In recent developments, the Ethereum derivatives market has witnessed a significant uptick in Open Interest, signaling a growing interest among traders.

Ethereum Open Interest Surpasses $30 Billion

According to insights shared by analyst Maartunn from the CryptoQuant community in a recent tweet, Open Interest in Ethereum has surged impressively. Open Interest refers to the total amount of outstanding derivative contracts in Ethereum that remain open across various exchanges, encompassing both long and short positions.

An increase in Open Interest typically indicates that traders are initiating new positions, which often correlates with heightened leverage in the market. This can lead to increased price volatility as the momentum builds. Conversely, a decline in this metric suggests that traders might be either liquidating positions or choosing to close them voluntarily. This scenario often results in reduced volatility due to the decrease in leveraged positions.

Here’s a visual representation shared by Maartunn, showcasing the evolution of Ethereum’s Open Interest over recent years:

The graph highlights a remarkable increase in Open Interest, particularly coinciding with Ethereum’s price surge past the $4,400 mark. This trend indicates a growing speculative interest among traders, which isn’t inherently alarming, but the rapid increase is noteworthy.

When the derivatives market becomes overly saturated, it can prompt mass liquidation events. Such episodes often result in sharp market corrections, affecting Ether’s price substantially.

The latest spike in Open Interest has pushed Ethereum’s positions beyond an impressive $30 billion, suggesting potential for future market fluctuations as traders react to price movements.

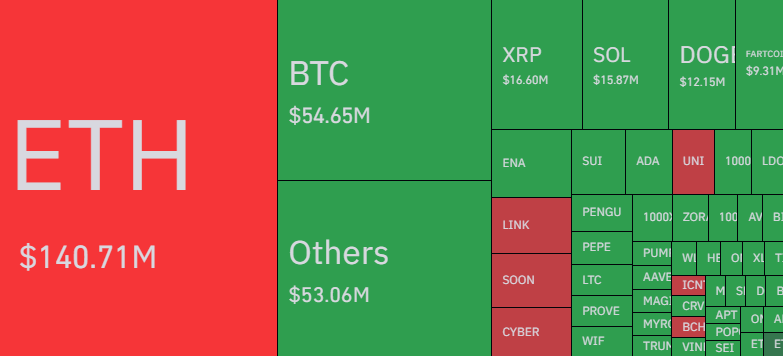

Notably, significant liquidation events have already transpired within the last 24 hours, as evidenced by data from CoinGlass.

The above heatmap illustrates that Ethereum has experienced approximately $140 million in forced liquidations, making it the leading asset affected by market corrections in the past day.

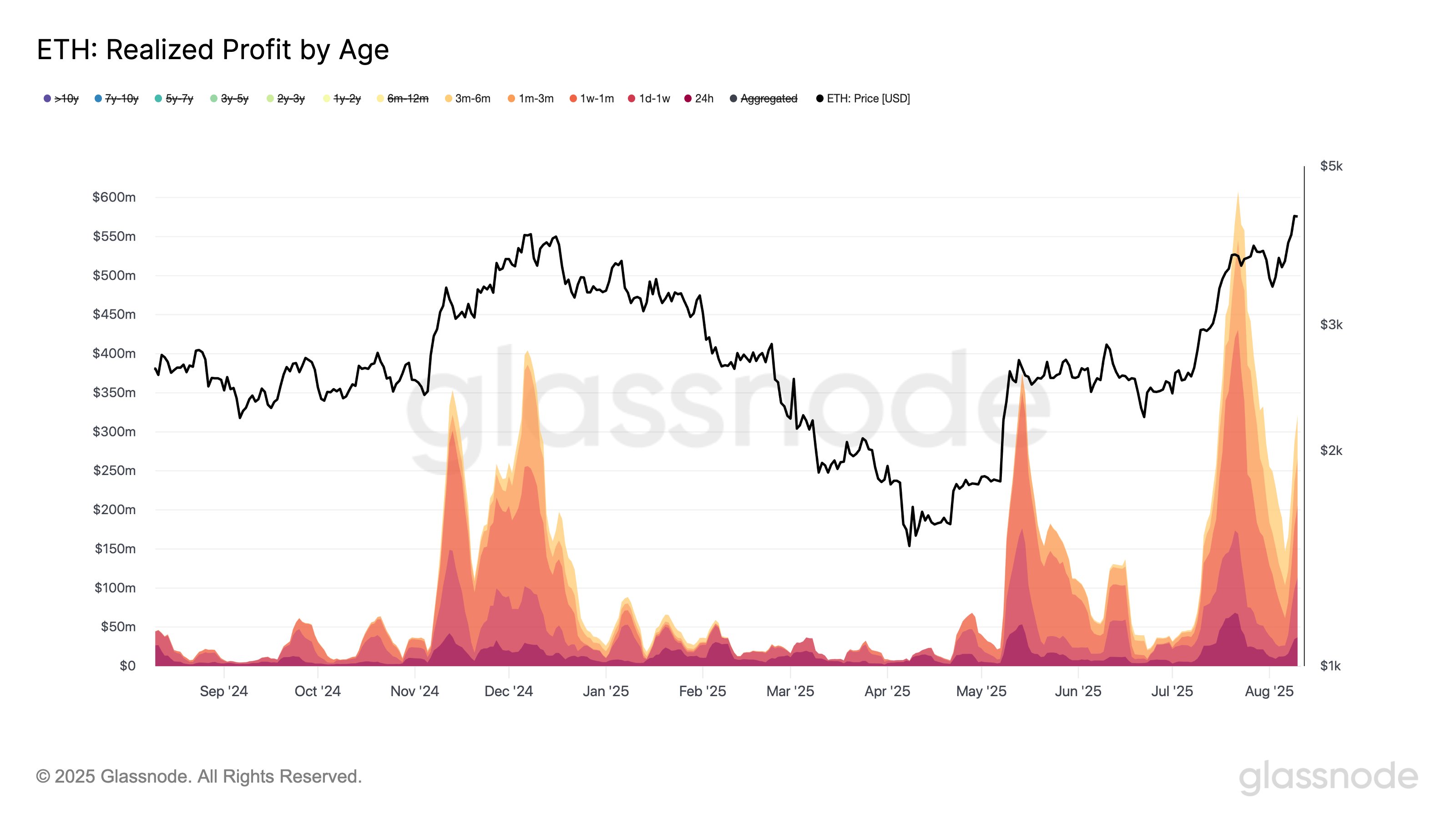

In a broader context, profit-taking among Ethereum investors has gradually decreased from its peak of $771 million per day in July but has started to increase again, spurred by the latest market rally. Insights from the on-chain analytics platform Glassnode indicate this resurgence in profitability through a recent update.

Currently, the rate of profit-taking is at $553 million per day, which, while lower than the previous high, remains substantial and significant.

Current ETH Pricing Trends

As of now, Ethereum’s price is hovering around $4,460, reflecting an over 24% increase over the past week, signaling a robust recovery.