Recent shifts in the financial landscape have sparked significant interest around Solana as several prominent asset managers edge closer to unveiling a new Solana Spot ETF. The recent filings of amended S-1 registration statements to the US Securities and Exchange Commission (SEC) signal a pivotal moment in discussions between these asset managers and the regulatory body.

Substantial Moves Towards Solana Spot ETF Approval Indicate Positive Trends

As reported by industry analysts, notable firms such as Canary Capital/Marinade, Franklin Templeton, and VanEck have taken initial steps by submitting their updated documentation. This move has been followed swiftly by other notable players including Grayscale, 21Shares, Bitwise, Fidelity, and CoinShares.

Analysts emphasize that these updated filings are indicative of a constructive dialogue with regulators, often seen as a favorable omen for potential approvals. Insights from industry expert Eric Balchunas suggest that continued amendments boost optimism regarding imminent support from the SEC, particularly as a “lock” for approval seems increasingly probable.

Balchunas further pointed out that Rex Shares is undergoing a significant transformation by switching its Solana Spot ETF structure to a Registered Investment Company (RIC). This transition is projected to mitigate tax inefficiencies, thereby enhancing its appeal as more firms prepare for a surge of Solana Spot ETFs in the upcoming months.

In addition to Solana, there has been rising anticipation surrounding the resubmission of XRP Spot ETF applications, clarity on the regulatory path is also building for other popular altcoins, such as Dogecoin, Cardano, Litecoin, Sei, and Avalanche.

There’s a general expectation that approvals may start materializing as early as October, coinciding with the critical deadline for many pending applications. Should these ETFs capture institutional interest similar to that seen with Bitcoin and Ethereum, we could witness a substantial upward shift across the altcoin market.

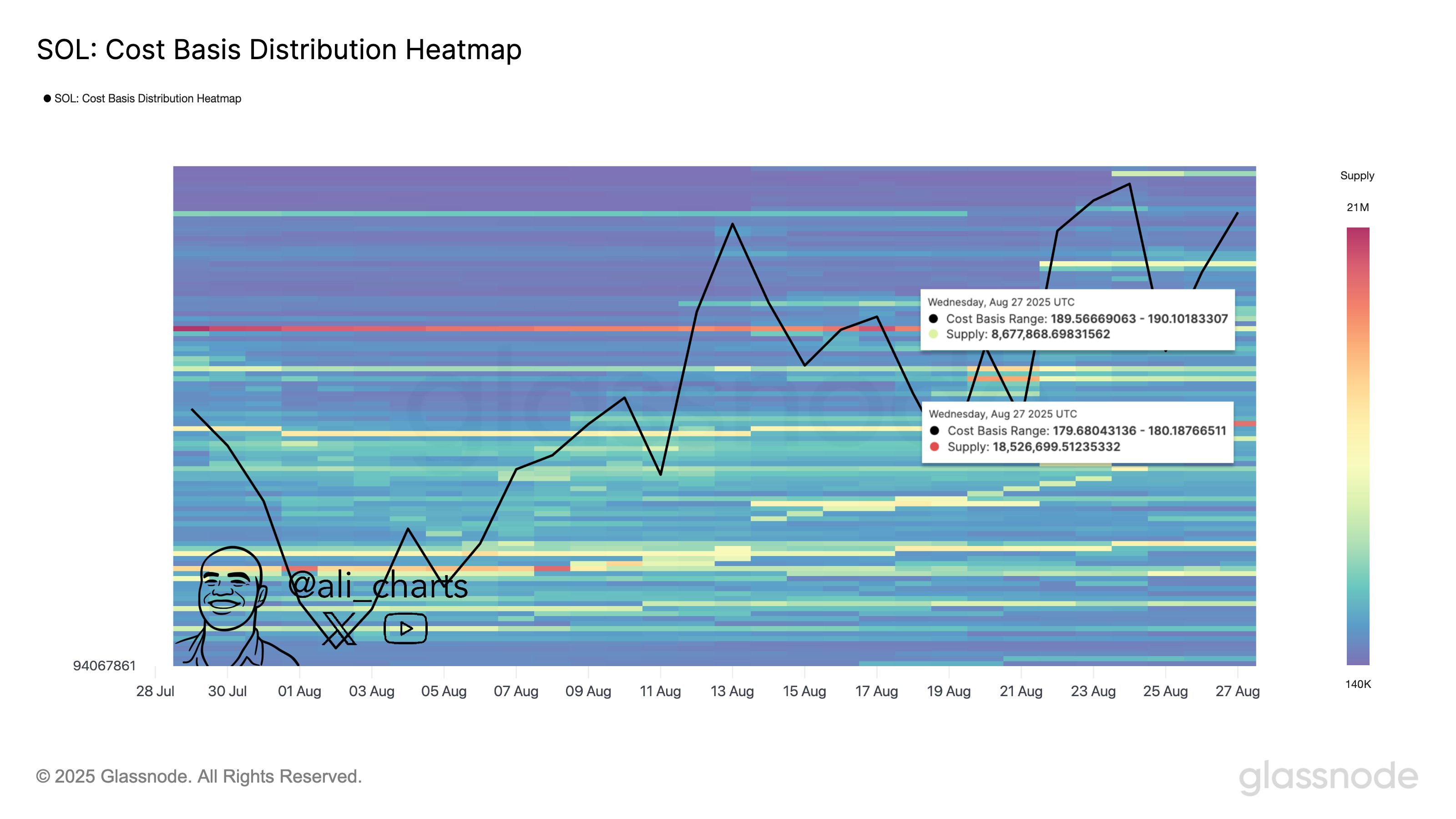

$180 Mark Becomes a Key Support Level for Solana

In related news, data from Glassnode highlights crucial insights regarding price dynamics for Solana. Their analysis points to the $180 level as a significant price support zone, revealing that approximately 18.56 million SOL tokens were gathered around this threshold, amounting to almost $4 billion in value.

This notable accumulation suggests strong backing from both institutional and retail investors, marking $180 as a pivotal battleground for price resistance and support. Current market activity shows Solana trading at approximately $204, following a minor dip of 3.84% in the last 24 hours; however, it has maintained a respectable weekly gain of 3.63% thanks to a strong performance earlier this week.