ONDO has experienced a dramatic decline, shedding over 65% of its value since October amid ongoing selling pressure within the altcoin realm. While Bitcoin maintains relative stability, numerous mid-cap tokens, including ONDO, have been unable to establish strong demand. This trend has shifted market sentiment toward the bearish side, particularly as traders grow wary of liquidity events and token unlocks.

Contrary to a purely negative outlook, some analysts propose that this current market dip may offer an unexpected investment opportunity. A recent report from CryptoQuant suggests that while headlines blare “plummeting prices,” the on-chain data reveals potential for positivity. Investors are turning their attention to an upcoming 1.94 billion token unlock on January 18, 2026, which historically can trigger market panic but also creates significant chances for strategic positioning.

This period, however, may prove to be a unique situation. The report indicates that larger market players appear to be using the decline to their advantage, capitalizing on the fear in the market as a prime opportunity for liquidity acquisition. Rather than fleeing before the unlock, evidence shows that “smart money” is swooping in to soak up excess supply while retail investor sentiment remains shaky.

Signs of Strategic Accumulation

The CryptoQuant analysis highlights why larger investors seem unfazed by ONDO’s decline. One major indicator is the presence of the “whale shield.” Despite the significant drop since December 2024, the Spot Average Order Size is consistently marked by “Big Whale Orders,” evidenced by persistent green dots on trading charts. This suggests that institutional investors are leveraging market weaknesses to scoop up liquidity, particularly in the $0.35–$0.40 range.

Additionally, ONDO has transitioned into a Taker Buy Dominant phase. The 90-day Cumulative Volume Delta (CVD) indicates that market buy pressures have consistently surpassed market sell pressures for several months. This factor is crucial as takers represent aggressive market participants who prioritize buying at current prices over waiting for better opportunities.

This alignment is described in the report as “taker alpha.” The synergy between substantial whale purchases and assertive taker activity amidst falling prices often signals absorption. If this trend persists through the upcoming unlock, ONDO could be poised for significant upward movement as we move into 2026, setting the stage for a breakout in the Real World Assets (RWA) sector.

ONDO Faces Challenges While Testing Demand Zones

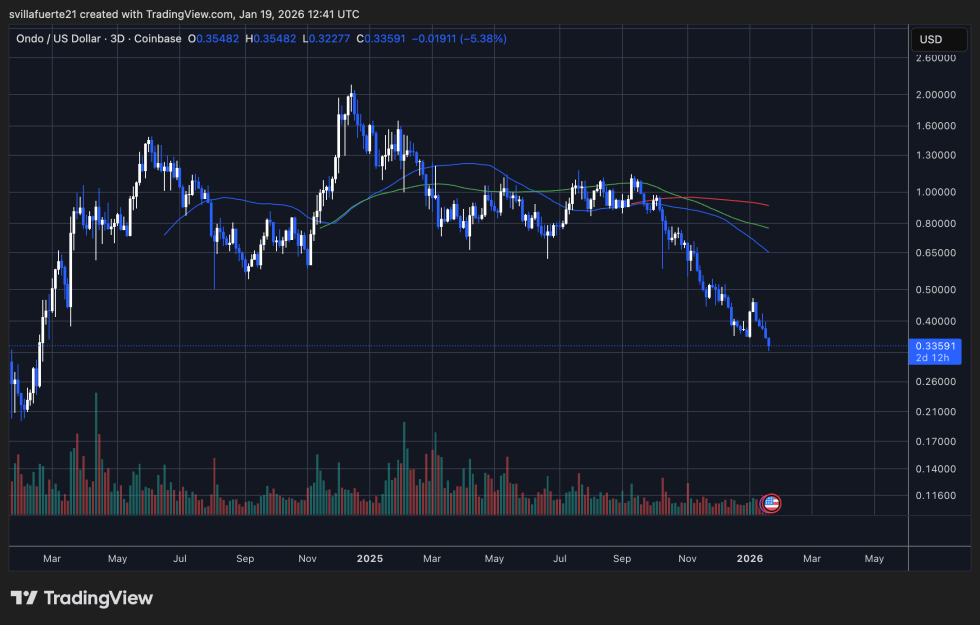

Currently, ONDO is grappling with sustained downward pressure, with much of the gains from 2025 effectively wiped out. A look at the 3-day chart illustrates a clear breakdown from the $0.90–$1.00 consolidation range, where attempts to regain momentum faltered during the latter part of the year. Following a decisive downturn, the market has entered a steep decline characterized by weak recoveries and ongoing lower highs.

As of now, ONDO is trading around $0.33 after slipping below the critical psychological level of $0.40, which had previously served as temporary support. This decline has pushed the token well below its essential moving averages, with short-term trend lines becoming resistance barriers. The failed attempts to recover throughout late 2025 illustrate that sellers remain in control, while buyers struggle to muster enough volume to initiate a trend reversal.

Despite this, the price is nearing a potential demand zone between $0.30 and $0.35, a region where market volatility typically spikes, and dip buyers might emerge. Failure to hold this level could accelerate declines. Conversely, strong support here could facilitate a stabilization phase before any meaningful recovery occurs.

Featured image from ChatGPT, chart from TradingView.com