The cryptocurrency landscape is witnessing remarkable growth, highlighted by the market capitalization recently exceeding $3.8 trillion. This surge has ignited a significant interest from institutional investors, particularly in Ethereum (ETH), as more corporations integrate this digital currency into their portfolios.

Rising Institutional Demand for Ethereum

Recent insights from crypto analyst Kyle Reidhead indicate that the appetite for ETH is nearing record levels. In just the past month, a consortium of ten treasury firms has amassed over 550,000 ETH, translating to around $1.65 billion in value.

Reidhead projects that this escalating interest shows no signs of abating. Each week brings new treasury companies to the fold, and the largest players might still be waiting to make their move.

The momentum is compelling, with firms reportedly planning to outdo their previous Ethereum purchases weekly. If these trends persist, we may see ETH acquisitions soar to $2 billion in the upcoming month and possibly even $3 billion in the following month.

Although demand may eventually cool off, indications suggest it will remain robust in the foreseeable future. Factors such as the expansion of stablecoin supply and supportive regulatory frameworks for digital assets are likely to drive more companies toward cryptocurrency investment.

Notably, the week of July 14 is recognized as “Crypto Week” in the US, during which pivotal digital asset legislation is slated for congressional votes. These bills focus on crucial areas such as regulating stablecoins and assessing the role of central bank digital currencies (CBDCs) in economic policy.

Potential for a Supply Shock in Ethereum?

Reidhead also pointed out that ETH treasury firms have recently acquired approximately 0.5% of the overall circulating ETH supply. A portion of this ETH is being redirected into Ethereum’s decentralized finance (DeFi) ecosystem via staking or lending platforms.

He contrasted the dynamics of treasury investors with those of Ethereum ETFs, asserting that unlike ETFs, treasury firms are not in a cycle of buying and selling. Their long-term commitment to holding ETH could trigger a significant supply shortage. As he articulated:

We are poised for a considerable supply shock regarding ETH in the coming months. Proceed with caution if you plan to underestimate either ETH or treasury companies.

Evidence supporting this prediction includes data from SoSoValue, which reveals that spot ETH ETFs have experienced nine successive weeks of net positive inflows, amassing $907 million in the week ending July 11. By July 15, these ETFs had already garnered an additional $259 million in new inflows.

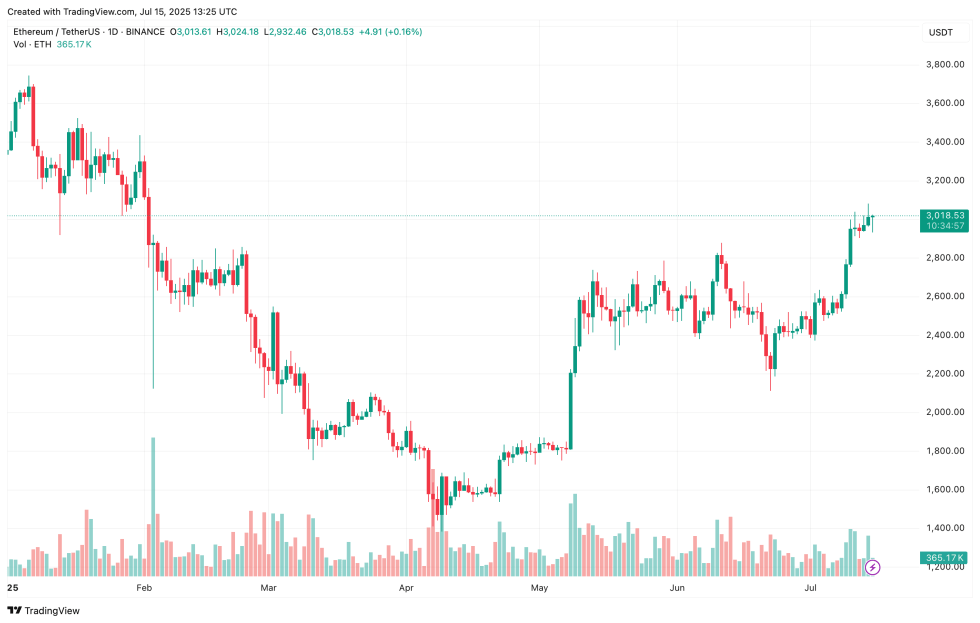

Moreover, the dwindling reserves across exchanges further bolster the case for an impending ETH supply shock. However, it is worth noting that caution is advisable; as of now, ETH is trading at $3,018, reflecting a 0.9% decline over the last 24 hours.