Recent developments in the crypto market have revealed a surge in investment products, as reported by CoinShares. The latest figures show an impressive total of $3.3 billion in inflows during the week ending May 24, which contributes to a record year-to-date total of $10.8 billion for 2024.

This surge marks the sixth consecutive week of positive inflows, indicating robust investor enthusiasm for digital assets despite prevailing economic concerns. CoinShares highlighted that total assets under management (AuM) briefly touched an all-time high of $187.5 billion early in the week before experiencing a slight decline.

Leading the Charge: Bitcoin and Ethereum

Bitcoin continues to reign supreme, leading the inflow statistics with a staggering $2.9 billion for the week. This accounts for more than 25% of total inflows for 2024 to date. Interestingly, some investors took advantage of the price rally to initiate short positions.

In a notable shift, short-Bitcoin products registered their highest weekly inflow since December 2024, totaling $12.7 million. This mixed trading behavior suggests varying opinions on Bitcoin’s short-term future among market participants.

Ethereum recorded a more than three-month-high with $326 million in inflows, marking its fifth consecutive week of positive momentum. This growth in Ethereum investment aligns with a strengthening belief in its underlying fundamentals and overall market position.

In contrast, XRP’s inflow streak came to an abrupt end last week, with the asset witnessing outflows of $37.2 million. This break, occurring after 80 weeks of inflows, raises questions about shifting investor confidence or portfolio amends.

Digital Asset Inflows Hit $3.3B in a Week, Driving YTD Total to Record $10.8B

Digital asset investment products saw inflows of US$3.3B last week. @Bitcoin saw inflows of US$2.9B @ethereum also observed inflows of US$326M. $XRP faced outflows of US$37.2M. Year-to-date inflows have… pic.twitter.com/eLnu5HfK8a

— CoinShares (@CoinSharesCo) May 26, 2025

Regional Insights and Market Trends

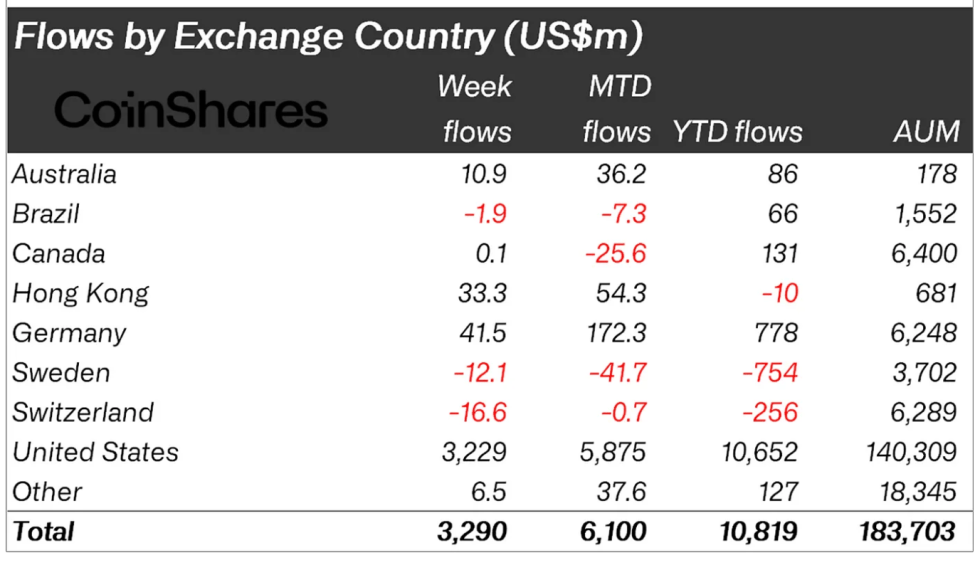

The United States remained at the forefront of global inflows, accounting for $3.2 billion last week. Other countries such as Germany, Hong Kong, and Australia observed inflows of $41.5 million, $33.3 million, and $10.9 million respectively.

Conversely, Switzerland experienced outflows of $16.6 million, as investors opted to cash in on profits following a robust price increase. These regional dynamics illustrate the varying levels of risk tolerance and economic sentiment among institutional traders.

CoinShares’ head of research, James Butterfill, remarked that the current inflow patterns reflect a desire for diversification amid global economic instability. Butterfill stated:

We believe increasing concerns about the U.S. economy, spurred by the recent ratings downgrade and soaring treasury yields, have led investors towards diversifying into digital assets.

With impressive inflow levels and AuM nearing historic highs, the focus is likely to shift towards how regulatory bodies will respond to this upswing in institutional interest in cryptocurrency products. The recent uptick in market activity may influence future policy considerations surrounding digital assets both domestically and globally.

Image generated with DALL-E, Chart derived from TradingView