Tron continues to set the pace in the world of stablecoins, with the recent minting of an additional $1 billion in USDT. This brings the total minted on the Tron network for 2025 to an impressive $23 billion. Such growth positions Tron as a powerhouse in the stablecoin arena, especially notable since 2021’s peak when the USDT supply also surged. With this latest issuance, the total USDT supply on Tron now surpasses $81.7 billion, reinforcing its status as the premier blockchain for Tether issuance.

In the cryptocurrency landscape, large minting events of USDT typically signal optimistic trends. These situations often precede fluctuations in liquidity, suggesting that traders and institutional investors are gearing up to deploy fresh capital strategically. The growth of USDT is closely monitored, as it serves as a key entry point into the cryptocurrency markets, reflecting increasing demand.

This recent mint aligns with Bitcoin’s consolidation near record highs while altcoins experience a rise in volatility. Analysts postulate that with available capital on the sidelines, the market might be poised for another growth phase. If past trends hold, Tron’s $1B mint could herald a wave of new inflows into the digital asset realm.

Tron’s Latest USDT Mint: A Catalyst for Financial Integration

Industry expert Darkfost has indicated that this latest $1 billion USDT mint stands apart from previous mints, potentially marking a pivotal shift for the Tron ecosystem. Uniquely, this$1B issuance appears not to have been recorded on-chain yet. The details surrounding the transaction reveal that funds were allocated to a multisig wallet, remaining inactive while awaiting further approval.

The absence of transaction fees reinforces the idea that this is an inventory replenishment approved by Tether, indicating funds not yet made available for use. Although this mint doesn’t immediately impact on-chain supply metrics, its underlying purpose carries significant implications for the market.

The timing of this mint is notable, coinciding with Tron.inc’s recent Nasdaq listing and Justin Sun’s submission of an S-3 filing to the U.S. Securities and Exchange Commission (SEC). This filing specifies a proposed issuance of hybrid securities totaling $1 billion, aligning perfectly with the amount of the recent mint. These securities may take the form of common stock, preferred shares, or various debt instruments.

This correlation hints at a strategic initiative wherein Tron seeks to merge traditional financial assets with stablecoins, creating a capital-efficient and compliant financial framework. Should this prove accurate, it would indeed be a groundbreaking development, positioning Tron as a versatile platform for both transfer and integrated financial services.

Although this mint hasn’t yet gone live on-chain, it may signal the beginning of a broader ambition to connect traditional finance (TradFi) and decentralized finance (DeFi), utilizing stablecoin liquidity as a tool for fundraising and capital management in a regulated environment. For Tron, this could represent a transformative step in its evolution.

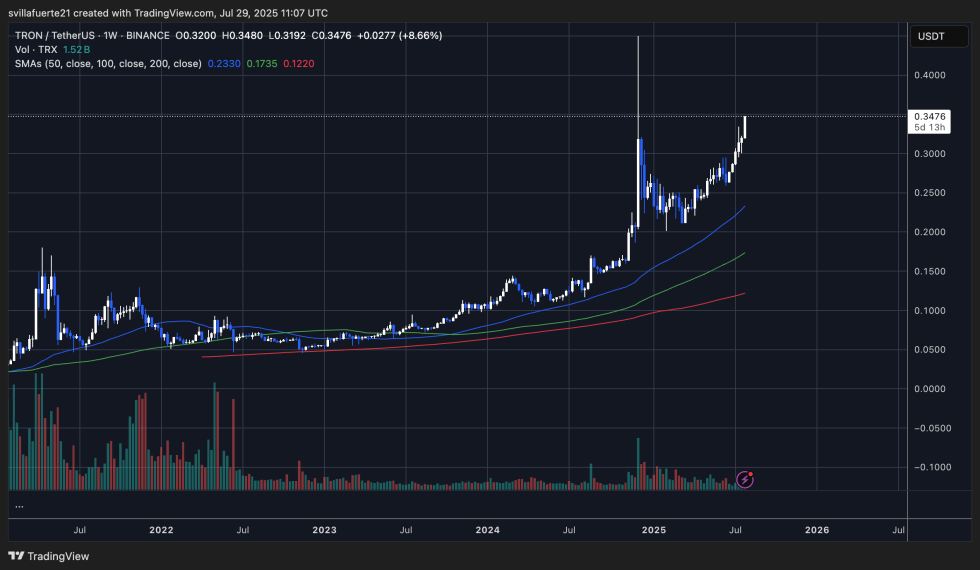

TRON Continues Bullish Momentum as Weekly Chart Shows Promise

Currently, TRX is displaying strong bullish momentum, trading at $0.3476 after experiencing an 8.66% rise in its last session. This recent upward movement marks a significant milestone, achieving its highest weekly close since early 2022 and surpassing key local resistance levels as it approaches its cycle high. The sustained price action reflects a well-defined uptrend that commenced in early 2023, evidenced by increasing trading volume and a consistent pattern of higher highs and higher lows.

The 50-week, 100-week, and 200-week simple moving averages (SMAs) are confirming an upward trajectory, situated well below the current price and affirming the strength of the ongoing trend. TRX has maintained a position above all major support levels, with no immediate signs of trend exhaustion visible on the chart.

Should TRX stay above the $0.32–$0.34 range, a major resistance level near $0.40 could become the next target. A robust weekly close beyond current levels may unlock additional growth opportunities in Q3, especially if broader market conditions remain favorable and supportive.

Featured image from Dall-E, chart from TradingView