Recent insights from crypto analyst Titan of Crypto indicate that Bitcoin (BTC) is nearing a golden cross, a bullish sign often linked to significant price increases. Nonetheless, other experts warn of a potential price correction for this leading cryptocurrency.

Bitcoin Approaching Golden Cross

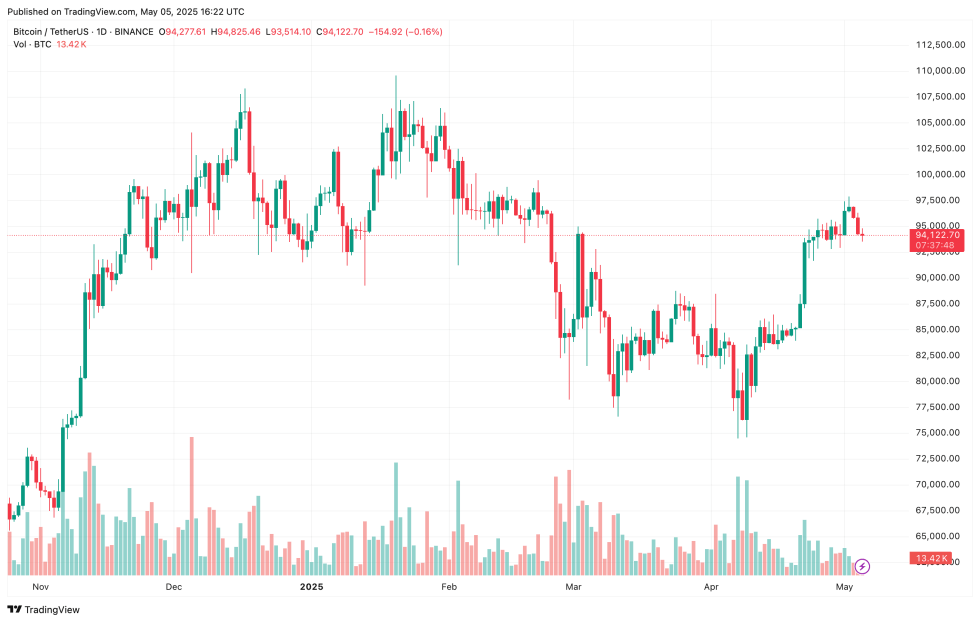

Bitcoin is currently trading in a tight range between $92,000 and $98,000, providing little direction for market analysts. Despite this, some believe the cryptocurrency is on the verge of a major breakout.

Titan of Crypto recently shared a chart suggesting that BTC is set to create a golden cross soon and may also transition to a bullish position in its Moving Average Convergence Divergence (MACD) indicator, a combination not seen since October 2024 when Bitcoin experienced a significant price surge following Donald Trump’s pro-crypto presidential campaign victory.

A golden cross occurs when a short-term moving average, typically the 50-day, crosses above a long-term moving average, commonly the 200-day. This event often signifies potential upward momentum and suggests a trend reversal or continuation of a rally.

Additionally, a bullish MACD indicates the MACD line’s crossover above the signal line, suggesting a momentum shift from bearish to bullish, which could imply increasing buying pressure and the start of an upward price trend.

Although Bitcoin faced resistance near $98,000 recently, analysts like Rekt Capital believe this is typical. For BTC to reach new all-time highs, it needs to maintain support around $93,500 and firmly surpass $99,000.

If Bitcoin manages to break this resistance, it may encounter further challenges at $104,500. However, converting the $99,000 level into a support base could lead to a new all-time high.

Mixed Analyst Perspectives

Despite rising optimism, not all analysts foresee an imminent breakout. Well-known analyst Ali Martinez noted that the TD Sequential indicator is currently signaling a sell on the 3-day BTC chart, hinting at potential short-term weakness.

Compounding the mixed outlook, Bitcoin’s futures market open interest is nearing historical highs, a trend often observed during past bull markets that has typically led to price increases. Currently, Bitcoin is trading at $94,122, reflecting a 1.5% decrease over the last 24 hours.