As the cryptocurrency ecosystem evolves, Bitcoin finds itself in a pivotal stage, wavering between excitement and uncertainty. While bullish sentiment strives to push the price upward, the bears are equally determined, resulting in a capped price range of approximately $110,000 to $115,000. This equilibrium suggests a significant shift in market sentiment, with Ethereum and other altcoins beginning to strengthen against Bitcoin, hinting at potential capital diversification.

Insights from the latest industry analysis reveal a curious trend: the disparity between the actions of short-term speculators and the more decisive moves by long-term investors. Data indicates that wallets holding between 100 and 1,000 BTC—often referred to as ‘whales’—have accumulated an impressive 65,000 BTC within just a week. This surge has propelled their collective holdings to an astonishing 3.65 million BTC.

What is particularly interesting is that this accumulation occurred while Bitcoin’s price remained relatively stable around $112,000. Although retail traders have contributed to short-term market swings, the underlying demand from larger players remains incredibly robust, hinting at confidence in Bitcoin’s future performance.

Onchain Data Indicates Potential Supply Squeeze

A recent report from XWIN Finance, shared by CryptoQuant, highlights two crucial onchain metrics showcasing that Bitcoin’s market behavior is predominantly influenced by substantial demand from long-term holders rather than transient speculation. The Long-Term Holder (LTH) Net Position Change and Exchange Netflow indicators clearly demonstrate that a significant level of supply is being absorbed in the market.

The LTH Net Position Change, which monitors the balance shifts among experienced holders over a 30-day period, has shown a marked increase. This positive trend hints that seasoned investors are not merely trading but actively acquiring Bitcoin. Historically, such moments of accumulation are precursors to explosive bull runs, leading to coins being retained in the hands of committed holders who are less susceptible to market fluctuations.

Moreover, the Exchange Netflow data reveals a noticeable trend of net withdrawals, indicating that investors are opting for cold storage rather than leaving their assets liquid for trading purposes. This trend, when combined with LTH accumulation, reinforces the notion that Bitcoin is being taken out of circulation rather than simply being traded among speculators.

The synergy between whale accumulation, LTH activity, and consistent exchange outflows cultivates the conditions for a possible supply squeeze. Although temporary price corrections may occur, especially if derivatives markets become overheated, the broader outlook appears to favor upward price movements as demand escalates. This underlying foundation suggests that Bitcoin’s next substantial rally is quietly gaining momentum beneath the surface.

Current Price Analysis: Consolidation Phase

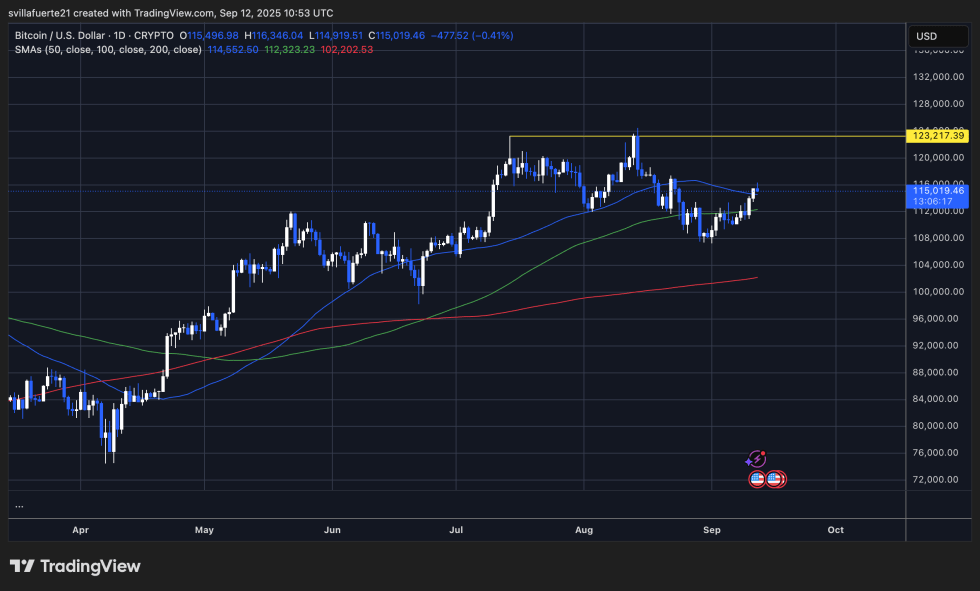

Presently, Bitcoin’s trading price stands at $115,019 after navigating a steady resurgence from September’s lower thresholds around $110,000. The daily trading charts illustrate BTC building significant momentum while entering a critical resistance zone. Recently reclaimed, the 50-day simple moving average (SMA) is positioned at $114,562, while the 100-day SMA at $112,323 provides a solid base of support, thereby reinforcing the overall bullish sentiment. The longer-term 200-day SMA at $102,202 continues to illustrate that Bitcoin remains fundamentally strong despite the recent fluctuations.

The key challenge for Bitcoin lies between $116,000 and $118,000, a resistance zone that has previously hindered upward momentum. A successful breakthrough and closing above this critical threshold could pave the way toward an important target around $123,217, a crucial level to watch for potential price advancement.

On the downside, significant support has been established around the $114,000 mark, with stronger support lingering near $112,000. Should Bitcoin maintain positions above these levels, it remains likely that buyers will retain control. However, a drop below $112,000 could shift the momentum, potentially attracting renewed selling pressure and bringing $110,000 back into the spotlight.

Featured image from Dall-E, chart sourced from TradingView.