Ethereum’s ability to stabilize around the significant $3,600 support level is crucial, following a slight retreat from its recent peaks. Despite this minor fluctuation, ETH has emerged as one of the strongest assets in the cryptocurrency landscape, demonstrating an impressive rise of over 85% since late June. Investor enthusiasm remains buoyant, fueled by weeks of continuous buying activity and confidence in the asset’s future.

In the midst of market volatility, Ethereum’s underlying fundamentals are robust. Legal clarity in the U.S. has created a welcoming atmosphere for institutional investors, increasing confidence in investing in ETH. Globally, the adoption of Ethereum’s platform is on the rise, especially in the rapidly growing sector of Real-World Asset (RWA) tokenization, where Ethereum possesses more than 80% of the total market share among various blockchains.

Analysis of on-chain data reveals significant accumulation by large investors, indicating that influential players are optimistic about Ethereum’s long-term prospects. The ongoing whale activities, combined with healthy on-chain metrics, suggest that the recent market adjustment might merely represent a consolidation phase, setting the stage for future price increases.

Ethereum’s Robust Position in the RWA Market Signals Future Growth

Notable analyst Ted Pillows recently disclosed that Ethereum commands an impressive 83.69% of the total market capitalization in the Real-World Asset sector, underscoring its pivotal role in one of the fastest-expanding areas in the crypto ecosystem. This commanding dominance enhances Ethereum’s position as the foundational technology for tokenizing real-world assets such as stablecoins, municipal bonds, and private equity.

The acceleration of this trend was particularly noticeable since April 2025, aligning with Ethereum’s price rally and a resurgence of investor faith. The marriage of price growth with an expansion into tokenized finance illustrates the synergy between speculative enthusiasm and genuine long-term utility.

RWAs are drawing substantial attention from institutional players, particularly through stablecoins. Experts predict that the stablecoin sector will act as a primary conduit for integrating real-world value into blockchain systems over the next decade. Notably, Ethereum leads the charge, hosting the largest stablecoin ecosystem, including significant players like USDT and USDC, alongside competitors like Tron.

Ethereum’s competitive edge lies in its composability and integration within the decentralized finance (DeFi) sector, fostering the development of more intricate and scalable RWA infrastructures. As regulatory frameworks become clearer and businesses pivot towards on-chain solutions, Ethereum is poised to seize even greater market opportunities.

If RWA tokenization evolves into a multi-trillion-dollar market, Ethereum’s early mover privilege and network effects could become pivotal advantages. Data suggests that Ethereum’s stronghold in the RWA arena may be one of the primary drivers of the next significant market cycle.

Weekly Chart Indicates Strong Bullish Potential Following Market Pullback

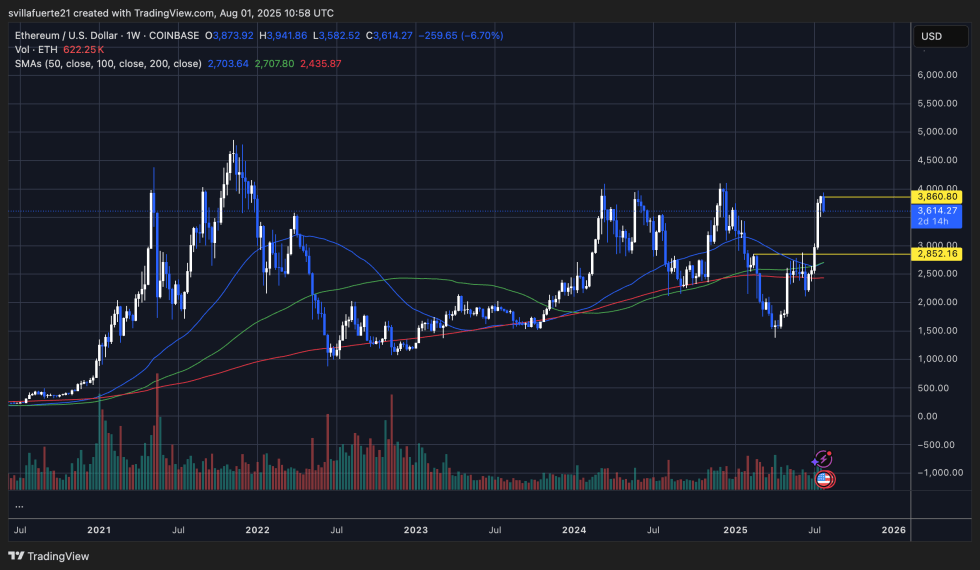

Ethereum’s weekly chart paints a picture of strength, featuring a breakout above the $3,000 level that led to a rise towards $3,860, albeit met with resistance and a 6.7% pullback to around $3,614. Despite the temporary setback, the broader trend remains decidedly bullish. ETH has managed to reclaim both the 100-week and 200-week moving averages, historically known as key indicators of long-term trends. Maintaining these levels could suggest a significant turn in the market from last year’s downturns.

Additionally, trading volume surged during the breakout event, signaling healthy demand rather than mere speculative engagement. The $2,852 level has now transitioned into a crucial support point, previously a resistant area, heightening its importance. Should ETH maintain this support through future tests, bullish traders might set sights on the $4,000 mark.

A weekly closure above the $3,860 threshold would signify a new yearly high, potentially paving the way toward the $4,500–$5,000 range last observed in late 2021. However, if ETH fails to regain momentum in the $3,850 zone promptly, it may be susceptible to larger pullbacks or sideways trading patterns.

Featured image from Dall-E, chart from TradingView