The current landscape of the cryptocurrency market has led to notable fluctuations in the value of XRP, a prominent digital asset. This downturn isn’t shocking, as XRP has witnessed low prices for an extended period. The recent upward movement in market sentiment has prompted many investors to consider capitalizing on their holdings, consequently reflecting a mix between cautious selling and potential market recovery. Interestingly, these sell-offs might contribute to an impending rebound, offering a critical juncture for buyers.

XRP Token Movement Analysis

Recent observations shared by crypto analyst Dom on social media highlight that XRP has experienced significant outflows recently. His insights illustrate that despite a modest increase in XRP’s price, the asset remains in oversold territory, indicating market corrections are still underway. Approximately 88 million XRP tokens have changed hands during this period, translating to a monetary value of over $210 million in sales.

Supporting this view, insights from platforms such as Coinglass reveal a consistent trend of negative net flows for XRP. On May 9, the asset faced its most considerable outflow, recording a -$96.33 million drop, with subsequent days averaging around -$20 million. This trend suggests a continuous pressure on the market, despite potential signs of recovery in prices.

Despite the rising outflows, there is no need for concern. According to Dom, this situation could be interpreted positively for XRP’s future. He emphasizes that rising prices combined with increased selling activity generally indicate that retail investors are not driving the price increases. Instead, it appears that larger investors – often referred to as whales – are absorbing these dumped tokens. This dynamic could ultimately support a bullish trend in the XRP market.

In essence, Dom suggests that this ”bullish imbalance” from a microstructure perspective signals a potential positive shift for XRP. As selling pressure diminishes, the asset may be primed for an upward trajectory, particularly as early sellers deplete their available holdings.

Investor Confidence Signaled by Open Interest

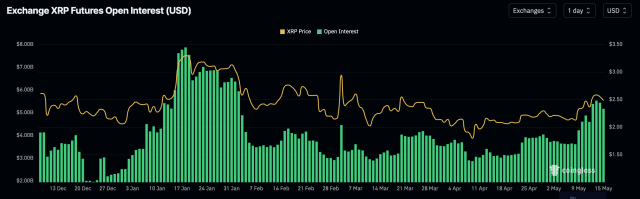

Despite the negatives surrounding net flows, a different narrative emerges from the data on XRP’s open interest. Reports indicate that open interest has surged dramatically throughout May, aligning closely with the price movements. At the month’s onset, open interest stood at $3.72 billion, skyrocketing to an impressive $5.53 billion by May 14.

This increase in open interest signifies that investors are becoming more confident in the XRP market, positioning themselves for potential price movements. As interest continues to grow, the influx of liquidity could facilitate a significant price surge, possibly steering XRP towards the $3 mark in the near future.