Cryptocurrency trends are ever-changing, and as Bitcoin nears a critical price juncture, the dynamics of market sentiment reveal key insights. Currently, Bitcoin is trading significantly below its peak of $112,000, raising questions among investors who are closely monitoring market movements for signs of a potential rebound. Despite exhibiting resilience, Bitcoin’s upward momentum appears to be faltering amid broader economic uncertainties.

Market analysts highlight that selling pressure has been observed, yet it has not escalated to alarming levels. This indicates that a considerable number of investors maintain a long-term positive outlook on Bitcoin, opting to hold rather than liquidate their assets. Nevertheless, the real challenge lies in the lack of new buying interest, which is crucial for propelling Bitcoin into a fresh rally.

Data suggests that while Bitcoin’s supply remains steadily limited, new capital entering the market has diminished, creating a paradox. This shortfall in demand reflects a potential barrier to Bitcoin’s ascent, indicating that a renewed wave of investment would be essential for any significant price increase. Until such an influx occurs, it seems Bitcoin is on a consolidation path.

Stable Above Key Levels Amid Diminished Demand

Since setting a foundation above the $100,000 threshold, Bitcoin has shown a remarkable strength, marking an increase of approximately 40% since its lows in April. However, lingering around $112,000 raises valid concerns regarding the viability of maintaining such high levels. Extended periods without a breakthrough can lead to negative pressures that risk pushing prices under vital support levels.

Recent insights from notable analysts emphasize a significant behavioral shift within the market, especially regarding profit-taking activities. Despite some activity, the prevailing trend shows most investors are opting to remain in their positions, indicating a continued belief in Bitcoin’s potential for appreciation. Still, the hesitance in demand remains a focal point for market watchers keen on future price movements.

A recent analysis showcased that the relationship between freshly introduced supply and dormant supply that has remained inactive for over a year presents telling signs of demand strength. This ratio has deteriorated since reaching the previous peak in May. While existing buyer sentiment can absorb limited selling pressure, this is insufficient for a substantial upward shift.

Currently, Bitcoin seems locked in a range of stability, buoyed by investor confidence but also hindered by a conspicuous lack of fresh demand. If this situation shifts and new interest re-emerges, a breakout into uncharted territories could be imminent. Until then, traders remain vigilant, awaiting more favorable market conditions.

Technical Analysis: Key Support Levels and Market Behavior

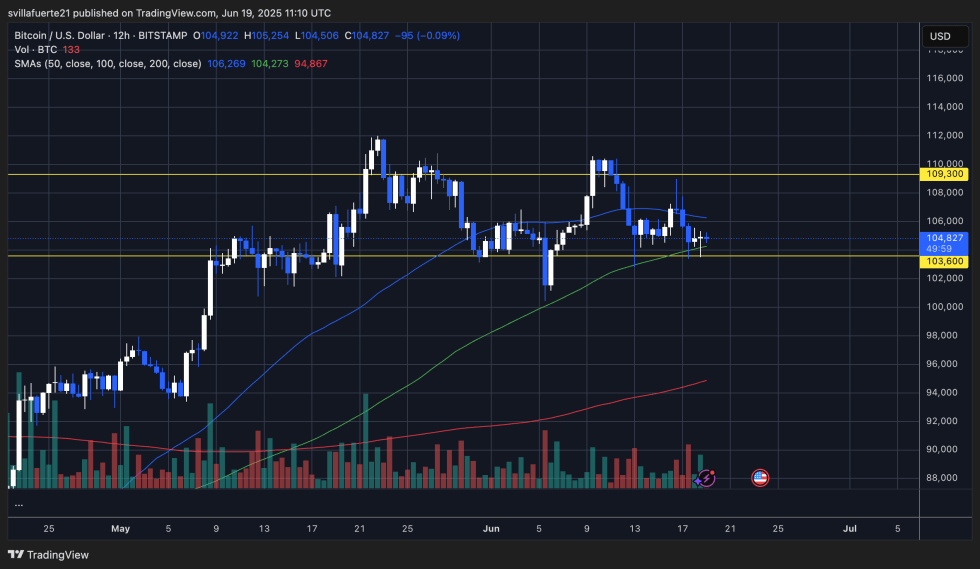

Presently, Bitcoin is trading in the vicinity of $104,827, carefully navigating just above a pivotal support zone at $103,600. This support level, established during previous market highs, serves as a crucial battleground for bullish traders. Observations from the 12-hour chart reveal that this support has successfully held firm through several tests, although these have been followed by a lack of substantial upward momentum.

The 100-period moving average provides vital support slightly above $104,200, with the 50-period moving average presenting resistance near $106,269. This convergence of moving averages indicates the market is in a phase of tightening, suggesting that a breakout—whether upward or downward—could manifest soon. Current trading volume remains subdued, which points to a hesitance from both buyers and sellers.

Resistance remains firmly capped at the $109,300 level, where Bitcoin has struggled to reclaim momentum in recent attempts. A decisive breakthrough above this price point could signal a resurgence of bullish behavior, ushering in price discovery. However, if Bitcoin continues to falter against this resistance amid prevailing uncertainties, the risk of descending past the $103,600 mark grows, indicating the potential for deeper market corrections. Presently, Bitcoin stands firm, yet signs of strain are evident.

In conclusion, while the current market scenario suggests a degree of stabilization, the fate of Bitcoin largely hinges on the revival of buyer interest and macroeconomic (and geopolitical) clarity. Investors remain poised, closely monitoring developments.