In a remarkable turnaround, Bitcoin has surprised many in the crypto market with a significant surge, approaching historic price points. With its value nearing the $110,000 threshold, many investors are excited about BTC’s potential for short-term growth, especially with increasing optimism among whale investors.

Whale Investors Signal Growing Confidence

The latest Bitcoin rally has ignited a wave of enthusiasm, pushing prices above the key $109,000 mark. Whale investors are holistically recalibrating their strategies, leaning heavily into long positions as BTC experiences this upward shift.

Recent insights shared on social media platforms indicate a powerful trend among these prominent investors. An analytical firm focused on on-chain data has noted that Bitcoin whales are actively participating in the current market dynamics, suggesting strong bullish sentiments.

Research implies that large-scale investors have started to favor long positions aggressively, resulting in significant liquidation of short positions. This shift reflects a reinvigorated confidence in Bitcoin’s potential, as these investors bet on greater price escalations ahead.

The combination of rising BTC prices and whale investors making substantial long bets illustrates an optimistic near-term outlook for Bitcoin. This collective investment strategy could potentially trigger further rallies, bolstering confidence in Bitcoin scaling newer heights.

Tracking these developments closely, the on-chain analytics firm employed a critical metric, the Whale Position Sentiment, which monitors transactions exceeding $1 million. This metric serves as a vital indicator in the wider derivatives market, illustrating the impact of whale activities on BTC’s trading patterns.

Significantly, the Whale Position Sentiment shows a strong correlation to Bitcoin’s price movements, given that whales dominate a considerable portion of the market volume. If the current trends prevail alongside ongoing price escalations, Bitcoin might soon reach unprecedented levels, heralding a potential new all-time high.

Bitcoin’s Ascendancy: A Clear Uptrend

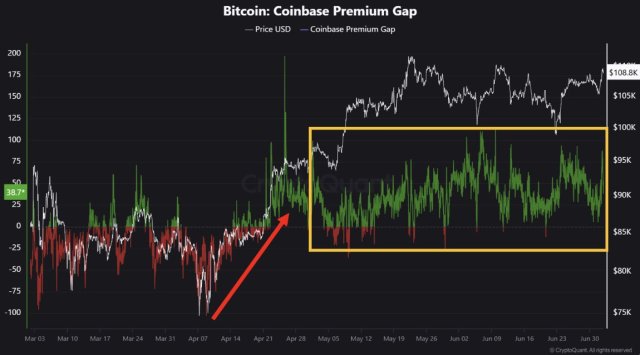

After a compelling rebound, Bitcoin is now confronting significant resistance as it eyes its highest price ever achieved. Notable market analysts have shared insights emphasizing that the momentum has decidedly shifted upwards. “Evaluating Bitcoin’s trajectory since April, it’s evident that market sentiment is pivoting towards positive growth,” stated a professional analyst.

Since the beginning of April, there has been a notable decrease in selling pressure from major players, highlighting an increase in buying interest. Current market dynamics point to an overall bullish sentiment prevailing within the established price ranges.

According to analysts, Bitcoin is presently navigating a phase of consolidation, addressing potential overheating and market corrections. While a brief pullback might be possible, the overarching trend suggests continued upward momentum, fostering optimism for the latter half of 2025.