The cryptocurrency landscape is experiencing notable turbulence, with Bitcoin recently dropping to $118,148 due to a decline of 0.40% in the last 24 hours. This market correction has raised eyebrows among traders and investors alike.

Analysts are attributing some of this downward trend to FTX’s impending payment strategy, which is scheduled to roll out in September. This situation has reignited fears tied to the compromised credibility of the once-prominent exchange.

In a significant development, FTX is preparing to distribute another court-approved payout of at least $1.9B managed through familiar third-party partners like Kraken, Payoneer, and BitGo.

This upcoming distribution marks another step in FTX’s roadmap to compensate creditors as part of their ongoing efforts to address $14.5B in losses. Concerns linger, however, as this payout has the potential to exacerbate existing fears about market instability.

The Impact of Bitcoin’s Substantial Outflows on Market Dynamics

A significant reason for the current market sentiment is the recorded outflow of $86M in Bitcoin, predominantly influenced by institutions such as BlackRock ($IBIT) and Fidelity ($FBTC), which reported outflows of approximately $142.48M and $227.24M, respectively.

Trader T’s analysis highlights the worrying trend of outflows persisting over consecutive days, adding to the unease in market circles.

Although outflows in isolation may not seem alarming, their cumulative effect can significantly influence market behavior. Major entities like Fidelity could be driven to liquidate Bitcoin assets to facilitate these withdrawals, which may amplify selling pressures and heighten price fluctuations.

What, then, are the underlying causes of this unexpected market shift beyond FTX’s payment plan?

- Economic instability: Persistent inflation, global conflicts, and the US Federal Reserve’s interest rate hikes contribute to wider financial uncertainty.

- Profit-taking: Investors may be pulling out after Bitcoin’s recent spike above $123K, creating a psychological sell-off once it dipped below $120K.

- Portfolio adjustments: Shifts towards promising altcoins could indicate that investors are moving away from stagnating Bitcoin.

- Regulatory concerns: Ambiguities surrounding the legal status of stablecoins and delayed ETF approvals from the SEC are fostering a climate of caution.

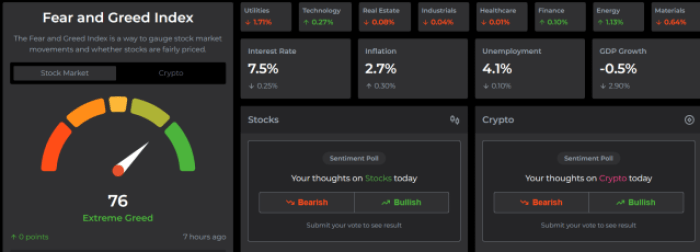

Despite these challenges, signs of resilience persist in the market, as indicated by the Fear and Greed Index, which shows sentiment still leaning towards greed. A prominent crypto trader remarked that despite current downturns, the potential for Bitcoin to become a dominant global asset remains.

Trader Tardigrade echoes this sentiment, predicting a bullish breakout that signals a transition towards Altcoin Season 3.0.

Trader Tardigrade echoes this sentiment, predicting a bullish breakout that signals a transition towards Altcoin Season 3.0.

As the market appears poised for a rally, assets with inherent blockchain utility stand to benefit greatly in the near future. One such asset is Snorter Token, which has introduced an innovative tool aimed at maximizing trading opportunities.

Snorter Token ($SNORT): Revolutionizing the Token Hunt

The Snorter Token ($SNORT) brings forth the Snorter Bot, a powerful tool designed to streamline the process of identifying lucrative tokens. Its features include integrated scam alerts to safeguard users against dubious projects while quickly capitalizing on trending opportunities.

The Bot eliminates the complexities of manual trading, which often requires extensive knowledge and leaves investors susceptible to scams like rug pulls.

The Bot eliminates the complexities of manual trading, which often requires extensive knowledge and leaves investors susceptible to scams like rug pulls.

Operating solely through its Telegram channel, the Snorter Bot centralizes trading activities, thus obviating the need for multiple wallets and cumbersome extensions. Users simply provide commands and can witness the Bot sniping desirable tokens with incredible speed.

Given these technological advancements and an ever-growing community, Snorter Token is positioned to become one of the leading players in the meme coin market. The ongoing presale has already raised over $2.3M and the token is currently selling at $0.0991.

With a promising roadmap ahead, the potential for $SNORT to reach $0.94 post-launch appears high, alongside ambitious long-term projections suggesting a price of $3.25 by 2030. This represents a staggering potential return on investment of 3,179% based on today’s pricing.

If you are interested in supporting this innovative project and want to acquire some $SNORT tokens, head over to the presale page and secure your purchase now.

Is the Cryptocurrency Market Facing a Recession?

In light of the significant Bitcoin outflows and overall market apprehension, some observers are questioning whether we are witnessing a recession in the crypto space or simply a market correction following a recent rally.

The outlook for Bitcoin remains optimistic, especially if it can surpass the critical resistance level of $120K. Should that happen, we anticipate projects like Snorter Token ($SNORT) will also begin to gain momentum significantly.

As a reminder, this is not financial advice. It is crucial to conduct your own research (DYOR) and make informed investment choices.