As Bitcoin approaches a crucial trading week, it stands strong with recent price action solidifying its position just under previous all-time highs. Currently fluctuating around the significant milestone of $110,000, market participants are watching keenly for signs of momentum that may propel the cryptocurrency to new heights. Many traders and analysts alike are on high alert, suggesting that the next breakthrough could be imminent as market conditions appear increasingly favorable.

Analysts’ confidence is on the rise, with many forecasting substantial price movements in the near future. Key metrics, including on-chain data and price performance, indicate sustained demand alongside a robust trend. Yet, one notable trend to consider is the activity of Bitcoin miners.

According to insights from crypto analyst Axel Adler, miners have noticeably increased their sales post all-time high. The daily average for Bitcoin inflows into exchanges has jumped from around 25 BTC to 50 BTC, indicating a potential trend of profit taking.

Anticipation Grows as Bitcoin Factors in Miner Dynamics

Bitcoin appears to be on the brink of an exciting market phase, bolstered by an optimistic sentiment that continues to rise. With prices hovering just below the historical benchmark near $112,000, BTC is positioned within a strong upward trajectory. Observers anticipate that the coming days will be crucial in determining whether Bitcoin is ready to embark on its next significant upturn. The current price stability and bullish setup suggest that an explosive move might soon surface.

Alongside these technical indicators, the broader global economic landscape plays a major role. As geopolitical tensions escalate, particularly involving major economies, Bitcoin is increasingly recognized as both a protective asset and a volatile growth instrument—making it attractive in uncertain times.

Adler’s recent analysis sheds light on miner activities that could sway short-term price movements. With miner inflows hitting an average of 50 BTC daily, a potential uptick in selling is evident. However, Adler emphasizes that this activity remains significantly below previous highs, which could be viewed as a steadying influence on prices.

Crucially, the market seems to be absorbing this increased selling pressure rather effectively, indicating that demand remains robust. This adaptability suggests that miner sell-offs have not critically affected the upward trend but rather reflect an expected adjustment following a significant price milestone.

As Bitcoin remains on the cusp of exploring all-time highs, the interplay between favorable market structure, supportive on-chain metrics, and poignant demand could create the necessary conditions for continued growth. Should bulls reclaim the significant $112K mark with determination, Bitcoin could enter a dynamic price discovery phase with targets substantially exceeding current levels.

Buyers Steady Above $108K Mark

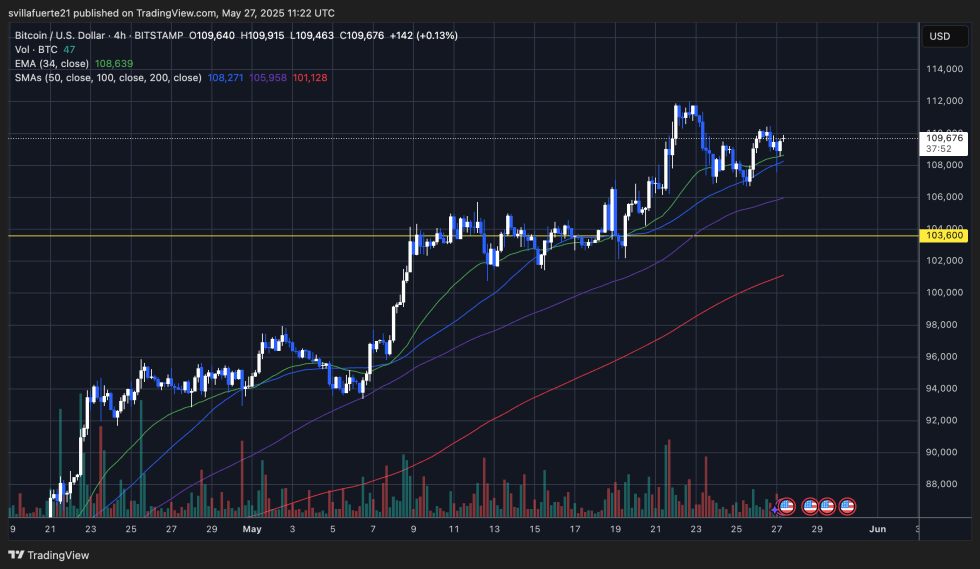

Currently positioned at $109,676, Bitcoin’s 4-hour chart indicates a consolidation phase just below recent all-time highs. Following a minor retracement, BTC has upheld its strong uptrend by consistently forming higher lows while maintaining distance from critical moving averages. The 34 EMA provides solid support at $108,639, while the 50 and 100 SMAs reinforce this base at $108,271 and $105,958, respectively.

The observed volume during this consolidation has shown slight declines, hinting at a temporary pause rather than a trend reversal. Importantly, Bitcoin is holding firmly above key horizontal support at $103,600, which now serves as a vital base for any further pullbacks. As long as this support level holds, the uptrend is likely to remain intact.

What stands out is Bitcoin’s ability to maintain levels above the 34 EMA, despite the increased miner activity and growing broader market caution. This resilience points to robust buying interest, signaling positioning ahead of what could be a significant upward movement.

To validate the continuation of this trend, bulls must aim to reclaim the $111K–$112K range with noteworthy volume. A decisive breakout above this resistance could set off the next wave of upward momentum. Presently, Bitcoin appears to be in a bullish holding pattern, supported by key levels that anchor its price action as the market eagerly anticipates a transformative move.

Featured image from Dall-E, chart from TradingView