The cryptocurrency market is experiencing a notable shift as Bitcoin shows early signs of a revival. After facing intense selling pressure for several weeks, the price made a startling dip to around $103,000 on October 10 but has since rebounded to test crucial resistance around $111,000. This price point has historically been a battleground for buyers and sellers, emphasizing the ongoing uncertainty among traders.

Market analyst Jordan Knight suggests that Bitcoin could be transitioning into a phase of skepticism, a common occurrence after significant downturns. Investors often find it challenging to trust early indicators of recovery, a sentiment that is now observable in the market’s derivatives, especially through the changing funding rates that represent trader sentiment.

On leading exchanges like Binance, which command a significant portion of global futures volume, funding rates have remained in the negative territory for the past week, currently hovering around -0.003%. This consistent bearish outlook indicates that short positions are still prevalent, as traders maintain a cautious stance following recent market disruptions. Historically, such sustained skepticism and short positioning often precede robust market recoveries or explosive price shifts.

Understanding the Path to Possible Moonshot

Knight emphasizes that this prevailing skepticism could paradoxically serve as a stepping stone for Bitcoin’s next major surge. When traders retain a bearish outlook despite any positive signals, the amassed short positions create a precarious environment ripe for a short squeeze. In these cases, even a slight upward movement can trigger a rush of short sellers to cover their positions, which in turn amplifies buying momentum, potentially leading to a significant breakout.

If the current supportive trend maintains its momentum, a wave of forced liquidations could dramatically elevate Bitcoin’s price. Knight highlights critical liquidity levels between $113,000 and $126,000, where short positions are heavily concentrated. As these positions unwind, we might witness cascading buying pressure — a dynamic that has historically led to significant price breakouts.

This pattern has played out in the past as well. For instance, in August 2023, Bitcoin plummeted to $55,000 yet managed to rebound above $100,000 due to a substantial short squeeze. Similarly, in May 2024, Bitcoin rallied from $87,000 to $114,000 before hitting around $125,000, demonstrating this recurring cycle.

Knight believes that we might be entering another phase of skepticism, where external doubt cloaks the underlying market strength. If history is any guide, this climate of uncertainty could transform into powerful momentum, setting the stage for Bitcoin’s next notable price movement.

Analyzing Support Levels and Resistance Ahead

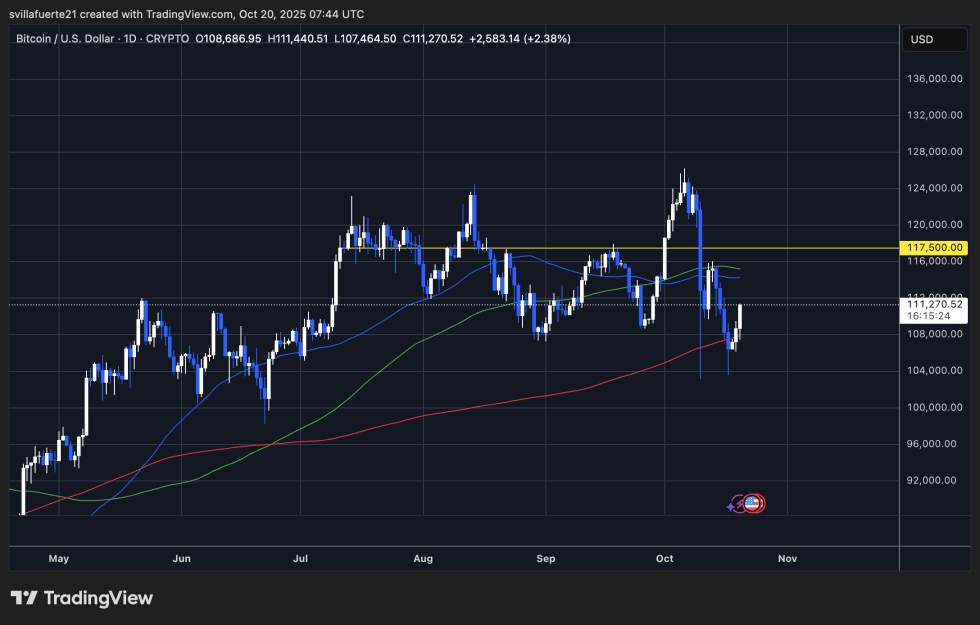

Bitcoin is currently stabilizing after a turbulent trading period, having recovered from a low point near $106,000 to around $111,200. The price action reflects an essential reclaim of gridlock, with buyers actively engaging around the 200-day moving average (outlined in red) — a critical long-term support region that historically indicates accumulation during downturns.

Nevertheless, Bitcoin is on the brink of encountering a formidable resistance zone. Both the 50-day (blue) and 100-day (green) moving averages converge around the $114,000 to $115,000 range, forming a significant resistance cluster. A successful breakthrough in this area could indicate restored bullish momentum and open pathways toward $117,500, representing the next liquidity threshold and psychological landmark for optimistic traders.

If, conversely, Bitcoin fails to maintain levels above $110,000, it could confront renewed selling pressure, potentially reassessing the $106,000 level or revisiting the $103,000 threshold experienced during the recent flash crash. The existing market structure suggests that the market remains in a recovery and skepticism phase, where investors exercise caution despite the brisk improvement in price.

The primary focus remains squarely on whether Bitcoin can solidify its momentum above the 200-day moving average. Achieving a confirmed daily close above $113,000 would enhance bullish sentiment and validate the inception of a possible short-term reversal.

Featured image sourced from remote data, chart insights generated by TradingView.com