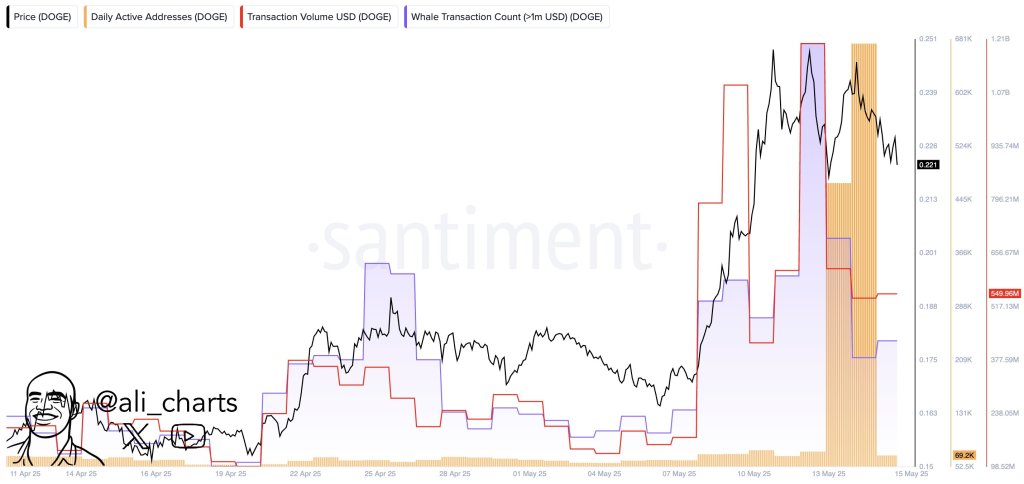

Recent insights from the on-chain analytics firm Santiment indicate intriguing developments in the Dogecoin ecosystem. As highlighted by analyst Ali Martinez, significant players within the Dogecoin market, particularly larger investors, have been strategically increasing their holdings while the overall network activity is on the rise. This momentum comes at a pivotal point, where the price approaches a crucial resistance level that could dictate its future trajectory.

Whale Accumulation Sparks Optimism

Martinez emphasizes the activity of wallets that contain between 100 million and 1 billion DOGE, often referred to as “mid-tier whales.” This segment has seen their collective holdings grow dramatically, from about 24.6 billion DOGE around early April to nearly 26 billion DOGE by mid-May, showcasing a bullish trend among these significant players.

This accumulation of approximately 1.4 billion DOGE, equivalent to over $300 million at current values, highlights that these large holders are eagerly absorbing the available supply, even as the price climbs. The latest data suggests that they controlled 25.97 billion DOGE, peaking at around 26.5 billion DOGE just a few days prior.

Accompanying this accumulation is a notable surge in network activity. According to a Santiment dashboard, the number of daily active addresses has soared, climbing from modest figures in mid-April to over 680,000 by May 12-13, before stabilizing at around 69,200 shortly after.

Transaction volumes are also telling a compelling story, with figures climbing to $1.21 billion and maintaining a high of nearly $550 million in recent readings. Notably, the increase in transactions exceeding $1 million signifies that substantial trades are at play, indicating that the movement is driven by influential investors rather than mere retail activity.

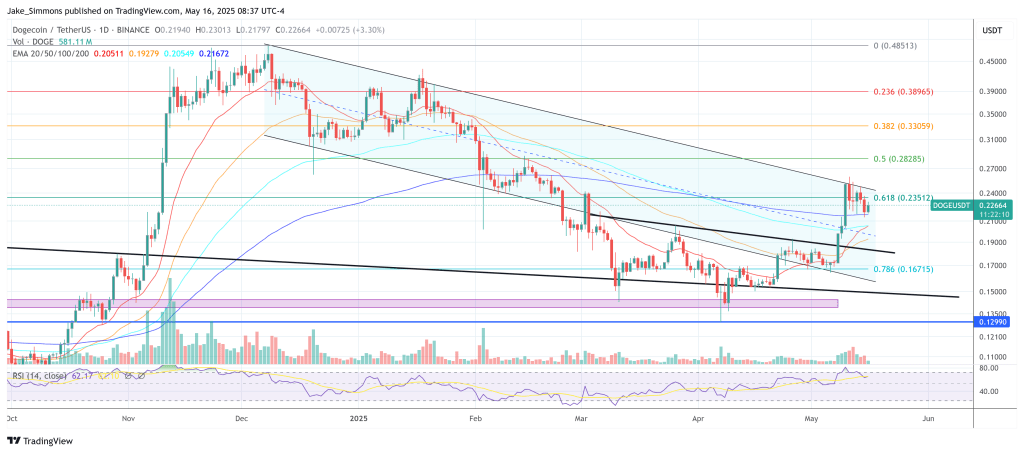

Resistance Levels and Price Action

Despite the encouraging accumulation trends, the price analysis reveals that DOGE finds itself at a critical crossroad. Currently trading around $0.2277, the token is approaching a crucial resistance band that spans from approximately $0.24 to $0.26.

This horizontal resistance cluster, initially strong support in December 2024, transitioned to become a barrier following a price drop in mid-February. The repeated rejections at this level indicate a sturdy resistance as confirmed by Martinez’s analysis. Although there was an attempt to breach it recently, the price failed to maintain its position above, reinforcing the significance of this resistance.

A decisive breakthrough above the $0.2600 level could ignite a rally toward the $0.3000 mark, igniting what could potentially be a fresh bull market. Conversely, if the ceiling proves too formidable, the price may retreat back to the mid-$0.1700 range, the same territory from which the recent upward momentum originated.

Considering the ongoing accumulation trends combined with the increase in high-value transactions and heightened address activity, the market finds itself primed for potential upside movement. The ability to surpass the defined $0.24-$0.26 resistance will determine if this accumulation phase signifies the onset of greater gains or if it is merely a prelude to a consolidating market. As it stands, large investors are positioning themselves, leaving the market in anticipation of how price action will unfold.

As of the latest update, DOGE is trading at $0.22.