In a significant development, Shanghai officials recently convened to delve into the realm of stablecoins and digital currencies. Is this a sign of China becoming more receptive to cryptocurrency?

Shanghai Officials Engage in Crypto Dialogue

The Shanghai State-owned Assets Supervision and Administration Commission (SASAC) organized an enlightening meeting on Thursday, bringing together local government representatives to examine policies surrounding stablecoins and digital currencies, as highlighted by Reuters.

With around 60-70 attendees participating, this meeting might signal a shift in China’s historically rigid stance, especially since cryptocurrency trading has faced prohibition since 2021. Reports indicate that the meeting’s director emphasized the importance of “greater awareness of emerging technologies” and the need for deeper exploration into digital currency landscapes.

This meeting follows requests from major corporations such as JD.com and Ant Group, advocating for China’s central bank to consider the endorsement of yuan-backed stablecoins. This discussion is particularly timely as Hong Kong prepares to introduce its stablecoin regulatory framework starting August 1st.

Corporations like JD.com and Ant Group are among over 40 entities planning to apply for stablecoin licenses in Hong Kong, though industry insiders suggest that only a handful of these applications are likely to receive approval, as reported by Yicai.

Although Shanghai has initiated this discourse, questions remain about the tangible outcomes, given the significant hurdles posed by stringent capital controls. Since the ban on crypto activities in 2021, both trading and mining operations effectively halted under concerns for financial stability.

Prior to this ban, China accounted for nearly half of the global Bitcoin mining power. However, the crackdown led to a substantial decrease in mining activity as operators were compelled to either shut their operations or relocate.

By early 2022, the Bitcoin network had rebounded, indicating resilience despite earlier setbacks. The growth trajectory of the mining sector has continued, with the global hashrate now approximately five times higher than it was before the ban.

A recent Cambridge report confirms that the United States currently dominates Bitcoin mining, representing 75% of the global activity.

Despite China’s restrictive measures, the global crypto market continues to thrive. With Bitcoin surging past $118,000, the increasing momentum may soon compel the Chinese authorities to reconsider their approach.

Bitcoin on Its Path to New Heights

Bitcoin recently breached a new all-time high, showcasing a surge in interest as its valuation increased by over 6% in just a day.

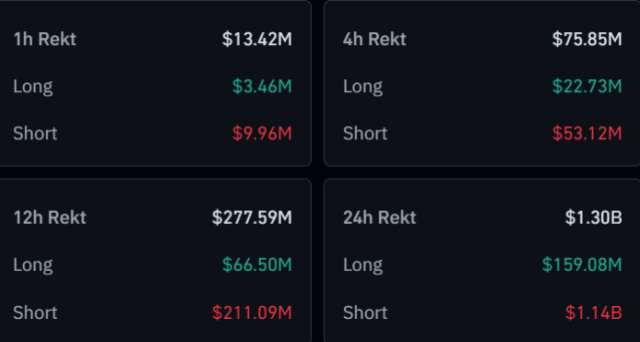

This price surge has invigorated the entire cryptocurrency market, leading to remarkable gains for other assets such as Ethereum (ETH) and XRP (XRP), even outperforming Bitcoin in terms of percentage gains. As a result, the derivatives market has experienced more than $1.1 billion in short liquidations, per data from CoinGlass.