Recent findings from Fidelity Digital Assets reveal a significant transformation in Bitcoin’s supply landscape. The report indicates that the segment of Bitcoin known as “ancient”—referring to coins that have remained untouched for a decade or more—is expanding at a pace that surpasses new coin creation for the first time in Bitcoin’s timeline. Projections suggest that by the year 2035, as much as 30% of all Bitcoin could fall into this dormant category.

Growing ‘Ancient’ Bitcoin Supply

The study, conducted by analyst Zack Wainwright and released on June 18, 2025, highlights a noticeable increase in ancient Bitcoin supply following the halving event of April 2024. As of June 8, 2025, approximately 566 BTC are added to the ancient supply daily, while around 450 BTC are introduced through mining. “This represents a significant shift in Bitcoin’s market dynamics,” Wainwright states, noting the moment when ancient supply outstripped new production.

This category of unspent transaction outputs (UTXOs), which have laid dormant for over ten years, now constitutes more than 17% of the total Bitcoin supply, equating to about 3.4 million BTC. At a current valuation of $107,000 per coin, the worth of this ancient supply amounts to upwards of $360 billion. The report particularly emphasizes that a substantial portion of this ancient wealth is tied to early adopters, notably Bitcoin’s enigmatic creator. “Around one-third of this ancient supply is attributed to Satoshi,” it mentions, while also emphasizing the uncertainty surrounding many coins that may be lost forever.

Fidelity’s findings indicate that the rising levels of ancient supply are not simply a numeric trend but are progressively reshaping Bitcoin’s market structure. “The unwavering stance of these long-term holders is beginning to significantly impact the broader Bitcoin market,” Wainwright highlights. He posits that as more supply consolidates into static wallets, it enhances the asset’s perceived scarcity, especially in conjunction with its predetermined issuance schedule.

However, the report clarifies that ancient supply isn’t a fixed entity. While reductions in ancient holdings are infrequent—occurring on only 3% of days since 2019—this frequency surged to 10% in the wake of the 2024 US election. The report includes a comprehensive chart, “Impact of Ancient Supply on Bitcoin Prices,” that illustrates how price fluctuations correlate with brief sell-offs or reallocations among long-term stakeholders.

This pattern is even more evident among Bitcoin holders with five-year tenure. Following the US elections, there was a 39% incidence of daily declines in this supply segment—three times the typical occurrence of 13%. Fidelity interprets this as indicative of heightened activities within the long-term holder demographic, potentially accounting for some of the price stagnation observed in early 2025. Nonetheless, Wainwright advises against jumping to conclusions about such coin movements implying actual sales, noting that many transfers might be due to various transactional needs.

Looking to the future, Fidelity outlines a potential trajectory for ancient supply as a growing fraction of total Bitcoin distribution. Current accumulation trends suggest ancient coins may reach 20% of overall Bitcoin by 2028, 25% by 2034, and possibly 30% by 2035. These forecasts also consider contributions from corporate entities known to hold over 1,000 BTC. As of June 8, 2025, Fidelity has identified 27 such companies, who together control more than 800,000 BTC.

While it’s recognized that corporate wallets don’t necessarily embody a long-term holding strategy, the report argues that these sizable entities could significantly influence future statistics for ancient supply—especially if they persist in accumulating and maintaining coins in cold storage, thereby limiting their circulation.

In conclusion, Wainwright posits that the increasing volume of ancient supply is indicative of evolving perceptions surrounding Bitcoin’s scarcity. “Considering Bitcoin’s programmed, diminishing supply issuance—as well as the trends showing long-term holders becoming more resolute—the asset’s rarity could intensify over time,” he explains. In a financial landscape where circulating supply and liquidity play crucial roles in establishing price, the less active nature of ancient coins may emerge as a pivotal element in Bitcoin’s forthcoming evolution.

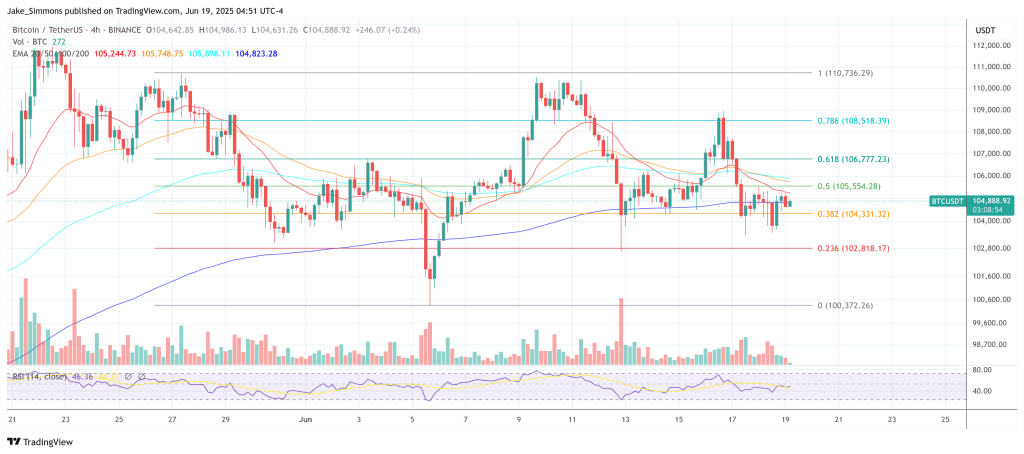

As of now, BTC is trading at $104,888.