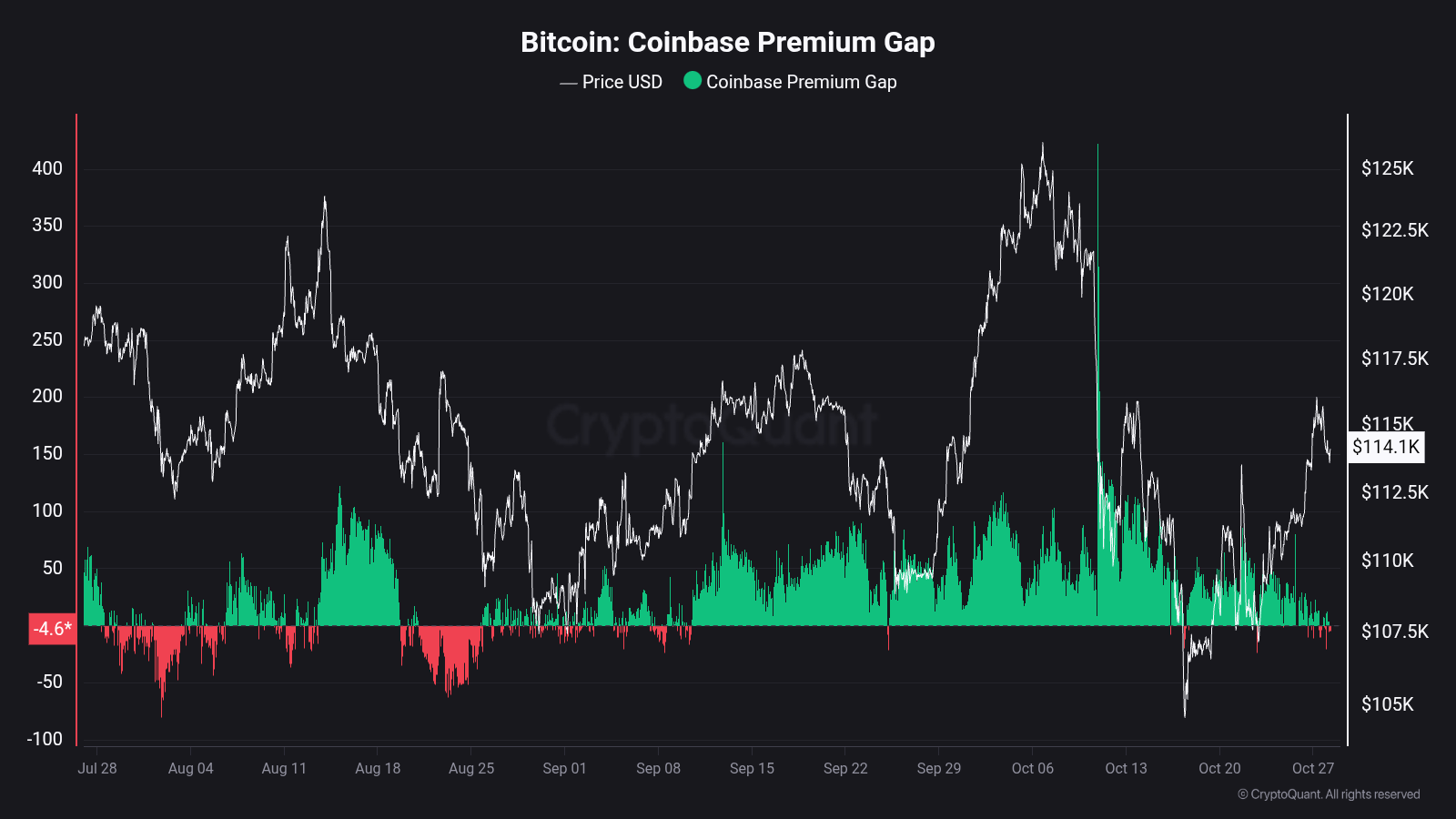

Below is the visual representation shared by the analytics firm that illustrates the fluctuations in Bitcoin ETF net inflows over the last year.

As depicted in the chart, a decline in Bitcoin’s spot ETF netflows was observed earlier this month, suggesting significant capital outflows during a period of price drop towards $104,000. However, following a recent price recovery, inflows have started to resume, signaling a potential uptick in demand for Bitcoin.

Despite this rebound, current netflows remain below 1,000 BTC per day. For perspective, previous market surges typically began with daily inflows exceeding 2,500 BTC. The firm noted, “While demand is increasing, it lacks the vigor observed in earlier rallies.”

Additionally, the ETF netflow isn’t the sole indicator pointing to softened institutional demand. Insights from a prominent community analyst reveal that the Coinbase Premium Gap is currently holding a neutral stance.

The Coinbase Premium Gap measures the disparity between Bitcoin’s price on Coinbase (USD pair) versus Binance (USDT pair). As Coinbase is the exchange of choice for many US institutional investors, including those managing spot ETFs, a positive gap would typically indicate higher buying interest among Coinbase users compared to their Binance counterparts. Recent strong uptrends in the market often accompany positive movement in this metric, yet it remains neutral at present.

Bitcoin’s Current Market Price

As of now, Bitcoin is trading at approximately $112,400, reflecting a 3.5% increase over the past week as market sentiment oscillates.