Recent insights from Tether’s leadership indicate that a significant percentage of blockchain fees, approximately 40%, are allocated to the transfer of USDT. This information sheds light on the broader impact of USDT in the cryptocurrency ecosystem.

The Dominance of USDT in Transaction Fees

In a recent update shared on social media, Paolo Ardoino, the CEO of Tether, provided compelling data illustrating the distribution of network fees associated with USDT transfers across various blockchains. These fees essentially serve as incentives for validators who confirm transactions.

The shared visual data highlights a marked trend, showing that the share of fees attributed to USDT transfers on major networks is steadily growing.

Included in the analysis are nine leading networks: Ethereum, Tron, Toncoin, Solana, BSC, Avalanche, Arbitrum, Polygon, and Optimism. Recently, data points indicate that the 7-day moving average of transfer fees related to USDT has surged to the impressive milestone of 40%.

This substantial fee volume hints at heightened transaction activity, suggesting that Tether’s digital currency remains a popular choice among users. Ardoino remarked, “In emerging markets, millions rely on Tether’s USDt to safeguard their families against inflation and currency devaluation.”

Typically, users must utilize the native token of the respective blockchain to cover transfer fees, even when dealing with alternative assets like USDT. For instance, Ethereum transactions necessitate gas fees paid in ETH.

Interestingly, Tron distinguishes itself by allowing users to pay gas fees in various tokens, including USDT, highlighting its innovative approach. This functionality has reinforced Tron’s position as a pivotal platform for USDT transfers.

Ardoino further suggested, “Future blockchains that prioritize lower gas fees and flexible payment options with USDT are likely to dominate the landscape.”

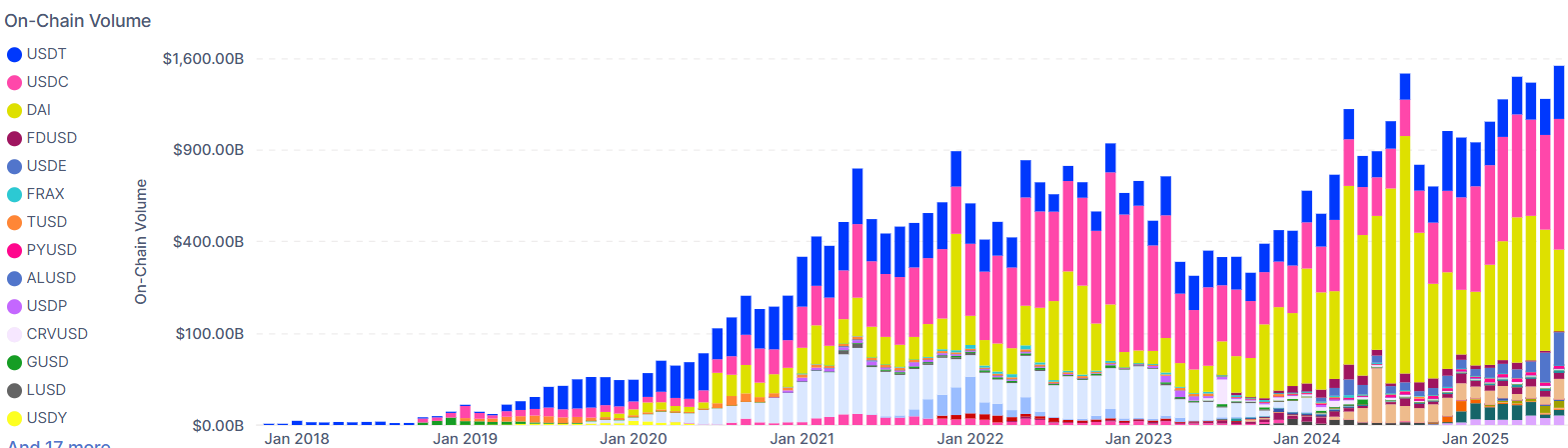

Moreover, parallel trends indicate that the overall on-chain volume for stablecoins has hit unprecedented levels, with recent reports from institutional DeFi provider Sentora confirming exploding transaction volumes.

According to the latest statistics, the total monthly transaction volume for stablecoins has exceeded $1.5 trillion, marking a striking all-time high.

Current Ethereum Market Position

As of the latest market analysis, Ethereum is trading near $3,600, reflecting a decline of over 4% during the past week.