In recent days, the cryptocurrency market has experienced high volatility, particularly with Bitcoin rebounding strongly from its recent lows and surpassing $68,000. However, this upward momentum was short-lived as Bitcoin retraced to around $66,800, triggering a wave of liquidations in the derivatives market.

Recent activities in the cryptocurrency space are depicted in the chart below:

Increased Liquidation Activities in Crypto Derivatives Sector

According to data from CoinGlass, there has been a significant increase in liquidations in the cryptocurrency derivatives market over the past 24 hours. Liquidation refers to the automatic closure of open contracts that have incurred substantial losses.

Recent liquidation data in the cryptocurrency market is outlined below:

Approximately $187 million worth of contracts were liquidated in the past day, with long contracts contributing $123 million to this total. Despite relatively stable market returns, the prevalence of long liquidations indicates late entries by investors chasing the rally, potentially using leverage to amplify gains but also risks.

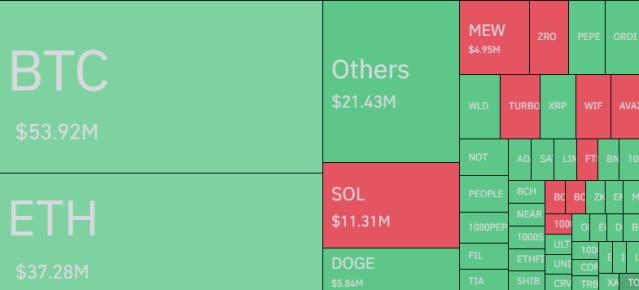

The breakdown of liquidations by different cryptocurrencies is illustrated below:

Among the various assets, Bitcoin and Ethereum led in liquidations, with $54 million and $37 million, respectively. Solana recorded significant liquidations, mainly on short positions, despite its price showing a net increase over the period.