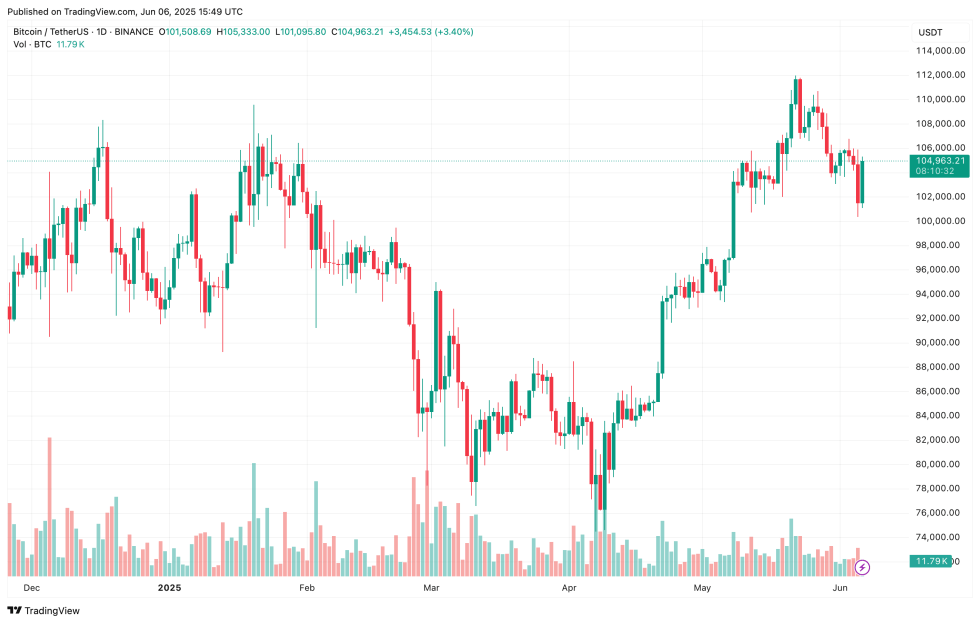

Bitcoin (BTC) saw a notable dip yesterday, plummeting to a low of $100,372 on the Binance exchange. As volatility continues, recent blockchain insights suggest that this downtrend could persist, primarily due to an increase in transfers made by BTC miners to exchanges.

Unprecedented Miner Transfers to Exchanges

A recent analysis from CryptoQuant highlighted a significant uptick in the amount of Bitcoin being sold by miners, reaching unprecedented levels. This surge likely played a role in the recent price drop from the higher $100,000 bracket.

For those unfamiliar, miner-to-exchange transfers reflect the total amount of Bitcoin that miners offload to exchanges, which can influence market dynamics. A rise in these transfers often indicates that miners are liquidating their assets, which increases supply and may consequently drive prices lower.

The data presented by CryptoQuant reveals that miner inflows exceeded $1 billion daily from May 19 to May 28, 2025. Should this trend continue, Bitcoin may enter a more significant correction phase, potentially revisiting the low $90,000s.

This pattern mirrors occurrences earlier in January when BTC experienced a historic surge, setting multiple all-time highs in rapid succession. At that time, miners sold nearly 140,000 BTC for around $13.72 billion.

