Understanding Spreads Finance

Spreads Finance represents an innovative approach in the decentralized finance (DeFi) landscape, utilizing Ethereum to facilitate market-neutral trading via perpetual futures. Users can engage by depositing USDC to mint sprUSD, a stablecoin designed to yield significant returns, providing an opportunity for passive income without exposure to market volatility.

This platform connects seamlessly with various established DeFi ecosystems such as Pacifica, Curvance, FastLane, Nado, and Upshift. By utilizing the Points Vault, users can accrue points weekly from these integrations, consolidating their earnings without the complexity of managing multiple assets. Since its mainnet launch on December 29, 2025, Spreads Finance emphasizes simplicity and efficiency in complex DeFi strategies.

Details on Spreads Finance Airdrop

As of now, there has been no official confirmation regarding a token launch or airdrop from Spreads Finance. Nonetheless, participants can earn weekly points by depositing sprUSD into designated vaults, potentially converting these points into future token rewards as partner projects issue airdrops.

Engaging early with sprUSD positions you optimally for rewards from both Spreads Finance and its affiliates. User activity is systematically tracked and rewarded through weekly updates shared on their social media platforms, ensuring participants are well-informed about potential benefits from their deposits.

Steps to Engage in Spreads Finance Points Farming

- Acquire USDC from Binance and transfer it to your Ethereum wallet.

- Access the Spreads Finance user interface

- Connect your preferred Web3 wallet, such as MetaMask

- Input referral code OXZ69V

- Initiate a deposit by specifying your USDC amount

- Authorize the USDC spending limit in your wallet settings

- Finalize the transaction to mint sprUSD tokens

- Go to the “Vaults” section on the dashboard

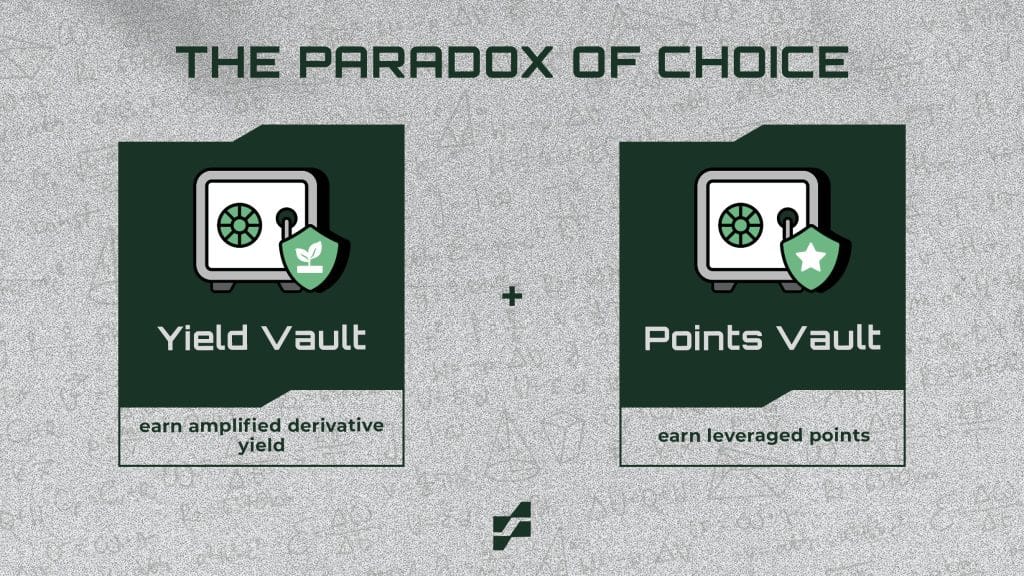

- Select the “Yield Vault” for enhanced returns or the “Points Vault” for maximized point earnings

- Opt for the Points Vault to gain exposure to airdrop opportunities from multiple projects

- Determine the amount of sprUSD you’d like to allocate

- Confirm your allocation transaction via your wallet

- Track your investments and weekly points updates through the dashboard

- Follow @spreads_fi for the latest announcements on points and airdrops

Maximizing Your Points Accumulation

Participate in Community Engagements: Attend AMAs and Twitter Spaces events hosted by Spreads Finance and their partner protocols to deepen your understanding and maximize your engagement.

Stay Updated on Partner Announcements: Keep an eye on news from integrated platforms like Pacifica and Curvance for additional incentives and updates that may impact your sprUSD holdings.

Common Questions

Is there confirmation of the Spreads Finance airdrop?

No formal announcements regarding airdrops or token launches have been made yet. Weekly points are distributed, and these may eventually convert to token rewards.

What is the minimum deposit requirement?

While there is no enforced minimum deposit, low amounts may not be cost-effective due to Ethereum network fees. It is advisable to deposit around $500 to $1000 to make the transaction worthwhile.

Can I withdraw my USDC at any moment?

You can always exchange sprUSD back to USDC. However, you should be mindful of the vault allocation periods, typically around 7 days, as well as transaction fees.

Which vault should I choose for optimal points farming?

The Points Vault caters specifically to those wanting to accumulate points, whereas the Yield Vault focuses on generating APR returns. Your choice should align with your financial goals.

How is the weekly points distribution determined?

The points are distributed based on formulas established by each integrated protocol, revealed weekly via Spreads Finance’s social media. The amount you allocate and the duration can affect the points you earn.

What happens to my funds while in the vault?

Funds allocated in sprUSD are controlled by you and can be retrieved after unallocating from the vaults. The protocol uses these funds for trading to generate income or points.

Final Thoughts

Spreads Finance simplifies the points farming experience within various DeFi protocols through a user-friendly interface. While an airdrop remains unconfirmed, early adopters may find themselves positioned favorably for future rewards from both Spreads Finance and its integrations. Investors can choose between generating passive yields or focusing on accumulating points based on their individual risk preferences.

This platform eliminates the hassle of managing assets across different protocols while offering lucrative returns through sophisticated trading algorithms. Regularly check the project’s social media for ongoing points updates and any announcements regarding token launches.

Interested in discovering other projects that might introduce tokens in the future? Explore our curated list of potential airdrops to ensure you do not miss the next opportunity in DeFi!

Don’t forget to connect with us on Twitter, Telegram, & Facebook and subscribe to our newsletter for the latest on new airdrop opportunities!