The cryptocurrency landscape experienced a remarkable resurgence in the first half of 2025. Bitcoin emerged as a standout performer, buoyed by favorable regulatory adjustments, increased ETF involvement, and robust accumulation strategies adopted by institutional players.

According to the latest Q2 2025 State of Crypto report by 99Bitcoins, traditional U.S. financial indices reported gains of less than 15%, with the S&P 500 IT index being an exception, rising 18.4% during that time.

In stark contrast, the crypto market outshone them all, achieving impressive returns of 21.72% within the same period.

The quarter marked significant milestones for the stablecoin sector. Total stablecoin transactions surged past $35 trillion, with active unique addresses reaching an impressive 265 million.

Among stablecoins, $USDT accounted for a substantial 68.77% of transaction volumes, while Circle’s $USDC held a close second position with 30.83%.

The successful IPO of Circle also made waves, with a remarkable 168% jump in its share price on the first trading day, reflecting the market’s strong interest in the stablecoin segment, even through indirect investment avenues.

In the following sections, we will dive deeper into the latest crypto trends, assess the performances of Bitcoin and Ethereum over recent months, and speculate about future market conditions for the remainder of 2025.

Bitcoin’s Performance in Early 2025

The journey of Bitcoin during the first half of 2025 can be described as two distinct phases. In the first quarter, Bitcoin faced a challenging environment, suffering a steep 30% decline, hitting a low of $74.5K due to external economic pressures like global trade disputes.

The second quarter, however, marked a dramatic turnaround, with Bitcoin surpassing its prior all-time high of $109K. Currently, Bitcoin is trading close to $120K, having achieved a new peak of $118,845.

Unlike previous bullish trends, the retail sector’s interest in Bitcoin was relatively subdued during Q2. Instead, it was characterized by significant institutional inflow.

By late May, publicly traded corporations had borrowed nearly $2.1 billion to buy Bitcoin, collectively holding over 5% of the entire Bitcoin supply.

Surge in ETF Inflows

The activity surrounding Bitcoin ETFs also witnessed considerable growth. The Total Assets Under Management (AUM) now represent approximately 6.35% of Bitcoin’s overall market capitalization.

Industry experts, including Chris Wright, Global Head of Marketing at 21Shares, anticipate a remarkable 50% increase in inflows throughout 2025, potentially reaching around $55 billion.

Should this trend persist, total AUM could approach $200 billion by year-end, up from the current $110 billion.

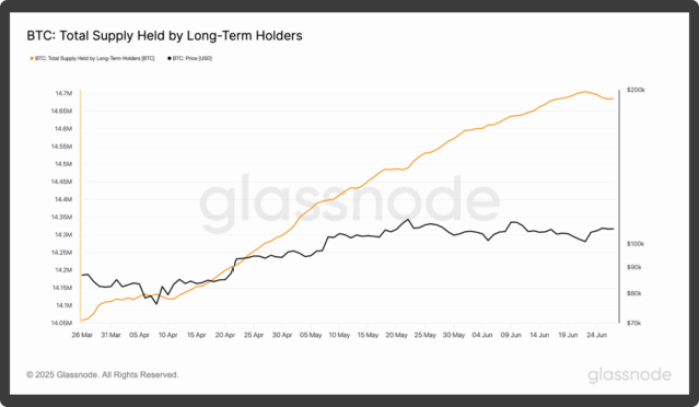

Notably, despite a decline in exchange inflows during the second quarter, investor behavior showed a clear preference for holding Bitcoin long-term, evidenced by a spike in supply from long-term holders from 14.05M to over 14.65M.

Further bullish signals can be seen in the derivatives market, where long positions substantially outnumbered shorts. Additionally, the number of crypto addresses holding more than 1M Bitcoin rose to 160,822 by June, up from 124,663 in mid-March.

The prevailing trend indicates a strong belief that Bitcoin will continue its upward trajectory for the foreseeable future.

Outlook for Bitcoin

According to projections from 99Bitcoins, there’s a 70% probability of bullish conditions for Bitcoin in the upcoming months. Thus far, this prediction has held true.

