Cryptocurrency markets are witnessing a remarkable resurgence, with Bitcoin recently hitting an impressive benchmark of $78.5K. This milestone has stirred optimistic predictions of a future surge beyond the $100K mark, yet caution is advised.

A careful examination of trading data reveals an unsettling trend: despite the rising prices, market confidence appears to be waning.

This recent bounce seems driven more by speculative trading than by genuine market interest. Analysis of trading volumes indicates a significant liquidity void between $72,000 and the current price point. This suggests that any abrupt sell-offs could lead to rapid declines due to a lack of strong support. The situation creates a precarious environment where market swings become the norm.

Even as price movements fluctuate, the underlying cryptocurrency ecosystem is evolving. Institutional investors are looking beyond daily price changes—often mere background noise—and focusing on the structural challenges that Bitcoin faces. Each time Bitcoin gains momentum, transaction fees surge and processing times lengthen.

This issue has prompted a pivot towards innovation in infrastructure aimed at alleviating these pain points. Investors are increasingly looking at high-throughput Layer 2 platforms as a way to hedge against market volatility. The rationale is straightforward: if Bitcoin thrives, it will require scaling solutions; if it stagnates, development will shift to the layers that enhance its capabilities.

Leading this innovation wave is a project called Bitcoin Hyper, which has captured the attention of institutional investors by merging the rapid capabilities of Solana’s framework with Bitcoin’s robust security features.

Explore $HYPER now.

Bitcoin Hyper: Combining Speed and Security

The ongoing debate around Bitcoin’s function as either a secure asset or a versatile platform for applications is becoming less relevant with Bitcoin Hyper ($HYPER). As the inaugural Bitcoin Layer 2 that taps into the Solana Virtual Machine (SVM), it provides capabilities far beyond those achieved by traditional sidechains.

This integration is significant. Ethereum has dominated the DeFi landscape primarily due to Bitcoin’s limitations in executing sophisticated smart contracts. By adopting the SVM, Bitcoin Hyper enhances the Bitcoin network’s speed and efficiency. Its architecture employs Bitcoin L1 for ultimate settlement and a real-time SVM L2 for effective execution. This leads to remarkable speed, achieving settlement in mere seconds compared to Bitcoin’s traditional 10-minute transaction time.

Developers, often early indicators of market trends, are particularly interested in the emerging ‘Decentralized Canonical Bridge.’ This infrastructure facilitates high-speed transactions in wrapped BTC and supports various DeFi applications, including lending platforms and NFT marketplaces, all engineered with Rust-based software development kits (SDKs). This approach successfully overcomes the so-called “trilemma” by preserving the security of the base layer while entrusting operational tasks to a highly effective execution layer.

Discover the Bitcoin Hyper ecosystem.

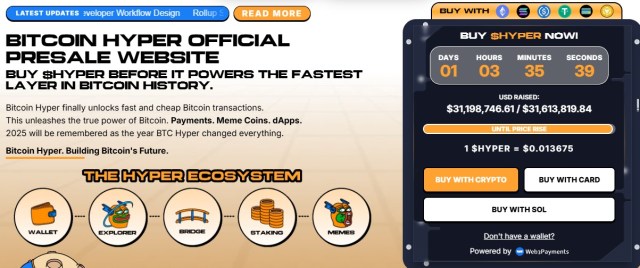

Strategic Investments in a $31M Presale

Even as the overall market exercises caution regarding short-term fluctuations, savvy capital allocators are actively engaging in the $HYPER presale. The initiative has successfully raised over $31.2 million, signaling substantial demand for scalable solutions on the Bitcoin network.

On-chain evidence supports this trend. Data from Etherscan shows that two prominent wallets have amassed over $1 million in $HYPER tokens.

The most significant transaction ($500K) was recorded on January 15, 2026, indicating that high-net-worth individuals are establishing positions ahead of public trading opportunities. With the current token price at $0.013675, these actions suggest a shared belief in the asset’s latent value considering its potential utility.

The tokenomics are structured to encourage long-term participation. Following the Token Generation Event (TGE), the protocol promises attractive APY staking, coupled with a short 7-day vesting period for presale participants. This design minimizes the risk of immediate sell-offs while rewarding those involved in governance. For investors cautious about Bitcoin’s current volatility at $78.5K, the $HYPER presale represents an informed opportunity for future growth potential.

Visit the official presale webpage.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies carries significant risks, including the risk of total loss. Always verify presale details independently.