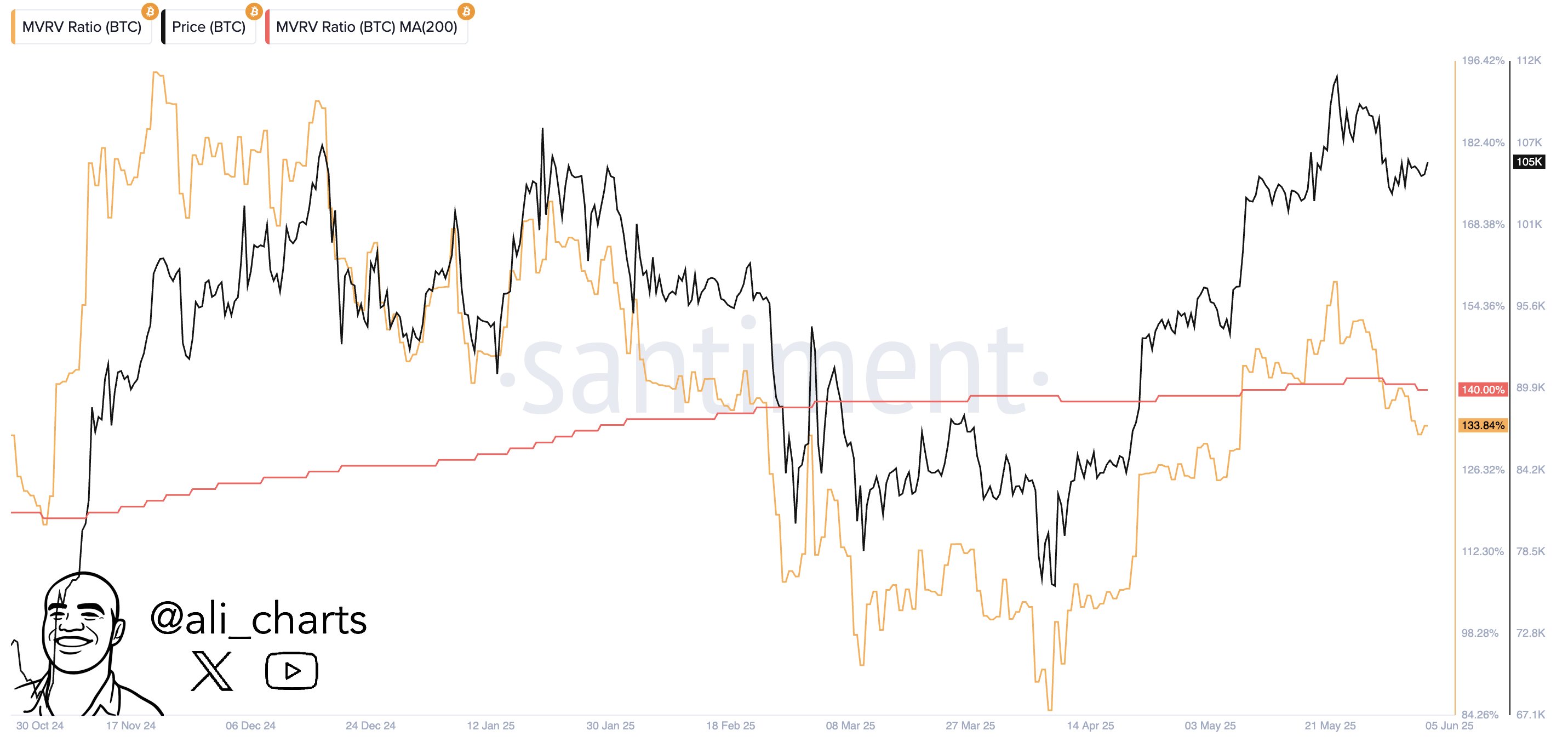

Adding further concern, well-known crypto analyst Ali Martinez recently noted in his social media updates that the Bitcoin Market Value to Realized Value (MVRV) ratio has dropped below its 200-day simple moving average (SMA), indicating potential for additional downward pressure.

When the MVRV ratio falls beneath its 200-day SMA, it implies that many holders are sitting on paper losses, which might foster a more bearish sentiment, causing small investors to sell off further.

Bitcoin Holders Weigh Their Options

Compounding the existing market anxiety, a recent public exchange between public figures such as US President Donald Trump and Elon Musk has seemingly driven market sentiment down. Current projections by analysts anticipate BTC might dip to around $96,000 if the conditions persist.

Another analyst, Anup Ziddi, echoed these sentiments, cautioning that BTC risks further declines as long as it remains below the $107,000 threshold.

However, there are positive indicators for investors to consider. Recent on-chain data presents a picture of new Bitcoin whales actively accumulating the asset, suggesting potential for a future supply shock. Currently, BTC is trading at $104,963, showing a slight increase of 0.2% over the last 24 hours.