The report highlighted that crossing the $103K threshold would likely lead Bitcoin toward its psychological resistance level of $120K.

Should ETF expansion and regulatory clarity persist, Bitcoin could push even further, eyeing a potential target of $135K.

Daniel Polotsky, Co-Founder of CoinFlip, is optimistic that Bitcoin will wrap up the year above the $100K mark.

However, with increasing global tensions and the looming threat of a trade war, caution is advised. If Bitcoin fails to maintain levels above $120K and tumbles below $103K, a revisit to prices around $98K or even $89K could become a reality.

Ethereum’s Q2 Performance

Ethereum’s performance closely tracked Bitcoin’s during Q2, showing a correlation coefficient between 0.48 and 0.98. This indicates that Ethereum largely mirrored Bitcoin’s price movements.

Similar to its counterpart, Ethereum suffered a sharp decline of nearly 60% from its previous all-time high during the first quarter, but rebounded robustly in the following months.

Currently trading just below $3K, Ethereum remains approximately 36% off its all-time high, a level that could be breached if bullish sentiment gains traction.

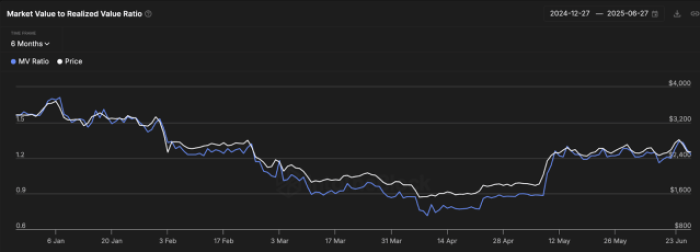

The MVRV (Market Value to Realized Value) ratio for Ethereum displayed considerable volatility during this timeframe. Beginning the year around 1.5, it indicated that Ethereum was trading above its average acquisition price.

The MVRV (Market Value to Realized Value) ratio for Ethereum displayed considerable volatility during this timeframe. Beginning the year around 1.5, it indicated that Ethereum was trading above its average acquisition price.

As anticipated, profit-taking set in, dragging the MVRV ratio below 1.0 come March, suggesting many $ETH holders were operating at a loss.

During the subsequent recovery in Q2, the MVRV ratio climbed back to 1.2, showing nominal profits for average holders.

On the charts, Ethereum faced considerable resistance around the $2.8K level since early May. It successfully broke above this mark on July 10 and is experiencing consolidation within this range.

If Ethereum maintains this level, it stands a solid chance of climbing toward the $3.4K mark.

Conversely, if it slips back into the $2.4K-$2.8K bracket, it may experience a prolonged sideways trend in the coming quarter before breaking out decisively.

Notable Crypto Statistics from Q2 2025

Let’s take a look at some additional noteworthy statistics from the report:

- In Q1 2025, crypto venture capital investments reached almost 60% of all VC funding in 2024, totaling around $4.8 billion. This influx of capital is slated to spur innovation and attract top-tier talent in the sector.

- Crypto-related job postings soared by 753%, primarily in marketing and development, showcasing the industry’s robust growth trajectory.

- The meme coin sector also gained traction, with over 5.9 million new tokens minted this year. Similar to Bitcoin and Ethereum, meme coins faced a downturn in Q1 but rebounded spectacularly in Q2.

- Tokens like $PEPE saw astronomical growth, catapulting by an unbelievable 89.93 million%. More established tokens like $SHIB and $DOGE did not make it to the top trending list this time.

Conclusion

After facing headwinds in Q1, the cryptocurrency market has regained its footing in Q2 2025.

With Bitcoin now setting unprecedented highs, the 99Bitcoins Q2 State of Crypto Market Report has bolstered market optimism with a prospective $135K year-end target.

With rising institutional investment, strong conviction among long-term holders, and a resurgence in Ethereum along with a record-setting meme coin rally, the data indicates an evolving market filled with renewed enthusiasm and expanding participation.

For investors eager to capitalize on this momentum, now could be an opportune moment to explore promising crypto investment options.