Bitcoin’s price is currently hovering around $108,000, showcasing a resilient bullish trend, despite its challenges in surpassing the notable $112,000 mark. This consolidation pattern, characterized by limited volatility, hints at a potential breakout that could dictate the market’s momentum in the near future. As both buyers and sellers gear up for their next strategic moves, this period might just be a precursor to substantial price shifts.

Insights from market analytics show that the Mayer Multiple — an important metric evaluating Bitcoin’s price against its 200-day moving average — stands at 1.1x. This places Bitcoin in a neutral zone, far from the speculative highs indicative of a booming market. Historically, valuations under 1.5x signal considerable room for growth before reaching saturation, suggesting investors may still find promising opportunities.

As the anticipation for a breakout heightens, investor focus on this value metric may confirm that Bitcoin is undervalued when compared to prior bull cycles. Should Bitcoin maintain its current price levels and successfully breach resistance, the neutral Mayer Multiple could indeed catalyze a renewed bullish trajectory; however, failure to do so may trigger a wave of short-term sell-offs.

Bitcoin Navigates Mixed Market Signals

If Bitcoin’s recent movements are any indication, many investors are feeling the pressure as the cryptocurrency lingers below its peak. Following several weeks of trading around the $110,000 threshold, market participants are preparing for a crucial price movement. While support remains robust above $105,000, the inability to exceed previous highs raises concerns about a potential sharp correction that could push prices below established demand zones that have held steady for the last month.

From a broader economic perspective, some signs of stability are emerging. As global conflicts take a backseat, and U.S. equities continue to thrive, a revived risk appetite is present. Conversely, concerns surrounding inflation and increased U.S. Treasury yields inject a level of caution into the environment, keeping traders on their toes.

Renowned analyst Axel Adler offers a positive interpretation, emphasizing the current Mayer Multiple of 1.1x, which remains firmly within a neutral range. Given that this indicator is still far from levels associated with market peaks, it implies Bitcoin could be trading at an advantageous price, indicating the potential for a significant rally if market momentum returns.

With fluctuating macroeconomic indicators and a neutral positioning in valuation models, Bitcoin’s future pathway hinges on whether bullish sentiment can regain dominance. A clear breakout beyond its historic highs would likely spark a new era of price exploration. However, if delays persist, there is a growing risk that sellers might test existing support levels.

Bitcoin’s Price Action Remains Range-Bound

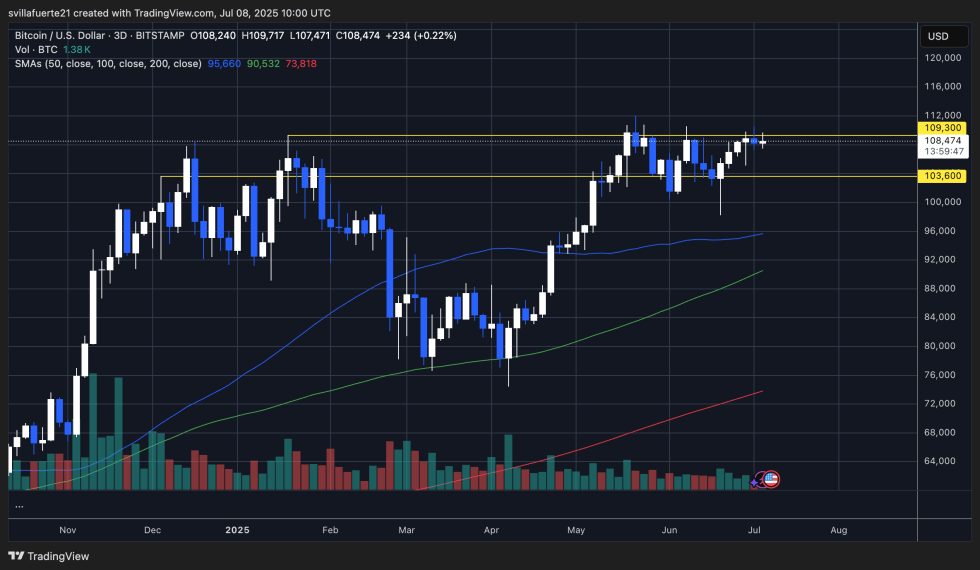

Currently, Bitcoin is fluctuating around $108,474, just shy of its peak. The 3-day chart illustrates a compressed price action between critical levels, with substantial support at $103,600 and resistance at $109,300 — the latter of which has been tested numerous times over the past two weeks. This indecisive range reflects the ongoing struggle between bullish ambitions and bearish pressures.

Importantly, Bitcoin remains comfortably above the 50-day, 100-day, and 200-day moving averages, indicating a sustained strength in market sentiment. While volume remains moderate, it has shown an uptick during price ascents, which signals sustained buyer interest near support levels.

As Bitcoin continues to hold its ground above $105K and maintains this ascending lower range, the likelihood of a breakout beyond $112K increases. However, if the price faces resistance at the $109K level, a retracement to support zones may ensue. Although momentum indicators aren’t provided here, they likely reflect the current stagnation in price movements.

Given the narrowing range between support and resistance, a critical price movement is on the horizon. Traders should keep an eye on a decisive breakout above $109,300 or a breakdown below $103,600, as either scenario will significantly influence Bitcoin’s trajectory as Q3 unfolds.

Image credit from Dall-E, chart provided by TradingView.