Recent on-chain research indicates significant changes in the distribution of Bitcoin supply, particularly concerning holders facing losses. This fluctuation offers insights into investor behavior and market psychology.

Current State of Bitcoin Supply Under Water

A recent analysis by leading on-chain data provider Glassnode highlights an important facet of the Bitcoin market—namely, the percentage of Bitcoin that is currently held at a loss. This Total Supply in Loss metric reveals just how many Bitcoin holders are experiencing unrealized losses.

This metric takes a deep dive into transaction histories, assessing the last recorded prices of Bitcoin. If a Bitcoin’s most recent transaction price is below the current market price, that Bitcoin is categorized as being “underwater.”

All such tokens are aggregated to formulate a network-wide metric, which is complemented by another metric known as the Total Supply in Profit. This latter metric accounts for coins that are currently valued higher than their last transaction prices.

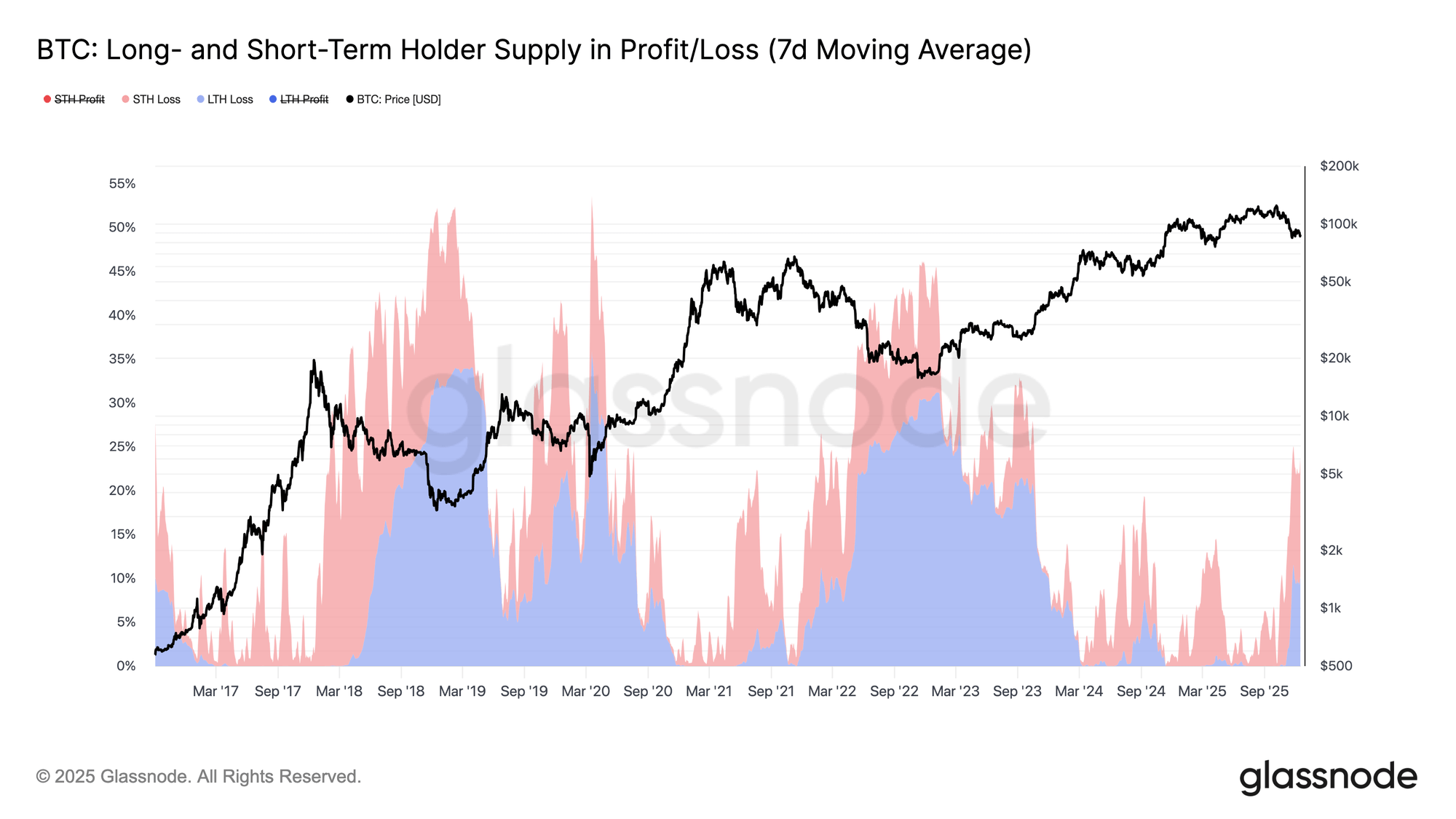

An insightful visual representation of this data provides a clear understanding of recent trends:

The graphic illustrates a sharp uptick in Bitcoin supply held at a loss, primarily attributed to the price plunge observed in November. Presently, there are approximately 6.7 million BTC in the loss category, marking the highest level of losses since the beginning of 2023.

Glassnode elaborates:

This persistent trend within the 6-7 million BTC span reflects previous cycles where rising investor discontent prefaced a pronounced downturn and subsequent capitulation in lower price environments.

The report also makes a significant distinction between short-term holders (STHs) and long-term holders (LTHs), defining the cutoff at 155 days. This classification allows for an understanding of how various groups are affected by the current market dynamics.

As illustrated in the subsequent chart, the recent surge in supply held at a loss was initially dominated by short-term holders.

However, as the market has continued to fluctuate, the distribution has evolved, with long-term holders increasingly accumulating a larger share of the loss supply.

- Currently, of the 23.7% of Bitcoin supply experiencing losses, 13.5% is allocated to short-term holders, while 10.2% is attributed to long-term holders.

- This shift mirrors past cycles where loss-bearing supply from recent purchasers transitions into long-term holding.

Current Bitcoin Pricing Analysis

As of now, Bitcoin is trading at approximately $85,400, reflecting a decrease of over 5.5% within the last week.