The recent announcement by Digital Future Ventures has ignited a wildfire of concerns regarding the company’s decision to venture into the volatile world of cryptocurrency. Their focus will be on creating a diversified asset pool primarily centered on popular cryptocurrencies.

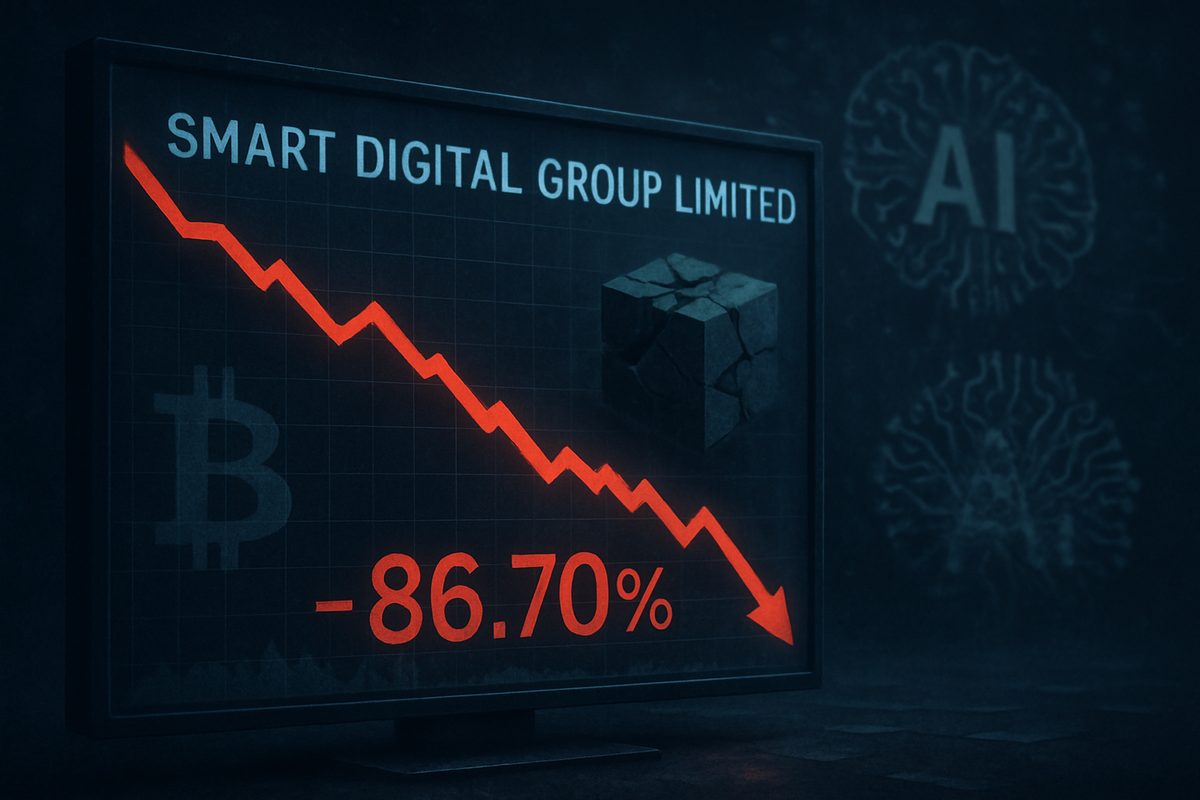

This sudden pivot caused a drastic decline in shareholder value, with the stock experiencing a staggering drop of approximately 85% in just a few hours.

Details of the Strategic Shift

In a recent press release, the firm outlined their vision to establish a cryptocurrency asset pool that aims to bring “transparency and security” to investors. The focus will be on major players in the digital currency marketplace, specifically Bitcoin and Ethereum.

However, the announcement left many unanswered questions. Investors are eagerly awaiting further insights into the expected scale and distribution of the asset pool, which are set to be revealed after a thorough evaluation of market conditions and regulatory frameworks. Many stakeholders have expressed frustration over the vagueness of the information provided.

$DFV

Digital Future Ventures Announces Intent to Create a Multi-Currency Asset PoolThe newly proposed asset pool is set to focus on established cryptocurrencies, emphasizing sustainability and investor protection. The objective is to…

— market observer (@InvestorInsights) September 26, 2025

Market Fallout and Stock Movement

On the day of the announcement, Digital Future Ventures’ shares tumbled sharply, hitting lows around $1.50 to $1.80 from a previous stable position.

This decline marked an approximate 85% reduction in stock value, with various reports echoing similar figures to summarize the significant drop.

The company had seen a promising year prior to this debacle, boasting a market cap that reached approximately $400 million and a notable rise of 120% in just six months. Unfortunately, this decline has effectively erased most of those gains.

Market analysts and trading sources attribute the drastic price changes to fear-driven sell-offs by individual investors as well as aggressive re-evaluations conducted by short sellers.

Many in the investment community expressed disappointment, as they had hoped for more concrete guidelines regarding the deployment of corporate resources, which were sadly absent in the announcement.

Regulatory Scrutiny and Investor Reactions

Reports suggest a heightened awareness from regulatory bodies, particularly the SEC and FINRA, concerning companies making significant moves toward cryptocurrency investments. This ongoing scrutiny could pose challenges for Digital Future Ventures.

Financial analysts and experts have raised alarms about the ambiguous nature of the announcement, recognizing it as a concerning signal. Companies delving into the crypto sphere have had varying degrees of success, often depending on their ability to communicate clear protocols and financial strategies.

Some industry commentators have speculated that the sharp decline in stock prices may represent an overreaction. When market sentiment deteriorates swiftly, it often leads to prices adjusting beyond what fundamental factors would suggest.

Others assert that transitioning a portion of corporate assets into high-risk investments introduces fundamental challenges, including issues of financial reporting, custody difficulties, and elevated regulatory attention.

Featured image from Financial News, chart from TradingView