The digital finance landscape is evolving rapidly, ushering in an era that could redefine investment strategies and market dynamics. As the spotlight shines on renowned cryptocurrencies like Bitcoin and Ethereum, it’s essential to focus on a pivotal component: stablecoins. This subset of digital currencies stands out for its ability to maintain value stability against traditional currencies, providing an essential backbone for the entire crypto ecosystem.

Recent analyses suggest that robust inflows into stablecoins indicate a significant buildup of purchasing power across the market. By offering a safety net during market fluctuations, stablecoins enable traders to swiftly pivot between different assets, ensuring liquidity is always available. As highlighted by industry experts, this period could very well be deemed the “Era of Stablecoins,” denoting their increasing influence and utility in crypto trades.

Understanding the Role of Stablecoins in Market Dynamics

Analysts have pointed out that increased issuance of stablecoins correlates directly with fiat inflows, injecting real liquidity into the crypto marketplace. Every stablecoin minted represents capital transitioning into the digital asset world, which can subsequently be deployed into various investments. This relationship underscores the importance of understanding stablecoin dynamics amid broader market trends.

Currently, stablecoin supplies have surpassed $240 billion, a staggering figure that reflects growing interest among investors. Newer entrants in the stablecoin arena add additional depth to this analysis, exemplifying how the demand for secure and efficient trading avenues is on the rise.

Experts have noted a remarkable trend whereby stablecoin issuance shows no signs of diminishing. This increasing supply is a clear indicator that capital is flowing into the marketplace, setting the stage for potential price surges in riskier assets. For market participants, this behavior serves as a telling sign of an impending bull run, one that might surpass previous expectations.

With the volatility of the past year in the rearview mirror, the persistent growth in stablecoins exemplifies a market poised for significant movement. Unlike speculative trades that can be fleeting, stablecoin reliability is becoming increasingly recognized as the foundation upon which bullish markets can build solid momentum.

Current Market Overview and Future Projections

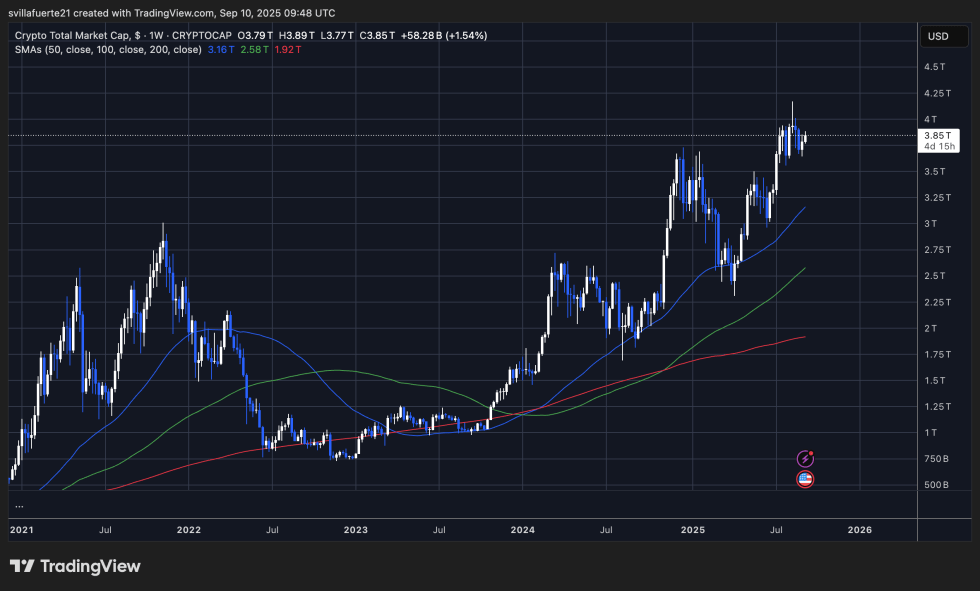

The overall cryptocurrency market capitalization is currently estimated at around $3.85 trillion—indicative of resilience after a period characterized by fluctuations. Observations reveal that the market is lapsing below the vital $4 trillion mark, encountering resistance that underscores its importance as a trading benchmark.

The 50-week simple moving average indicates a positive trend around $3.16 trillion, acting as a significant support level for the cryptocurrency market. Meanwhile, the longer-term averages, including the 100-week SMA at $2.58 trillion and the 200-week SMA at $1.92 trillion, reaffirm that bullish sentiment remains prevalent as the market sustains its position above these thresholds.

A breakthrough above the $4 trillion threshold would mark a major turning point, potentially heralding new peaks and extending the bullish trend. Failure to navigate above this critical line could lead to consolidation in the $3.5 trillion to $3.9 trillion range in upcoming weeks, creating new opportunities for investors to reassess their positions.

As the market draws closer to imminent shifts, various factors—particularly stablecoins—will play a key role in shaping the future of cryptocurrency trading. Understanding these mechanisms is essential for investors looking to navigate the complexities of this dynamic sector.