The crypto market is currently under a microscope, and Bitcoin’s price movements are at the forefront.

With recent fluctuations keeping investors on their toes, some traders are closely watching the $84K level as a potential pivot point. Historical patterns often indicate that when volatility dips, it might be a prelude to significant price movements. Current metrics reveal that while short-term traders may be retreating, long-term investors are persistently accumulating.

Source: X

If Bitcoin successfully breaks through into the mid-$80K range, it would validate the ongoing bullish trend rather than suggesting the peak of a cycle. Analysts on X propose that this movement may lead Bitcoin towards its initial Fair Value Gap (FVG).

However, focusing solely on the Bitcoin price charts overlooks critical developments. As the leading cryptocurrency continues to dominate the market, significant attention is shifting toward solutions that resolve its inherent limitations, such as programmability issues and sluggish transaction finality.

Intelligent capital is increasingly investing not just in Bitcoin itself but in the frameworks that enhance its functionality for decentralized finance (DeFi) applications. This pursuit of efficiency is channeling significant funds into emerging Layer 2 technologies.

At the forefront is Bitcoin Hyper ($HYPER), a protocol striving to merge Bitcoin’s robust security with the rapid transaction speeds of Solana. This creates a high-return potential for users within the evolving crypto landscape.

$HYPER Pushes Boundaries: SVM Integration Enhances Scalability

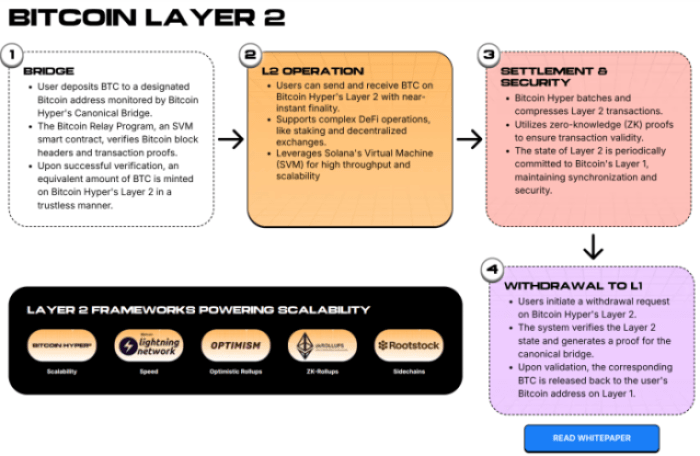

The primary barrier to Bitcoin’s broader adoption in decentralized finance is its original architecture, which was not built for intricate smart contracts. $HYPER addresses these issues by introducing the first Bitcoin Layer 2 solution that integrates with the Solana Virtual Machine (SVM).

Source: Bitcoin Hyper

This architectural innovation is vital. Rather than depending on the typically slower Ethereum Virtual Machine (EVM), it leverages the high-throughput capabilities expected from Solana’s ecosystem while anchoring it to Bitcoin’s settlement infrastructure.

With a decentralized bridge for $BTC transfers, Bitcoin Hyper aims to permit expedient operations such as payments, extensive DeFi activities, swaps, lending, and staking—all without the prohibitive costs and delays of the main chain.

Additionally, by integrating Rust support via SVM, Bitcoin Hyper allows developers from the Solana community to roll out decentralized applications (dApps) on Bitcoin smoothly without the need for extensive retraining. This modular framework aims to address the long-discussed ‘programmability gap’ that has hindered Bitcoin’s competitive edge against Ethereum.

DISCOVER THE $HYPER L2 NETWORK.

Attracting Talent: The Migration of Developers to $HYPER

Market movements often overshadow the key component of any successful project: its development community. While raising $31.2M during the presale is impressive, the noteworthy trend lies in attracting Rust developers to the Bitcoin Hyper ecosystem.

By implementing the Solana Virtual Machine (SVM), $HYPER has opened a new gateway for the industry’s most resourceful builders to operate within Bitcoin’s secure network.

The current valuation of $0.013675 indicates a project still in its foundational stage, but strong underlying technology suggests significant ecosystem growth is on the horizon. Unlike traditional Bitcoin forks or sidechains that necessitate learning specific languages, with $HYPER, developers can quickly move their high-performance dApps from Solana to Bitcoin without hassle.

Ecosystem Innovation: A New Way Forward

The initial capital influx is being strategically deployed, transforming how Bitcoin engages with the extensive Web3 ecosystem:

- Cross-Chain Harmony: $HYPER is set to become the central liquidity hub connecting the $BTC and $SOL ecosystems, facilitating seamless value transfer between these prominent assets.

- Staking as a Fundamental Security Mechanism: The $HYPER staking model allows immediate APY following the Token Generation Event (TGE), enhancing network security while providing a yield option for Bitcoin holders.

- Strategic Selling Limits: A thoughtful 7-day vesting period for presale participants sets up a market environment defined by natural price movements instead of premature liquidations.

Curious about the full scope of the project? Check out our comprehensive guide on ‘What is Bitcoin Hyper?’.

By prioritizing the developer experience, Bitcoin Hyper is addressing a long-standing challenge for Bitcoin: creating a dynamic, fast-evolving application landscape. As the presale approach significant targets, the project is not only drawing capital but also attracting creators poised to shape the next wave of DeFi.

VISIT THE $HYPER PRESALE PAGE.

This article serves as an informational resource and should not be seen as financial advice. Engaging in cryptocurrency investment, particularly during presale phases, carries substantial risks, including volatile price changes and potential capital loss. Always perform due diligence before investing.