As the landscape of finance evolves, stablecoins are on the cusp of a significant breakthrough within the European banking system. Deutsche Bank is taking bold steps by considering the launch of its own stablecoin, aiming to create tokenized deposits that seamlessly integrate with the growing crypto economy.

Speaking in a recent Bloomberg interview, Sabih Behzad, who leads Digital Assets at Deutsche Bank, shared his insights on strategies meant to propel the institution into the forefront of the crypto sector. A key highlight is the envisioned development of their unique digital token.

This pivotal announcement aligns seamlessly with recent advancements in the U.S., as Congress has introduced a Stablecoin Legislation Bill, highlighting the increasing global push towards regulatory clarity and adoption.

As if that wasn’t enough, more exciting developments are underway!

Tech Giants Dive into Stablecoin Innovations

Indeed, some leading technology giants, including Apple, X (formerly Twitter), Airbnb, and Google, are actively exploring the potential of stablecoins.

In a noteworthy twist, Musk’s X is reportedly in talks with various crypto firms, envisioning its own all-encompassing application. This was first hinted at in an announcement dated back to January 2025, indicating ambitious plans.

Moreover, X’s engagement with Stripe is particularly intriguing, as Stripe has recently revealed its advancement in developing stablecoin-focused products.

Apple, for its part, is reportedly collaborating with Circle, the creator behind the USDC stablecoin, signifying a serious commitment to virtual currency integration.

Likewise, Airbnb is pivoting towards stablecoin options in its payment processing, demonstrating a broadening acceptance of cryptocurrency within the hospitality sector.

These moves come amidst a supportive pro-crypto environment in 2025, particularly with the anticipated passage of Trump’s Genius Act, aimed at regulating stablecoin frameworks and enhancing legal clarity for issuers in the U.S.

As reported by journalist Eleanor Terrett, the bill is currently undergoing revisions with numerous amendments being discussed:

‘Negotiations between Senate Republicans and Democrats are ongoing to finalize the list. If a consensus is reached, we could see the bill reach the Senate floor soon; otherwise, its progress may face delays,’

A successful passage of the Genius Act could help dispel uncertainty caused by the ongoing tension between market influencers, ultimately propelling the crypto economy towards greater adoption and institutional interest.

Already, Bitcoin is exhibiting recovery trends, recently recording a modest 1.34% increase in just 24 hours, signaling positive momentum.

Given these developments, now may be the ideal time to consider secure, non-custodial crypto wallets to safeguard your investments as the market continues its evolution. Best Wallet is currently recognized as a leading option within this category.

Introducing Best Wallet: Your Gateway to Crypto Freedom

Best Wallet is a pioneering non-custodial wallet that offers extensive multi-chain capabilities without imposing KYC verification. All you need is an email address to get started.

The user-friendly platform makes navigation effortless, with a sign-up process that’s quick and efficient, typically only taking a couple of minutes.

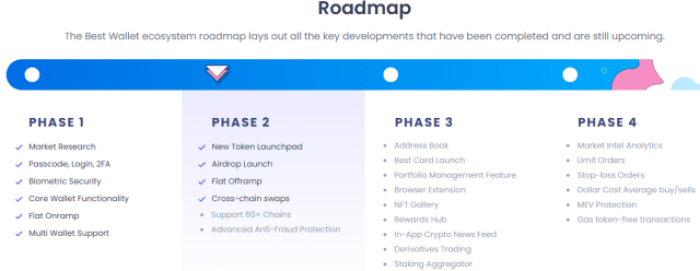

The development team is committed to continuous improvement, promising to introduce a host of new features in the near future, including:

- Support for over 60 different blockchain networks (currently supports five)

- A unique crypto purchase card

- An NFT gallery for managing digital collectibles

- A staking aggregator to maximize your earnings

- In-depth market intelligence tools

- Derivatives trading capabilities

- A convenient browser extension

There are countless reasons to be enthusiastic about what lies ahead for Best Wallet.

Additionally, Best Wallet has launched its own governance token, Best Wallet Token ($BEST), amplifying your experience with lower fees, boosted staking rewards, and community engagement. The presale has already raised over $13 million, with ambitions to control 40% of the total wallet market share by 2026.

Due to its exceptional utility and vision, analysts predict a potential rise for $BEST to $0.072 by the end of 2025, representing an impressive return on investment (ROI) of 186% from its current value of $0.025145.

Looking even longer-term, projections suggest $BEST could soar to $0.82 by 2030, yielding a staggering growth rate of 3,161% fueled by widespread acceptance and continuous development.

Investing in the presale now may be a prudent decision, considering the project’s existing capabilities and its ambitious vision for the future.

To capitalize on this wave of innovation, now is the time to visit the presale page and secure your $BEST tokens today.

Stablecoins: A New Era for the EU Banking Sector

The shift towards stablecoins in European banks is undeniable, with Deutsche Bank paving the way and other institutions likely to join in. However, while institutional engagement is promising, maintaining personal financial freedom remains paramount.

In a time when traditional custodial solutions exert considerable control over your assets, Best Wallet and the $BEST presale offer a compelling alternative. Embrace a model where you retain control over your cryptocurrencies and dictate how they serve your objectives.

Please note, this is not financial advice. Conduct thorough research and make informed investment choices.