Bitcoin remains a focal point in the evolving landscape of digital currencies, currently trading around the critical support level of $103,600. This threshold has been pivotal for Bitcoin bulls, acting as a buffer against volatility. If it fails to hold, there are predictions of a potential decline below the $100,000 mark, which would trigger widespread sell-offs across the cryptocurrency market. The financial atmosphere is shaken further by rising geopolitical tensions, notably the unforeseen military actions in the Middle East, which have injected significant uncertainty into global markets.

Even amid these challenges, Bitcoin demonstrates notable resilience, managing to maintain its position above the psychological barrier of $100,000 as many investors shift away from riskier assets. Analyst insights, like those from prominent figure Darkfost, shed light on an interesting trend: Bitcoin seems to be diverging from traditional correlations with US Treasury yields. Typically, rising yields have indicated dwindling interest in cryptocurrencies, yet Bitcoin continues to thrive as yields reach historic highs.

Darkfost notes that the fate of Bitcoin may increasingly hinge on fluctuations in the U.S. Dollar Index (DXY). A weakening dollar has correlated with a swift rise in Bitcoin prices, suggesting that liquidity is flowing into Bitcoin as a preferred safeguard in the financial ecosystem. The coming days could be crucial, holding the potential to reshape investor strategies.

Bitcoin Stands Strong Despite Market Turbulence

Having struggled to breach the $112,000 resistance, Bitcoin experienced a notable decline of over 6%. Nevertheless, it has remained steadfast above the crucial $103,600 threshold, even in the face of geopolitical upheaval associated with the Israel-Iran conflict.

Darkfost underlines the increasing relevance of macroeconomic indicators such as the DXY and US Treasury yields in shaping institutional attitudes towards cryptocurrency. In a traditional market context, rising metrics in these areas often coincide with drastic capital exits from the risk sector, resulting in price corrections across Bitcoin and other digital assets.

Historically, when both DXY and yields decline, confidence in risk assets generally rebounds. These phases frequently align with potential monetary easing or anticipated cuts in interest rates from the Federal Reserve, igniting bullish trends in the cryptocurrency sector.

What distinguishes the current market cycle, according to insightful analysts like Darkfost, is Bitcoin’s continued increase despite rising yield rates. This divergence could signal a transformative shift in the interaction between Bitcoin and established financial indicators.

Analysts propose that this market anomaly may indicate a changing perception of Bitcoin as a safeguard against systemic risks, rather than merely a speculative vehicle. With concerns surrounding inflation and the stability of sovereign jurisdictions on the rise, institutional investors are starting to see Bitcoin as a legitimate means for risk management, broadening its role in the financial world.

Buyers Step In as Support Levels Face Renewed Pressure

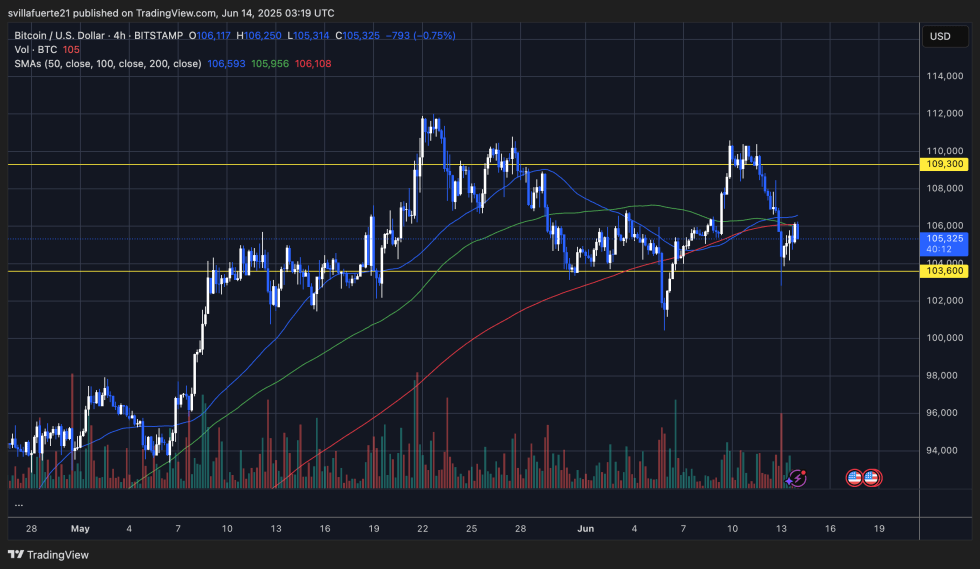

Bitcoin is currently positioned around $105,300, following turbulent trading influenced by geopolitical tensions and uncertainty in the macroeconomic landscape. Recent charts reveal that Bitcoin temporarily dipped below the crucial $103,600 support level—a key area of demand—but quickly rebounded, showcasing strong buying interest at lower price points.

The alignment of the 50, 100, and 200-period simple moving averages between $105,950 and $106,600 indicates strong dynamic resistance. For Bitcoin to regain bullish momentum, surpassing this range will be essential, specifically the $106,600–$107,000 zone. Failure to do so could signal another testing of the pivotal $103,600 support level, which has been challenged multiple times since early May.

Heightened trading volume during this most recent dip suggests either capitulation or forced selling, trends that frequently precede short-term recoveries. Buyers are eager to see sustained upward momentum beyond the $106,000 mark to validate this as a genuine reversal rather than a mere rebound.

Featured image from Dall-E, chart from TradingView