Current trends in the cryptocurrency market reveal significant shifts in investor sentiment, particularly regarding Ethereum and XRP. While Ethereum funds are showing considerable capital withdrawals, XRP-linked products are enjoying a surge in investments, establishing themselves as leaders in the crypto ETF sphere.

Recent analysis indicates that this trend has been consistent for several weeks, suggesting a possible reevaluation of investment strategies among crypto investors, with a noticeable preference for assets like XRP that are perceived to have stronger regulatory backing.

Ethereum ETFs Experience Major Withdrawals

In a troubling trend, Ethereum Spot ETFs have witnessed remarkable outflows, with a staggering $1.725 billion in net redemptions recorded since early November. Notably, November was particularly harsh, representing the lowest monthly inflow figures since the product’s inception.

Throughout November, certain days saw outflows surpassing $250 million, indicating a strong selling momentum that has persisted into December. The continuous withdrawals have led to ongoing declines in Ethereum’s market price, with ETH consistently struggling to maintain a value above $3,000.

This trend highlights a critical movement of capital away from Ethereum-focused investments, potentially signaling a broader shift in asset allocation strategies among crypto investors as they seek opportunities elsewhere. The emergence of XRP as a preferred alternative is particularly noteworthy.

Source: SoSoValue on Ethereum ETF Flows

XRP ETFs Thrive with Sustained Inflows

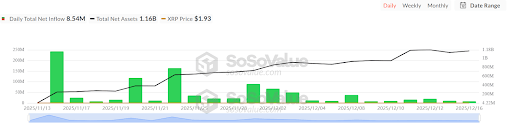

Since launching its first U.S.-listed Spot XRP ETF on November 23, XRP has enjoyed a steady influx of funds, totaling $1.01 billion over a remarkable stretch of 22 consecutive trading days. The consistent inflows speak volumes about the growing appeal of XRP in the current market.

Five issuers now offer Spot XRP ETFs, each observing uninterrupted inflows, a stark contrast to the challenges faced by Ethereum. With total assets under management reaching approximately $1.16 billion, XRP is solidifying its position in the competitive ETF landscape.

Ripple’s CEO, Brad Garlinghouse, has noted this growth as indicative of a substantial demand for regulated crypto investment options, reiterating that XRP is becoming the go-to choice for institutional investors seeking stability and compliance over the past months.

Comparative analysis with Bitcoin’s performance reveals another layer of complexity; Bitcoin ETFs are experiencing substantial outflows, amounting to nearly $3.915 billion since November. This downturn contrasts sharply with XRP’s upward trajectory.

Source: SoSoValue on XRP ETF Flows

Such trends unfold during a particularly rough patch for the overall crypto market, challenging the perception of stability and potential growth among many investors. As XRP’s price also faces downward pressure, these inflows reflect a profound shift in confidence towards regulated and established crypto assets.