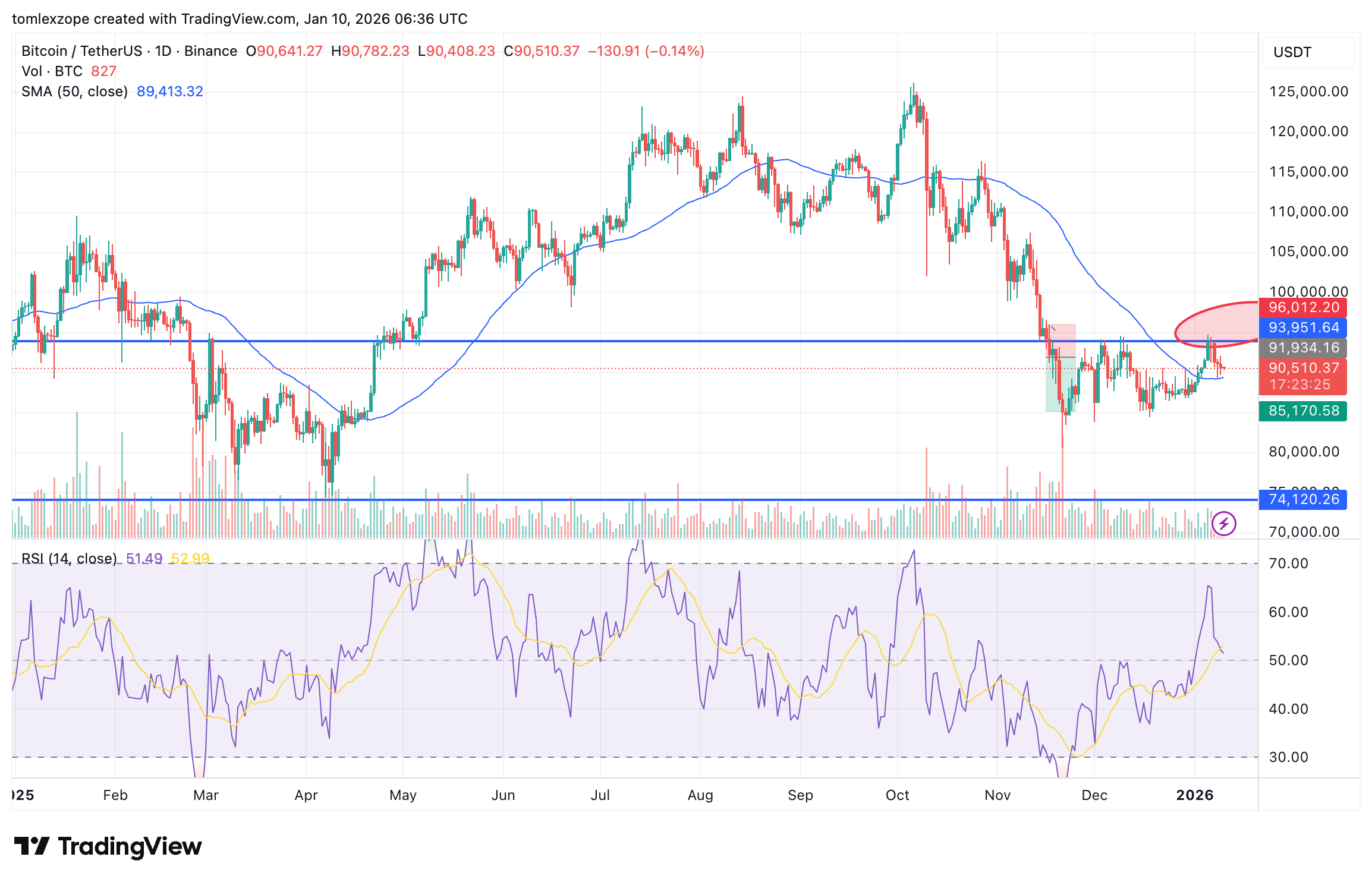

The cryptocurrency landscape is witnessing dynamic changes as Bitcoin’s value fluctuates, currently resting around the significant mark of $90,000. As we progress through 2026, market participants are questioning whether this trend indicates a robust upward momentum or merely a temporary rebound.

Recent discussions suggest an intriguing possibility: is it the beginning of a new bullish phase for Bitcoin, or are we simply observing a short-term bounce within a prevailing downtrend?

Market Insights: Possible Bear Market Bounce or Bullish Revival?

In a recent Twitter exchange, cryptocurrency analyst James Collins shared valuable perspectives on Bitcoin’s recent performance. His analysis incorporated both technical indicators and on-chain data to determine the sustainability of the current price actions.

Collins noted that the rebound was anticipated as Bitcoin sought support near its historical price levels. The $85,000 threshold serves as a pivotal point, representing significant buy-in from various investors. The defensive stance by these market players contributed to the current uptick.

Moreover, a notable metric called the Coinbase Premium Gap has emerged as a key indicator. This metric reflects the difference in Bitcoin prices on major exchanges. Collins pointed out an uptick post-New Year’s Eve, hinting at renewed buying interest primarily from U.S. investors.

In addition, the inflow of capital into spot exchange-traded funds has augmented since the rise in the Coinbase metric, reinforcing the notion that this activity likely stems from calculated investment strategies rather than impulsive buying driven by fear of missing out (FOMO).

However, Collins emphasized that while recent gains saw Bitcoin peak at around $94,000, there was a notable rejection at this level. This resistance indicates a lack of sufficient buying power to move beyond this price point convincingly.

He further pointed out that Bitcoin continues to navigate below essential levels like the Short-Term Holder Realized Price, posing a potential hurdle for any sustained price recovery. Observations from on-chain analyses lead to the conclusion that this recent surge may be more of a temporary relief within a bear market, despite the approximately 10% increase in value.

Current Status of Bitcoin

As of the latest updates, Bitcoin’s price is approximately $90,360, reflecting a slight decrease of nearly 1% within the last 24 hours.