As June comes to an end, Bitcoin has achieved a significant milestone, reaching an all-time high monthly close. Renowned cryptocurrency analyst Rekt Capital reports that this historic close indicates a strong bullish sentiment in the market. However, despite this bullish indicator, certain bearish elements pose risks to what would typically be a favorable market condition for Bitcoin.

A Historic Breakout

With Bitcoin’s latest monthly close surpassing the $106,000 mark, the cryptocurrency is confirming a strategic bullish breakout. This indicates that market participants are confident, establishing a foothold above the crucial psychological threshold of $100,000.

According to Rekt Capital’s analysis, while the recent monthly close is promising, bullish traders must remain vigilant. The core issue lies in the low buying volume; for Bitcoin to sustain its upward trajectory, demand from buyers must strengthen significantly.

Overall trading volume is still relatively subdued, which has resulted in Bitcoin experiencing a sideways trend. A significant movement in price necessitates an increase in trading volume; otherwise, there is a substantial risk of a downside correction.

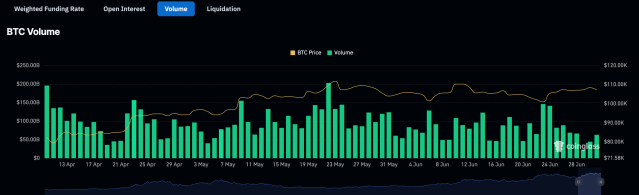

Looking at the data from Coinglass, we observe that Bitcoin’s daily trading volume plummeted by over 60% during the final week of June. Remarkably, daily volume peaked at $146 billion on June 23, shortly after experiencing a decline below the $102,000 threshold. However, as Bitcoin’s price climbed throughout the month, trading volume receded, culminating in a lower closing figure.

By June 29, daily trading volume had dropped to as low as $22 billion before bouncing back to close at $44.7 billion at the end of the month. This pattern reveals a troubling trend: as Bitcoin’s price rises, trading volume has consistently declined, indicating a growing cautiousness among investors about price sustainability.

If low trading volume persists, Rekt Capital still sees potential for a bullish scenario for Bitcoin. A logical initial step would be revisiting the high range around $102,000, aiming to attract additional buying liquidity for a subsequent bullish move. However, if that crucial support level fails to hold amid low volume, Bitcoin could face risks of falling to around $93,000.

Should the buying volume rise at this high range, it could set the stage for a new upward trajectory. Given that Bitcoin is trading near its all-time highs, even a modest 10% price increase could catapult it to new records, particularly if the bullish sentiment manages to uphold support around the $102,000 mark.